Activists are not always pests — as Peltz should prove at Rentokil

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

There are precious few reasons to utter Rentokil Initial in the same breath as Disney. But the UK pest control company has one thing in common with the US entertainment giant: Nelson Peltz.

Rentokil this week handed the activist investor’s Trian Partners a board seat, three months after it disclosed a position in the UK-listed company. There was none of the acrimonious language that preceded Peltz’s (failed) battle in April to gain a seat on Disney’s board. Instead, Rentokil chair Richard Solomons was “delighted” to welcome Trian’s Brian Baldwin. So he should be. Rentokil needs fresh ideas to fix its messy integration of Terminix, the US business acquired three years ago for $6.7bn.

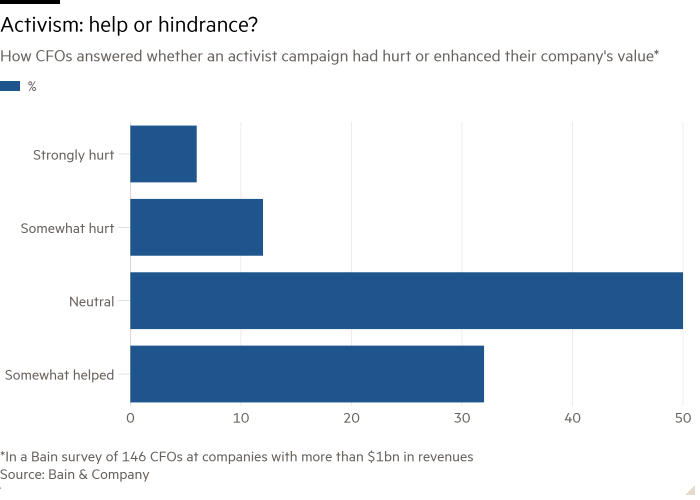

Acquiescence can be a reasonable form of defence for companies facing activist advances. Nearly a third of 146 chief financial officers polled by Bain & Co conceded that an activist had improved their company’s value, although admittedly a greater proportion thought it had no effect.

It may help that Solomons has dealt with Trian before. He was IHG’s chief executive when Trian appeared on its shareholder register in 2012. That led to expectations the hotelier might combine with a big rival, or shift its listing to New York. When Trian reduced its stake a year later, neither had happened. But IHG’s market cap had risen by more than £1bn.

At Rentokil, too, the best solutions might not be showy. Rentokil needs help sorting out its US business — the cause of its recent profit warning, which knocked £2bn off its market value.

Rentokil was built through M&A. Yet its swoop on Terminix was a break from its usual modest bolt-on deals. Integrating a company of that scale — Terminix added about 300 branches to Rentokil’s 600 in the US — is proving problematic. The end of this arduous job is already delayed to 2026 from an initial target of 2025. It could well slip again.

Meanwhile, US competitors are taking share. Organic growth in North America is expected to be a paltry 1 per cent in the second half, despite Rentokil spending an extra $25mn on marketing to stimulate sales. Investors are not clear why that tactic is not paying off. The fact the profit warning came just two months after interim results added to questions about management credibility, noted James Beard at Deutsche Numis Research.

There are other options: Rentokil could sell off non-core businesses such as its French workwear unit to reduce its net debt to ebitda ratio of about 2.8 times. Even so, nothing will work better than properly rooting out Rentokil’s problems in the US. For this Trian should be a help, not a hindrance.

#Activists #pests #Peltz #prove #Rentokil