DoJ uses its Big Tech playbook against Visa

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The Biden administration has made reining in Big Tech companies a cornerstone of its economic agenda. Since 2021, the president’s top antitrust enforcers have launched major legal challenges against Google, Meta, Apple and Amazon.

Of course, trustbusting isn’t confined to tech. The government wants to break up Ticketmaster-owner Live Nation and has taken action against pharmacy benefit managers.

But this week, it took a page out of the Big Tech playbook to go after Visa. The Department of Justice is suing the payment processing giant, accusing it of illegally maintaining a monopoly in the debit card market.

Visa has been in regulatory crosshairs before. But while past challenges have focused on tackling high card fees and the proposed acquisition of Plaid, the DoJ’s latest salvo stands out. The suit would mark the first time in recent memory that the DoJ has filed an antitrust case against a financial services company under Section 2 of the Sherman Act, which covers the acquisition or maintenance of monopoly power.

The case against Visa involves its dominance of the card market. Visa is the country’s largest card network operator. It handles more than 60 per cent of US debit transactions each year. This netted it over $7bn in fees, according the DoJ.

Size is not necessarily a bad thing. But the concern is that Visa uses the dominance of its network to limit the growth of existing competitors and prevent other companies from developing new and innovative payment alternatives.

The complaint alleges that Visa signed agreements with potential rivals such as Apple to ensure they did not develop competitive products. In return, Visa offered reduced fees and deals worth hundreds of millions of dollars. Another alleged tactic: Visa threatened merchants with higher fees if they routed a “meaningful share” of debit transactions to competitors. Visa has called the suit “meritless”, adding there is “an ever-expanding universe of companies offering new ways to pay.”

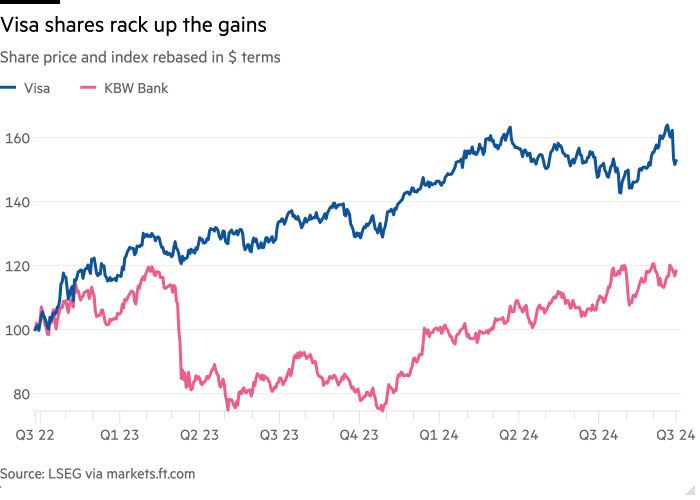

Visa’s shares remain unbowed. The company’s market valuation has doubled since March 2020 to touch a new high of $567bn in May 2024. The $32bn in revenue it pulled in for its most recent fiscal year is about 50 per cent higher than four years ago. It boasts one of the highest operating margins in financial services.

But, if successful, this type of antitrust suit can have significant impacts. Just ask Google. Earlier this summer, a federal judge ruled that Google acted illegally to maintain a monopoly in online search, striking at the heart of Google’s business model. Remedies could include breaking off parts of the company. The stakes are no less high for Visa. It makes more money from debit business than credit. Investors need to start factoring in the risk.

#DoJ #Big #Tech #playbook #Visa