Roche plans to launch 13 drugs and slash development costs

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Roche is planning to launch 13 medicines by the end of the decade and cut research costs for new drugs by a fifth, according to a strategy update on Monday.

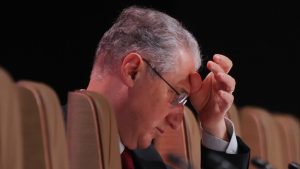

Thomas Schinecker, chief executive of the Swiss pharmaceutical company, outlined a focus on five areas: oncology and haematology, neurology, cardiovascular and metabolic diseases, eye diseases and immune diseases, as part of a shake-up of the company’s research and development.

The company said it would bring 20 drugs with “transformational” potential to the market by the end of the decade, with Schinecker later clarifying that seven have already been launched.

Medicines would have to combine significant therapeutic benefits with commercial opportunities or their research programmes could be axed, he said. The company will also aim to increase the success rate of late-stage phase 3 trials by more than 20 per cent, and cut research costs for each new drug launched by 20 per cent.

“We want to make sure our engine works extremely efficiently,” Schinecker said. “The bar is high.”

Roche has some of the highest research and development spending in the industry but has had a series of recent misses in experimental drugs for Alzheimer’s and cancer.

In choosing areas to focus on, Schinecker said that cardiovascular-metabolic diseases such as heart failure and obesity were the “number one problem” for health systems, followed by oncology and neurology, and that the new drugs would tackle these challenges.

Cardio-metabolic, cancer and neurology diseases will account for 50 per cent of the disease burden for health systems by 2035, compared to 45 per cent currently, the company said.

Roche has long had a strong oncology portfolio through its wholly-owned subsidiary Genentech. In eye diseases, its Vabysmo drug has challenged Bayer’s Eylea for the treatment of several common causes of blindness since its approval in 2022.

But on anti-obesity treatments, a market expected to be worth $130bn by 2030, Novo Nordisk and Eli Lilly have a big head start.

Roche said in July that it would fast-track its experimental anti-obesity drugs, which were acquired in a takeover of biotech Carmot last year. They include a weight-loss injection and a pill that have both completed early, phase 1 trials, though Roche’s shares were hit earlier this month by disappointing data on side effects.

Teresa Graham, the company’s head of pharmaceuticals, said that Roche had secured space at contract manufacturers to produce weight-loss drugs. Both Novo Nordisk and Eli Lilly have struggled to keep up with huge demand.

She added that Roche would continue to look for deals that could help it meet its targets. On Monday, it announced an $850mn deal for Genentech to acquire breast cancer immunotherapy drugs from Regor Therapeutics, a Chinese-American biotech.

It is also speeding up development of treatments for Alzheimer’s disease and inflammatory bowel disease.

As part of its R&D overhaul, Levi Garraway, chief medical officer and head of product development, said that the company was prepared to end programmes that were not getting results, pointing to a decision in July to stop development of tiragolumab, an immunotherapy treatment for non-small cell lung cancer.

#Roche #plans #launch #drugs #slash #development #costs