TPG takes on pay-TV bondholders to ride to Ergen’s rescue

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Billionaires (sometimes) do not let billionaires go bankrupt. For a price, at least.

For a year, some Wall Street vultures dreamt that EchoStar — the satellite TV and telecoms empire assembled by Charlie Ergen — would fall into Chapter 11.

That would have handed control to its creditors, owning more than $20bn of EchoStar debt.

But on Monday, David Bonderman decided to play white knight. The private equity firm he co-founded, TPG Capital, said it would lead a rescue transaction that keeps Ergen’s EchoStar equity afloat.

TPG’s satellite TV provider, DirecTV, will acquire its arch-rival Dish Network from EchoStar. The official purchase price is $1, along with assuming billions in Dish’s currently distressed debt.

TPG, however, will not make those bondholders whole, conditioning the DirecTV/Dish merger on $11.7bn of bond debt taking a $1.6bn haircut. Those bondholders can decline if they like.

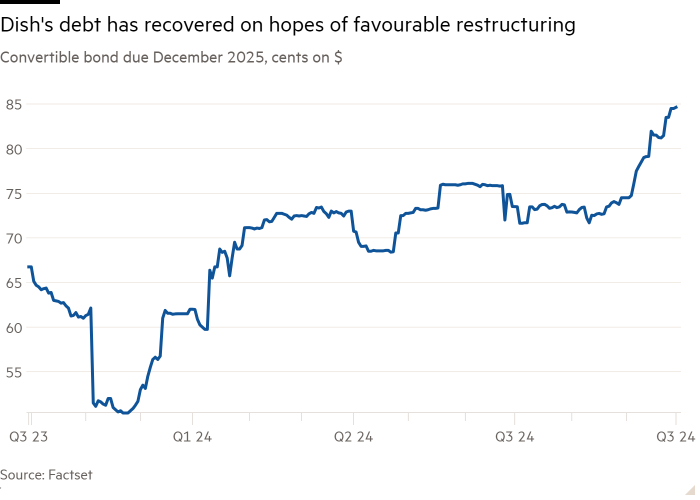

But the bet by Ergen and TPG is that those creditors can live with a modest discount to avoid having to run a complicated business that is in decline. As it happens, the hand of those main bondholders had already been forced.

Nearly all holders of convertible bonds, who are owed around $5bn in principal due soon, agreed to swap their debt at a small discount in exchange for a better coupon, enhanced collateral and the chance to reinvest in EchoStar.

TPG’s bargain contains its own risks. It is providing $2.5bn in the form of debt to solve pending maturities at Dish. It also said on Monday that it would pay $7.6bn over the next several years to buy out AT&T from the 70 per cent of DirecTV still owned by its telecoms partner.

The combined company will have 18mn pay-TV subscribers, a deterioration of several million in the past decade. But private equity firms care more about cash flow than revenue growth.

The combined company retains almost $10bn of annual ebitda, according to researcher CreditSights, setting its likely enterprise value between $30bn and $40bn. TPG’s risk is largely mitigated by investing at a cheap valuation, and the cash it has and will continue to extract.

Ergen will now concentrate on the EchoStar stub, which is a portfolio of spectrum and a play on building a new mobile phone network.

Its shares fell by more than a tenth on Wednesday, a personal loss for Ergen of a few hundred million dollars. But it could have been far worse, if not for the intervention of Bonderman & Co.

#TPG #takes #payTV #bondholders #ride #Ergens #rescue