Google break-up reads like antitrust fan-fiction

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Imagine a world where Google parent Alphabet, at $2tn the world’s fourth-largest listed company, is torn asunder. Its search engine goes one way, the Android operating system another. Web browser Chrome, advertising businesses, all set free in the name of fostering competition. It’s a world Google’s detractors might welcome, but not the one investors see.

The US Department of Justice on Tuesday set out potential ways to defang Google’s illegal monopoly in general internet search. Its ideas, which a judge will consider over the coming year, range from the relatively mild, such as limiting payments to smartphone makers in return for exclusivity on their devices, to so-called structural remedies — in other words, a break-up. A day earlier, another judge decreed Google must open up the Play Store, its shopfront for apps, to competition.

The cases — plus a third one over advertising technology — are complex, but boil down to a common idea: Google has created innovative products users and advertisers love, but then used overly sharp-elbowed tactics to entrench them. Curtailing those specific practices, be they the near-$20bn it pays iPhone-maker Apple to displace other search engines on its devices, or the up-to-30 per cent rents imposed on in-app payments, sounds sensible.

But if the question is how to reverse rather than stop monopolistic wickedness, it’s not clear courts and prosecutors have the answer. Being bigger has made Google’s offering palpably better. Strip away Android or Chrome from search and there’s every chance it will remain dominant. Customers may actively uphold the status quo. Europeans select a search engine when they set up a new phone; nine out of 10 still use Google.

Whatever courts may order, endless appeals are likely to push a final reckoning far beyond most investors’ horizon. Chief executive Sundar Pichai says Google’s trials will drag on for years; legal fees make little dent on a company set to make $80bn in free cash flow this year, by LSEG estimates. The longer it takes, the less it hurts. A dollar of profit forsaken today is worth a dollar; the same dollar lost five years hence, assuming Google has a 10 per cent cost of capital, is worth about 60 cents.

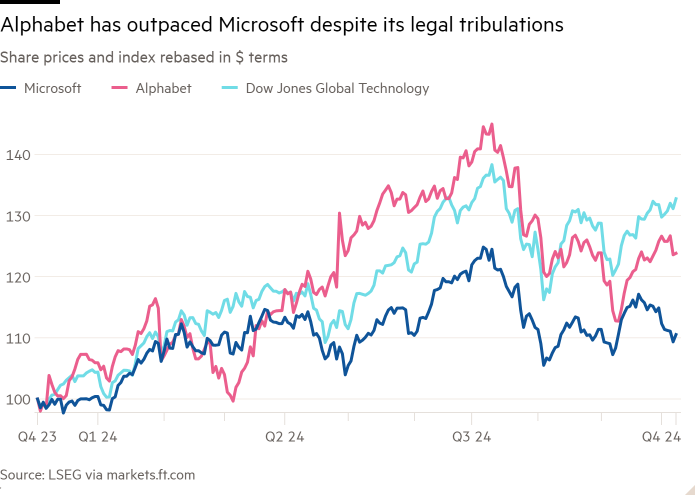

That makes it hard to see this as an existential threat. Investors so far don’t: Alphabet’s shares have fared no worse than Microsoft’s since December’s unfavourable app-store decision. That could reflect the fact that any real reckoning will take an age. Or that users will continue to favour Google even when they have other options. Either way, the implication is that an end to Google’s long-standing dominance remains the stuff of fantasy.

#Google #breakup #reads #antitrust #fanfiction