How the US should reform taxes

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The writer is the author of A Random Walk Down Wall Street

With the US presidential election upon us and a seemingly intractable budget deficit looming in the background, candidates are turning to how the country raises revenue through taxes.

This will be important for investors to watch given the rising government budget deficit is unlikely to be reduced without both spending restraint and new sources of revenue. But many of the proposals coming from both political parties make little sense and would upend the principles of a fair and efficient tax system.

A fair and efficient tax system means that taxes should raise revenue at the smallest cost to the economy. The system should be easy to administer and do as little as possible to distort economic decisions. Taxes should be fair: two people with equal income and similar economic circumstances should pay equal taxes. Wealthy taxpayers with a higher ability to pay should pay more taxes and at a higher rate. But rates should not be so high as to discourage work effort and decisions to invest in innovative and risky ventures that promise to improve the nation’s productivity and future growth.

One set of proposals floated during the presidential campaign involves a substantial increase in the top marginal tax rates. In answer to objections that such an increase could sharply reduce incentives on work effort and investment, proponents of these proposals answer that we had marginal tax rates of 90 per cent in the early 1950s and the economy continued to grow (albeit slowly).

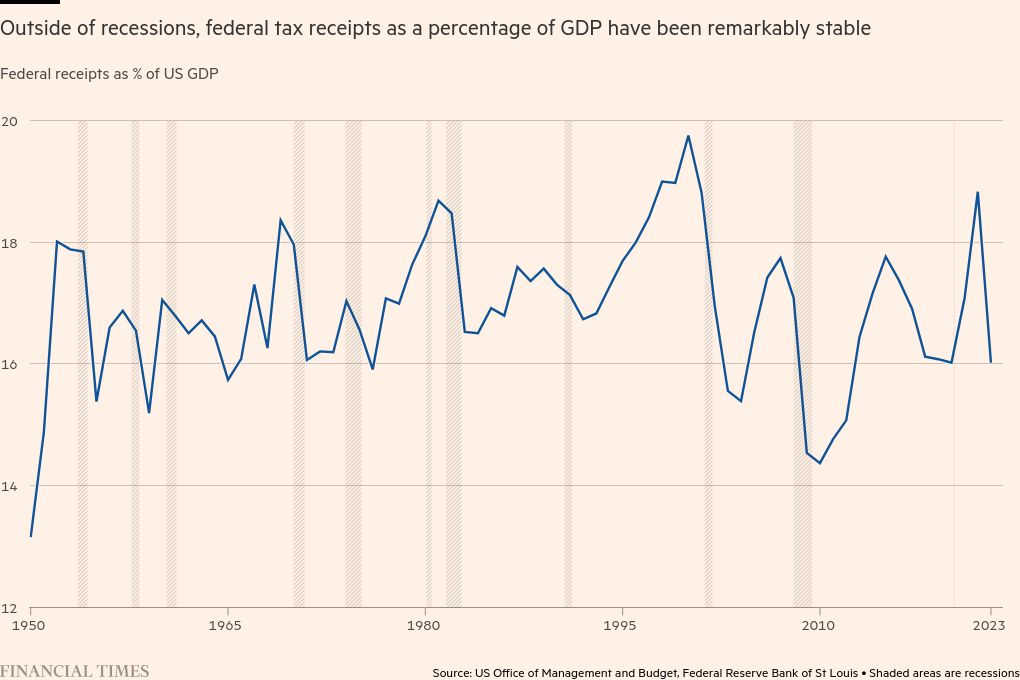

What these politicians neglect to mention is that people did not pay those high rates. Federal tax receipts as a percentage of GDP have been remarkably stable, averaging about 17.5 per cent since the 1950s. Taxpayers did not report income that would have put them in the highest bracket, taking advantage of shelters and loopholes while using strategies such as shifting income to the corporate sector where tax rates were lower or to family members in lower tax brackets. Revenue collected by the federal government as a percentage of GDP was no higher when the top marginal rate was 90 per cent than when it was just under 40 per cent.

Our experience with income shifting shows the danger of the proposal made by both parties to eliminate all taxes on tips. There is an unfairness in taxing people who receive regular wages differently from those who receive tips. Such a proposal also would inevitably result in companies finding ways to pay their employees in tips rather than wages. It is hard to imagine a policy better designed to erode the tax base. Proposals to eliminate taxes on other income such as overtime invites a similar form of income shifting.

Likewise, a variety of proposals have surfaced regarding wealth taxes. Such taxes have been a previous feature of European tax systems. They have proved virtually impossible to administer, spurred countless methods of avoidance and raised little revenue. Most European countries have dropped such taxes.

Are there ways to raise revenues while preserving fairness and not harming incentives? Closing existing loopholes would be most preferable. “Carried interest”, the share of profits on deals that private equity fund managers receive, is another promising target. We should incentivise putting new money into new businesses. But the income from managing such enterprises should be taxed like all other income, not as capital gains.

If we believe that fairness requires the wealthy to pay more in taxes, the most efficient method is to legislate the constructive realisation of capital gains at death — when all assets have to be evaluated for estate taxes. At present, the cost basis of assets is written up to current market value at death and capital gains taxes are avoided. Imposing such taxes at death corrects this avoidance and the lock-in effect of escaping taxation by holding appreciated shares.

A further method of increasing revenue would be to add a federal consumption tax to the current income tax. In some sense it is far more reasonable to tax people on what they take out of the goods and services produced by the economy rather than on what they put into the productive process through work effort and investments. And there are methods to make consumption taxes far less regressive than critics claim.

With a Congress under the influence of lobbyists, we should have no illusions about how difficult closing loopholes will be. But we should not abandon the goal of creating a fairer and more efficient tax system.

#reform #taxes