Couche-Tard’s pursuit will force 7-Eleven to mount a tougher defence

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

For some, rejection just means a stronger resolve to get a deal done. Alimentation Couche-Tard has told Japan’s Seven & i Holdings that it is willing to pay about $47bn to take over the convenience store giant — a fifth more than its first offer. Still, the Canadian operator could end up jilted.

Seven & i shares surged more than 10 per cent in Tokyo morning trade following reports of the proposed all-share buyout. The latest approach follows an offer of $38.5bn in September, which the Japanese group received and rejected, saying it “grossly” undervalued the group.

Couche-Tard has good reason to make an aggressive push for this deal. Unlike in Japan where three groups — 7-Eleven, FamilyMart and Lawson — control about 90 per cent of the country’s convenience store market, the US market is highly fragmented and presents ample opportunity for a new leader to win market share from local rivals. 7-Eleven and Couche-Tard’s brands would give it a combined market share of about a fifth in the US, making it the country’s biggest convenience store operator.

The US is an especially lucrative market for convenience stores with sales hitting a record $860bn last year. That is reflected at Seven & i, with three-quarters of group revenues coming from outside Japan, mostly from North America. Recent trends also make an acquisition of a Japanese group more attractive — fuel sales have been decreasing while prepared food and beverage sales have been rising. In Japan, convenience store sales consist primarily of food and beverages.

But for Seven & i, the offer comes at a time when there is a rosy outlook at home too. Convenience store sales in Japan rose last year to a record high of $78.6bn, the third straight year of sales growth for the sector, according to industry data. Increasingly frequent heatwaves in Japan have made ice cream and drink sales especially lucrative.

Since Couche-Tard’s first approach, Japan has designated Seven & i as a “core business” that is essential to national security. As foreign investors would be required to go through a security review to take over a Japanese company anyway, the designation does not necessarily change much for Couche-Tard. But the designation does suggest that striking a deal will not be easy.

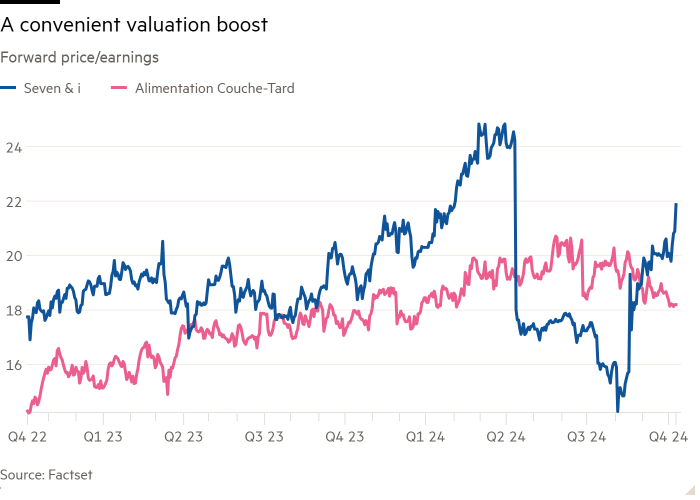

Seven & i investors should benefit regardless. The stock is up 45 per cent from an August low. It now trades at a forward earnings multiple of approaching 22 times. Meanwhile, the Canadian company’s interest has already prompted Seven & i’s management to consider an overdue pruning of its conglomerate structure. As the offer price rises, the urgency to mount those defences will only increase.

#CoucheTards #pursuit #force #7Eleven #mount #tougher #defence