Is there a GLP-1 bubble?

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

This article is an on-site version of our Unhedged newsletter. Premium subscribers can sign up here to get the newsletter delivered every weekday. Standard subscribers can upgrade to Premium here, or explore all FT newsletters

Good morning. Hurricane Milton is hammering Florida. Conflict in the Middle East is still running hot. Fair to say we have already had several October surprises. Let’s hope CPI, out this morning, is not another. Email us with your fears: [email protected] and [email protected].

Is there a GLP-1 bubble?

AI gets a lot of attention. There have been thousands of think pieces on how it will transform society, and almost as many arguing that AI hype has driven tech stocks into bubble territory. Glucagon-like peptide-1 (GLP-1) obesity drugs get a lot of attention, too, for their impact on fashion, exercise and health. But almost no one seems to be wondering if there is a GLP bubble.

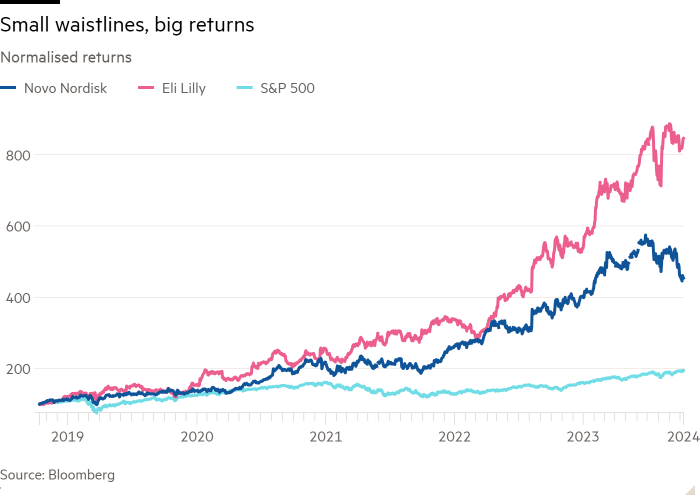

Eli Lilly and Novo Nordisk, which make the leading GLPs on the market, have wildly outperformed the S&P 500 for the past five years:

Eli Lilly has a price/earnings ratio almost as high as Nvidia’s:

Expectations for both companies are really high. Morningstar estimates the GLP-1 drug market will be worth $200bn by 2031, and analysts expect Eli Lilly and Novo Nordisk to take the lion’s share of it. Revenues are expected to nearly triple for Eli Lilly from now until 2031, largely driven by its GLP-1 blockbusters Zepbound and Mounjaro:

Novo Nordisk is on a similar trajectory, though Wall Street expects its GLP-1 revenues from Wegovy and Ozempic to start falling after 2029:

The free cash flow estimates for the two companies are even more astonishing, with both expected to pull in more than $35bn by 2031:

Are expectations set too high? There are several factors to consider.

Competition is fierce. Profitable drugs invite competitors with slightly different formulations or delivery methods. Here is a chart from Morningstar of aspiring GLP-1 market entrants. Novo Nordisk and Eli Lilly may both keep their edge for a while due to their own new products — Novo Nordisk already has an oral drug on the market, though it is not as popular as the injectables, and both companies are set to be first out of the gate on lower-dose oral GLP-1s. But Pfizer and Roche will follow soon after:

Then there are the patents. Novo is set to lose its US patent in 2032, while Eli Lilly is scheduled for 2036 (this partially explains its valuation premium over Novo Nordisk). But importantly for both, Novo Nordisk’s GLP-1 products lose their Chinese patents in 2026, potentially opening the US and European markets to trafficked generics.

The market will begin to discount the patent expirations years before they actually arrive. Shares in AstraZeneca traded sideways for years (at a single-digit price-to-earnings valuation) before the main patents on its blockbusters Nexium and Seroquel expired in the early teens. Pfizer launched its mega-blockbuster Lipitor in 1996. Its revenues peaked at almost $13bn in 2006 and were still about $10bn in 2010, the year before its US patent expired. But the stock had peaked by 2000 and traded at less than 10 times earnings from 2008 to 2011.

It is also worth noting, in the context of competition, that while Lipitor was by far the best-selling of the cholesterol-fighting statin drugs, it was the fifth one to launch. Just because Lilly and Novo were the first in GLPs does not mean they will maintain their lead.

Price will also be a question going forward. The GLP-1s face Medicare price negotiations in 2027, and the CBO’s report from this week suggests that Medicare and other insurers may demand significant price reductions.

There is also uncertainty about future volumes. Here is Karen Andersen at Morningstar, one of the few analysts to express scepticism about the buy case for Lilly and Novo:

One of [the big questions] is how long patients will need to stay on therapy. So far from what we have seen, it is difficult to maintain weight loss when patients go off of therapy. Eli Lilly, Novo Nordisk and competitors are thinking of the best way to help patients stay compliant on a maintenance regimen. The answer may be to take the medication less frequently, or at a lower dose . . . That is going to have huge implications for the long-term revenue forecast of these companies, and for the potential health benefits of taking the drugs.

Finally, weight-loss drugs have a rocky history. Some readers may remember the rise and fall of Fen-Phen, or how Sanofi’s much-hyped Acomplia was withdrawn in Europe and never won approval in the US. There have been rumblings about muscle loss and other issues with GLP-1 drugs. As the population of people being treated increases, new issues may emerge.

We don’t know if Lilly and Novo are overvalued. If other drug companies do not develop good alternatives in the next couple of years, no worrisome side effects emerge, most patients are happy to stay on the drugs for the long run, and pricing negotiations go well, the two companies should print money for years to come. What worries us is that no one in the market seems to be taking the bearish side of the GLP-1 trade. In markets, unanimity is dangerous.

(Reiter and Armstrong)

One good read

Mystery (maybe) solved.

FT Unhedged podcast

Can’t get enough of Unhedged? Listen to our new podcast, for a 15-minute dive into the latest markets news and financial headlines, twice a week. Catch up on past editions of the newsletter here.

Recommended newsletters for you

Due Diligence — Top stories from the world of corporate finance. Sign up here

Chris Giles on Central Banks — Vital news and views on what central banks are thinking, inflation, interest rates and money. Sign up here

#GLP1 #bubble