Don’t bet on a taxing outcome for UK gambling companies

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

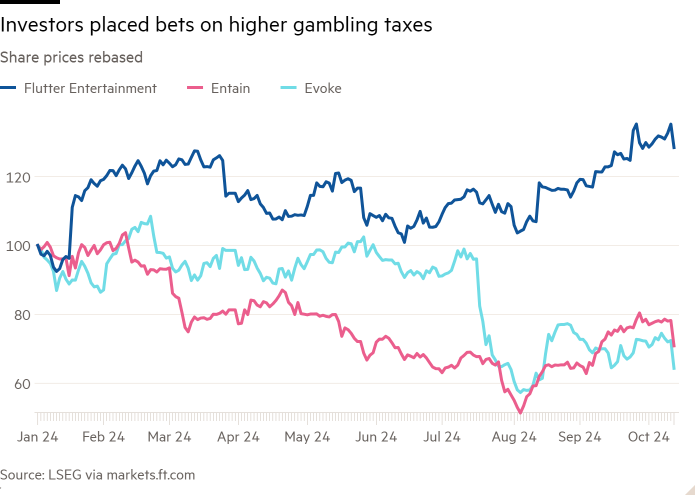

With the UK government trying to plug a £22bn fiscal hole, investors figured it was worth taking a punt on higher gambling taxes. Shares in Flutter, Entain and Evoke fell as much as 14 per cent early on Monday morning on reports of a £3bn raid on bookies.

Think-tanks have provided grist to this mill: vice taxes carry a social as well as financial benefit, they argue. Doubling duty on online casinos alone could bring in £900mn, says the Social Market Foundation. That is a quarter of this year’s estimated duties, levied on gross profits or total stakes, of £3.6bn.

Though government figures downplayed the idea of a tax raid, this looks to be an opportunity for a decent haul without raising mass hackles. It is easier to target a contentious sector. A lightly staffed online sector means reduced risk of job cuts. The UK, already a low taxer by international standards, would be following Sweden, which has raised gambling taxes, and the Netherlands, which will do so from January.

Still, there would be an outsized blow to the industry. UK-related operating margins stand at about 20 per cent. A few big participants have fatter margins (Flutter’s ebitda margin is about 30 per cent for UK and Ireland) but plenty fall below that. Taxes at the rates proposed by IPPR — 50 per cent for online operators and a doubling to 30 per cent for high street bookies — would essentially wipe out profitability.

Operators cannot simply pass these on to customers: this is no penny added to a can of full-sugar soda. True, bookies can offer poorer odds. But in a competitive and largely undifferentiated industry, this would be tough unless the companies moved in lockstep.

There would be other ramifications. Companies might seek savings by cutting back on sponsorships and advertising budgets. Online gambling generates about £1.4bn of marketing spend, says Regulus Partners, a consultancy. Poorer odds could also drive gamblers into the so-called black market. Customers already stake an annual £2.7bn here a year, reckons the Betting and Gaming Council, equivalent to 2 per cent of the £128bn in Britain’s regulated market.

Nearly £15bn of that is placed by customers who also use black market operators and who may be minded to switch more activity over. Fears that money would flow from the regulated sector (denting the Treasury’s take) has long deterred action against the industry.

The knee-jerk share price moves were an overreaction. Last year, for example, Flutter derived three-quarters of its revenue outside the UK and Ireland. But those reflected nerves about an unpopular sector, still on the watchlist of regulators and governments.

#Dont #bet #taxing #outcome #gambling #companies