23andMe succumbs to a dismal genetic destiny

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

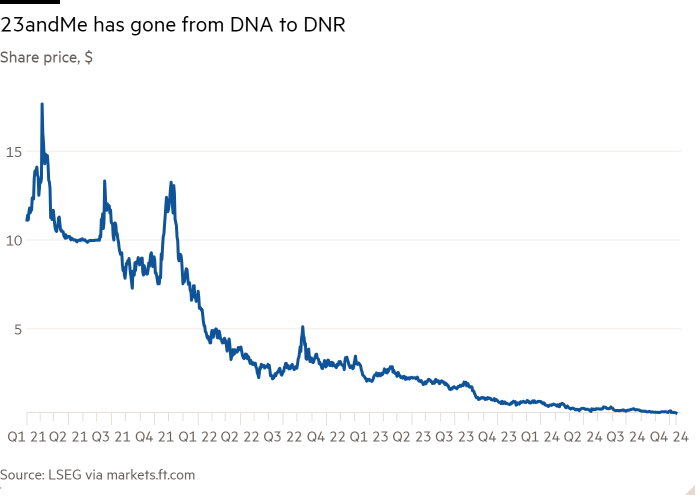

Even before its birth as a public company, 23andMe never really had a chance. The DNA-testing firm’s shares have slid, revenue has disappointed and profit has not materialised. Co-founder Anne Wojcicki now wants to take 23andMe private, at a meagre price. This misfortune is the result of both nature and nurture.

As business models go, 23andMe was stunted from the start. Customers pay to spit into a tube, mail it back and learn what is written in their genes. Results can range from discovery of genes associated with serious medical conditions to more frivolous revelations, such as the genetic propensity to hate other people’s eating noises.

The problem is that after that big reveal, there is not much scope for recurring business. Back when 23andMe’s backers exploited frothy market conditions to merge with a special purpose acquisition company, the company forecast $400mn of revenue by 2024, boosted by activities such as drug development. It made just $220mn.

Wojcicki is to blame, though a wider slide in valuations of experimental drugmakers didn’t help. The godparents share some responsibility: Citigroup and the late Credit Suisse brought 23andMe to market in 2021. Citi’s analyst declared the $10 stock to be worth $14, only for the share price to halve in just over six months.

Even an injection of Richard Branson’s DNA didn’t help. The Virgin mogul set up the Spac that acquired 23andMe and handed it a public listing. His involvement in other blank-cheque firms has flopped too. An investment in eco-disinfectant maker Grove Collaborative has shrunk by 97 per cent. Of the two space companies Branson sold to Spacs, Virgin Galactic’s operations are on hold and Virgin Orbit went bankrupt.

The best hope for 23andMe is a takeover by Wojcicki, who proposed buying the portion of the company she doesn’t own for 40 cents a share in July. That was rejected by independent directors, who subsequently resigned. With the stock trading at 27 cents, it no longer looks so mean.

Still, it’s not clear what Wojcicki would get. No fewer than 13 US states — covering one-third of the population — have passed laws forcing companies to get consent from genetic data providers before a transfer to a new owner, say privacy advocates at the Electronic Frontier Foundation. If many say no, the value of 23andMe’s main asset may melt away before the ink is dry on a deal.

That’s more reason for investors to take what they can get and learn from their mistakes — namely, piling into a fragile, unproven business model in a hyped-up market. Genetic testing makes it possible to anticipate future challenges from the get-go. Backers of 23andMe did nothing of the sort.

#23andMe #succumbs #dismal #genetic #destiny