There are no easy answers to the decline of UK’s Aim

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

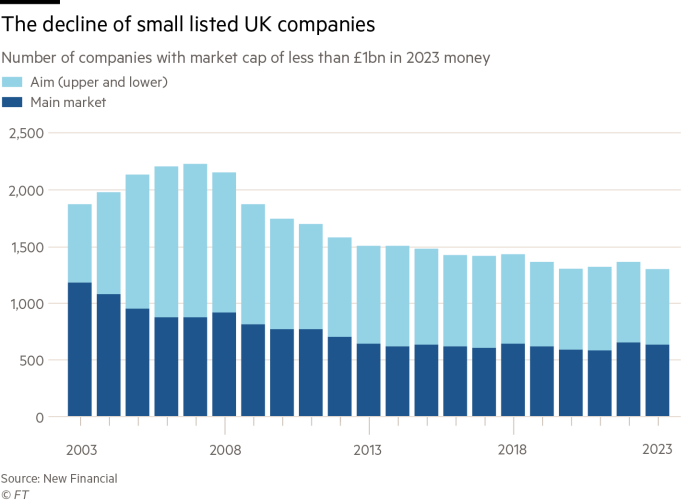

London’s junior stock market is in a dire state, no matter how you look at it. The number of companies listed on Aim is barely over 700, its lowest level in more than 20 years. In fact, the broader universe of small quoted companies is ailing. Take the universe of UK-listed companies valued at under £1bn, whether on the main market or Aim: their numbers are down by a third in the past 20 years.

There has been much soul-searching about the UK equity markets generally. But these small-cap difficulties have this week alone inspired a duo of think-tank reports. One, by capital markets think-tank New Financial, warns of an “almost existential threat”. The problem is there are no magic bullets that will reverse Aim’s decline.

Of course, the junior exchange’s problems cannot be disconnected from those of the wider London market, including the shift by UK pension funds to global equities allocation models, weak liquidity and structural valuation gaps compared with US peers (although the latter point has been contested by UBS among others).

The effect, though, has a disproportionate impact on smaller companies, argues New Financial’s managing director William Wright. Small companies that have delisted from Aim or are choosing to float elsewhere also complain about the lack of analyst coverage in the UK compared with other markets. Mid-size Aim groups have on average a quarter of the analysts covering them than US rivals, think-tanks the Tony Blair Institute and Onward have found.

Wider changes, such as the Financial Conduct Authority’s listing reforms, may help but will be something of a slow burn. Other measures could help: asset manager Abrdn has backed a call for the Mansion House Compact to be expanded to include all listed small caps. This voluntary agreement, signed last year by nine pension funds, aims for at least 5 per cent of members’ default funds to be invested in “unlisted” assets. This definition, however, already included Aim stocks. Amid calls to scrap stamp duty on share purchases, Aim again is already exempt.

Many proposals aimed at reviving the market involve tax breaks. Given UK chancellor Rachel Reeves has to close a £40bn funding gap, this is fanciful. The most optimistic outcome from the Budget would be no change to current tax reliefs.

The blunt assessment, from one of this week’s reports, was that Aim should simply be put out of its misery and scrapped. Unless policymakers and investors focus on ways to revive it, that is where the conversation will surely head.

#easy #answers #decline #UKs #Aim