Burst of trades gives Trump a winning edge in election prediction markets

Unlock the US Election Countdown newsletter for free

The stories that matter on money and politics in the race for the White House

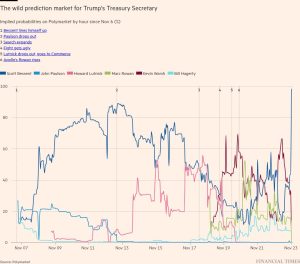

A small group of anonymous traders has propelled a dramatic surge in Donald Trump’s perceived chances of winning the US presidential election in prominent prediction markets, according to data analysed by the Financial Times.

On the largest of these sites, cryptocurrency-based exchange Polymarket, Trump’s odds have climbed to 62 per cent as of Thursday night.

However, four anonymous traders have had a noticeably large influence on Trump’s Polymarket odds. These accounts, the largest of which goes by the handle Fredi9999, have since the start of September collectively bought more than $30mn in shares predicting a Trump victory and hold the four largest stakes in the market.

Recent polling has also shown Trump gaining momentum, with the FT’s poll tracker now showing him ahead of Harris in five of the seven crucial swing states. Nationally, he has also narrowed the Democratic candidate’s lead to just 2.3 per cent.

But the moves in Trump’s favour in the predictions markets have been much bigger. Data shows that on certain days, trades from the four big accounts have represented as much as 20 per cent of the total volume in the presidential market.

Little information is publicly available about these four accounts. But prediction market experts and internet sleuths have identified a plausible connection among the set of accounts, suggesting that they may be tied to a single person or group. Trading and deposit patterns suggest coordinations between the accounts and public comments exhibit a similar tone and writing style.

These comments, as well as messages shared by other users, hint at some sparse biographical details about the trader or traders. They claim to be French, an “investor and statistician” who lived in New York from 2000 until 2006 working as a trader. They repeatedly claim to have “no political preference”, but rather a sincere belief that Trump is likely to win the election and that the true odds should be “75% Trump”.

Independent efforts by the FT to identify or contact Fredi9999 were unsuccessful, and Polymarket did not immediately respond to a request for comment.

The traders’ comments, taken at face value, suggest deep-pocketed “true believers”, making what they see as profitable trades. But there are other potential motives that they could be concealing, says Rajiv Sethi, a professor of economics at New York’s Barnard College who studies betting markets.

“You could have dominance of the market by a small group of traders who have big budgets and confident views,” he said, or somebody might “want to move the price a few percentage points . . . to affect public beliefs about momentum for a candidate”.

A third possibility, he explained, is “somebody with material inside information that is not yet public”, the fear of which could explain some reluctance from other traders to trade against the group of large accounts.

Despite the uncertain motivations of traders, certain rightwing personalities have pointed to Trump’s surge on Polymarket as evidence of the former president’s electoral strength. In early October, Elon Musk, the billionaire Trump backer, posted a screenshot of the Polymarket odds, commenting that the market was, “more accurate than polls, as actual money is on the line”, an idea echoed by many Trump allies since.

In theory, betting markets may offer a more accurate forecast of election results than polls and models, though fee structures, market sizes and other limitations can cloud those results.

Polymarket competitor PredictIt infamously gave Hillary Clinton roughly 80 per cent odds of victory in 2016 before her loss. PredictIt traders also continued to give Trump a 10 per cent chance of winning the state of Wisconsin weeks after the race had been called in the media.

#Burst #trades #Trump #winning #edge #election #prediction #markets