Back-to-back rate cuts no indication of future ECB policy, governor says

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Back-to-back reductions in borrowing costs by the European Central Bank are “not necessarily an indication” of faster rate cuts to come, Slovenia’s central bank governor has said, arguing that its next actions will be guided by new signals on inflation dynamics.

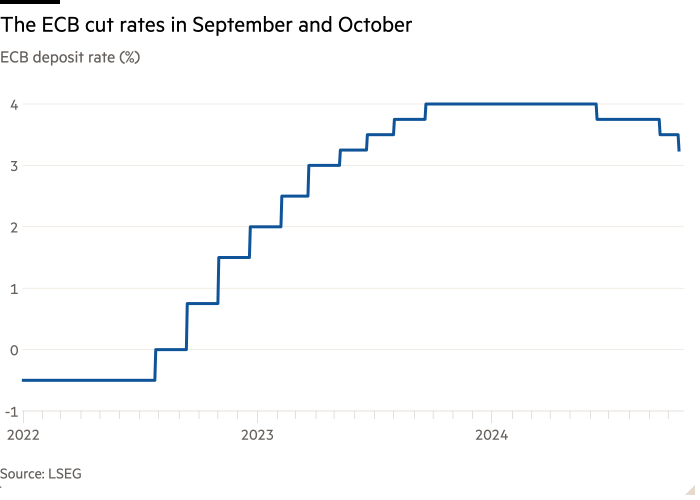

Boštjan Vasle’s comments come as traders now expect consecutive cuts at each of the next four meetings, according to levels implied by swaps markets. Such a path would lower the deposit rate to 2.25 per cent by April — the lowest point since February 2023 and close to the level that most economists believe neither restricts nor stimulates economic activity.

The ECB has lowered the key deposit rate by half a percentage point to 3.25 per cent at its governing council meetings in September and October, amid signs of softer inflation and weaker economic activity. Vasle hosted the ECB’s meeting on Thursday in Slovenia’s capital Ljubljana.

But Vasle, regarded by analysts as a moderate hawk who puts a strong emphasis on prioritising low inflation, stressed that the ECB’s actions in September and October has not defined a path for its future approach.

“This does not automatically mean that we will now act at every meeting,” he said, adding that he neither ruled out nor endorsed another cut in December at this stage. Vasle said the next meeting would be a “good opportunity” to assess the economic outlook in detail as ECB staff will have published updated forecasts. “This would be a starting point for the broader debate” about the bloc’s economy, he said.

The ECB for months has been reluctant to give guidance over its future monetary policy, reiterating on Thursday that it is taking “a data-dependent and meeting-by-meeting approach” and is “not pre-committing to a particular rate path”.

In the run-up to the October meeting, some analysts had expected the central bank to change its rhetoric but two people with direct knowledge of the governing council’s discussions told the Financial Times that the option was not even discussed.

Vasle, a former academic economist who has led the Bank of Slovenia since 2019, declined to comment on other policymakers’ views but said he was “very comfortable with our current approach” as it provided the flexibility needed to “act in a very uncertain environment”.

The October rate cut, which until a few weeks ago was not expected by analysts and traders, showed that the approach was “working well” as the ECB was able to respond swiftly to changes in economic data, he said.

The quarter-point cut to 3.25 per cent was unanimously supported, mainly because the ECB was “well on track regarding the decline in inflation . . . the data during the past few weeks provided additional confirmation that inflation is declining”, Vasle said.

In the 12 months to September, annual consumer prices across the Eurozone rose 1.7 per cent, falling below the ECB’s medium-term target of 2 per cent for the first time in more than three years.

But Slovenia’s central bank governor warned that it was too early to declare a definitive victory over the inflationary surge of the past few years as labour markets across the bloc were still tight.

“I cannot rule out at the moment that we will not see another spike in wage growth,” he warned, adding that there are still “concerns” linked to “high and persistent” inflation in the services sector, where year-on-year price increases are still twice as high as the ECB’s 2 per cent overall inflation target.

Vasle said the risk of too little inflation next year and in 2026 — a scenario that is concerning some rate setters — was not “a pressing issue”: on a quarterly basis, September’s ECB forecast predicts inflation will only reach its 2 per cent target by the end of 2025.

“My primary concern is to bring inflation back [down] to 2 per cent,” he added.

Additional reporting by Ian Smith in London

#Backtoback #rate #cuts #indication #future #ECB #policy #governor