The new corporate green goal: being ‘nature positive’

Marco Lambertini holds up his hands and splays his fingers: that is how many companies turned up to previous UN conferences on biodiversity, says the veteran conservationist, with only a flicker of exaggeration.

While big business has flocked to the UN’s recent climate summits to talk about decarbonisation, protecting nature has remained the domain of conservationists, philanthropists and other ethically minded types.

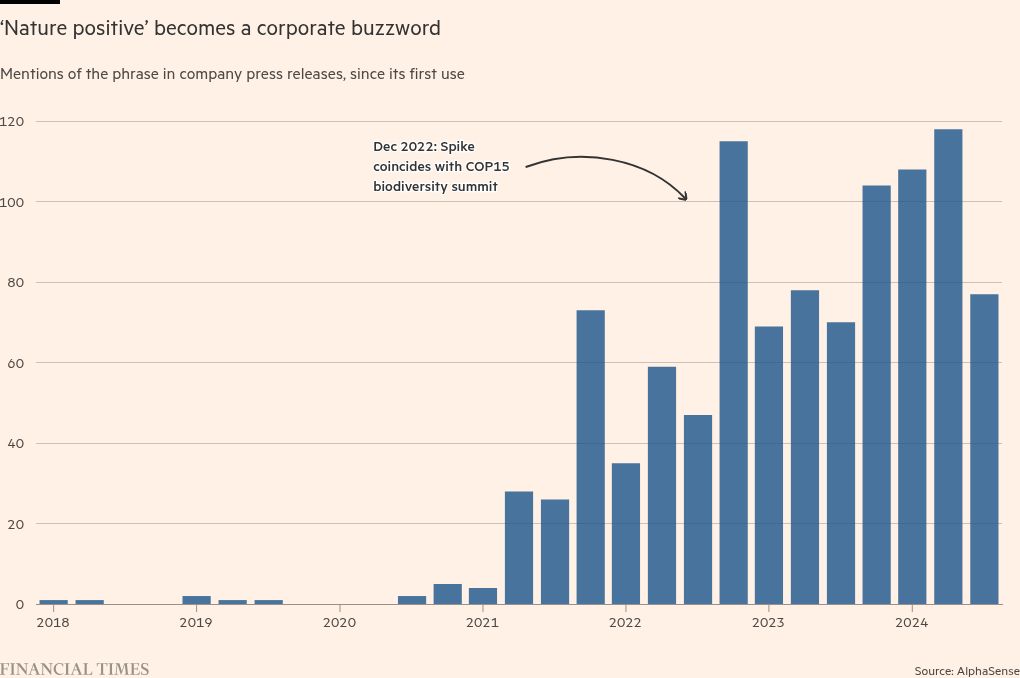

This has started to change. About 1,000 businesses and financial institutions went to the last biodiversity summit, COP15, held in Montreal, Canada at the end of 2022, according to Business for Nature, a coalition of businesses and conservation groups. This week record numbers are expected to be at COP16 in Cali, Colombia.

Their expanding presence points to nature’s rise up the corporate agenda. From agribusinesses to asset managers, companies around the world are increasingly touting their ambitions to be “nature positive” alongside their net zero targets.

At its core, nature positive means halting and reversing biodiversity loss, targeting an overall increase in nature — trees, species, ecosystems — by 2030, relative to a 2020 baseline.

“Recognising the value of peatlands, forest, ocean, their capacity to regulate the climate, and not only to store carbon, is really important,” says Laurence Tubiana, chief executive of the European Climate Foundation and an architect of the 2015 Paris climate accord.

Global wildlife populations have shrunk by an average of nearly 75 per cent over the past 50 years, according to a report published this month by the World Wildlife Fund. The UN estimates that nearly 1mn animal and plant species are in danger of extinction.

While the Earth’s rising temperature is one of the biggest drivers of biodiversity loss, the destruction of the natural world is in turn catastrophic for climate change. In 2023 — the hottest year on record — forests, plants and soil absorbed almost no carbon dioxide in net terms as drought and wildfires depleted these natural carbon sinks, according to the preliminary findings of a study led by French research organisation, the Laboratory for Climate and Environmental Sciences.

“Until now, nature has buffered climate change massively,” explains Lambertini, a former director-general of the WWF who today heads the Nature Positive Initiative. “More than 50 per cent of the CO₂ emissions of anthropogenic nature have been neutralised by forests, wetlands and the ocean. Now, as all that is weakening . . . it’s failing, and that is exacerbating climate change with it.” Nature positive is “a goal”, he adds, “not a slogan”.

For some, however, the distinction may not be clear. Scientists and environmental groups worry that companies and governments are starting to brandish the term as a buzzword, before the definitions and metrics needed to ensure accountability have been put in place and without having grasped the scale of the work required. For example, you can now make ‘nature positive’ investments, book a ‘nature positive’ holiday, and buy a ‘nature positive’ coffee.

FT Edit

This article was featured in FT Edit, a daily selection of eight stories to inform, inspire and delight, free to read for 30 days. Explore FT Edit here ➼

Biodiversity-linked claims are more challenging to substantiate than those around climate, warns Michael Wironen of global non-profit the Nature Conservancy. While greenhouse gases are fungible and emissions can be tallied in neat units, nature is far messier, he explains. “I think when it comes to really establishing credible definitions and metrics around nature positive, there’s still a lot of work to be done,” he says.

Previous biodiversity targets for businesses fell flat and nature positive is an even “more ambitious goal”, says Professor Martine Maron from Australia’s University of Queensland. Yet “everybody is jumping on the new bandwagon,” she adds. “There is a risk that they’re going to discover that delivering that is a lot harder than they realise.”

Nature positive’s advocates respond that metrics and governance are on the way. A global biodiversity framework adopted by 196 countries at COP15 provides the means to achieve nature positive, they say. For the first time, it included specific targets that made it clear that businesses must play a role in reversing nature loss, says Eva Zabey of Business for Nature.

But two years on, many of the details around how governments and companies should go about implementing the targets set out in Montreal still need to be thrashed out.

On a global scale, it is clear what the nature positive goal means, says Jenn-Hui Tan, chief sustainability officer at Fidelity International. “The challenge is, when you take that big aspiration, what does that mean, operationally, at either an individual or organisational level? That’s where the complexity comes in.”

The impact of the decline of carbon sinks has served as a wake-up call about the “synergies between nature and climate”, says Lambertini.

Climate scientists have acknowledged that the failure to factor this in to their models is why the scale of climate change has been worse than many predicted.

The message is increasingly sinking in for the corporate world too, says Wironen of the Nature Conservancy, as the financial risks tied to biodiversity loss are becoming clearer. The World Economic Forum estimated in a 2020 report that more than half of global GDP at the time, or about $44tn, was “moderately” or “highly” dependent on nature.

“We rely on nature ecosystems to provide us with the things that run our society, whether that’s food, fuel or fibre,” says Wironen. “It’s fisheries, it’s medicines, it’s a whole slew of things that we depend on nature for.”

Companies in agriculture, forestry and other land-based sectors are already feeling the impact of degraded ecosystems, from declining crop yields to supply chain disruptions, says Paul McMahon of SLM Partners, a global asset manager that buys farmland and implements regenerative practices to improve soil quality. “Businesses are realising that protecting nature is not just a moral obligation, it’s a strategic necessity.”

For Olam Food Ingredients, one of the world’s biggest suppliers of food and drink ingredients, the alarm rang with the bees.

As one of the world’s largest almond growers, OFI says it spends between $8mn and $11mn a year on honeybees needed to pollinate almond trees. Despite this, productivity on the farms started to decline “because the bees were stressed by their industrialised environment”, says Rishi Kalra, executive director and group chief financial officer. “So, we worked with partners to create natural habitats for bees on our farms and reduce their exposure to agrichemicals. What we saw was that productivity steadily increased.”

Now OFI — whose parent company Olam had previously come under criticism for clearing rainforest in Gabon for palm oil production — has plans to convert 2mn hectares of land within its supply chains to regenerative agriculture by 2030.

“We know the importance of building a nature-positive economy,” says Kalra. “If we don’t focus on nature, the business that we operate may not even exist in years to come.”

As the capital value of the natural world rises, investors are taking note. From pension funds to insurance firms, many are recognising the financial risks posed by nature loss and seeking ways to align their portfolios with nature-positive outcomes.

Environmental, social and governance investing has evolved, according to Fidelity’s Tan, as the systemic risks related to nature become more apparent.

“These are longer-term system risks that affect everybody, not just any individual sector or company,” he says. “You have to think about how could nature impacts or dependencies affect a company’s business, and what, if anything, is a company doing?”

In January, members of investor network Fairr, who represent a combined assets under management of $51tn, said that biodiversity was the second most important theme after climate, in the network’s annual survey. “Biodiversity and nature” was also the top response to the question: “Are you focusing on any new ESG theme this year?”

There are even emerging investment vehicles specifically targeting biodiversity. ASN Bank in the Netherlands launched a biodiversity fund, which aims to deliver financial returns while directly investing in nature-positive projects.

Such funds are still rare but represent a growing trend as investors come to believe that aligning portfolios with environmental outcomes can generate value — not just risk mitigation but tangible financial returns.

Nature positive may be infiltrating corporate sustainability strategy documents around the world, but Queensland University’s Maron argues there is an “urgent need” for safeguards and guidance around some of the claims being made.

Part of the problem is the term itself. While Lambertini and the Nature Positive Initiative have come up with a strict definition, in practice there is nothing to enforce it, leaving companies and other institutions free to use their own.

“There is this concern that people just assume that, ‘I do my net zero and I do it in a way that’s sort of nice for nature, might use nature-based solutions, but I’m not actually really monitoring the absolute change in biodiversity’,” says Professor EJ Milner-Gulland from the University of Oxford. “That’s not nature positive. That’s just, using some nature-based solutions.”

Maron gives the Australian government’s planned reforms of national conservation — which she welcomes — as an example. “They developed this pathway of reforms called the nature positive plan and they’re introducing nature positive bills . . . The problem is what sits underneath this so far does not look nature positive at all.”

The frameworks aim to ensure that any loss in biodiversity from development is offset by conservation efforts elsewhere, often using a dynamic counterfactual of what would have happened in the absence of the business’s activity. So, if the koala population, for example, was declining anyway, additional decline caused by the company’s or government’s activity would be offset, but the overall decline could continue.

The plans would be better characterised, she says, as “biodiversity no net loss” or “net gain”. “Just because they’re using the term doesn’t make it nature positive.”

“Having a target is very different from having a credible plan with sufficient investment to actually achieve it,” echoes Wironen. “We see companies set ambitious goals that might depend on technological breakthroughs or external factors, but without robust infrastructure and realistic investment, these commitments risk being superficial.”

It is also intrinsically harder to define and measure progress on nature and biodiversity than on climate, adds Wironen. “Mitigating a tonne [of greenhouse gases] in Pakistan has the same effect as mitigating a tonne in London as it does in Argentina. With nature and biodiversity, it’s inherently non-fungible. The species you have in Argentina are different from the ones you have in Pakistan, as are the ones you have in London, and the ways in which an organisation impacts them, or a corporate impacts them, are much more complicated than really a simple question of emissions.”

This lack of a global standard for measuring biodiversity means that companies could, intentionally or otherwise, manipulate data to present themselves as nature positive without making substantial changes.

“There is no one global metric [for] diversity so you need to have this trade off between usability and accuracy, and that trade off is really difficult because there’s a lot of data limitation,” says Milner-Gulland.

“Whenever we measure biodiversity, what we’re doing is measuring a proxy or component or something we’re particularly interested in, or something that’s easy to measure, or we’re using some kind of metric that doesn’t really reflect the underlying biodiversity that’s there.”

This creates “room for greenwashing”, she says. “There’s lots and lots of loopholes that you can exploit by choosing your metric appropriately or inappropriately.”

For many advocates of nature positive, though, the worries around greenwashing miss the broader potential of the initiative.

“What’s bigger, the risk of greenwashing or the risk of a failed transition?” asks Fidelity’s Tan. He and others argue that clearer frameworks and better governance will soon help bridge the gap between ambition and action.

“Right now, the corporate says, ‘I do a certain thing. Well, that’s very great. We’re very happy with that.’ But how does that contribute to a broader objective of nature positive? No corporate can answer that question by themselves,” says Tan.

He hopes COP16 will provide a greater level of policy certainty, with governments due to put forward their national biodiversity strategy and action plans in Colombia. These will “provide the baseline against which you can measure corporate progress”, he says.

Rather than companies seeking to take advantage of vagueness, “there’s a yearning for clarity and specificity”, says Joshua Katz from McKinsey.

Some 130 businesses called on governments to enact tougher policies to reverse and halt nature loss in a letter organised by Business for Nature in July.

More than 300 companies, from food retail giant Carrefour to pharmaceutical powerhouse GSK, have also signed up as early adopters of the Taskforce on Nature-related Financial Disclosures, which aims to create a standardised system for companies to assess and report their biodiversity risks, much like existing frameworks do for carbon emissions.

This involves four main steps: assessing how their activities rely on and affect natural ecosystems, setting standardised metrics to track these impacts, transparently disclosing risks and strategies, and integrating this information into broader business decisions. For example, a beverage company might need to report how its water use affects local supplies, which would help investors understand potential environmental risks.

The Taskforce on Climate-related Financial Disclosures is a voluntary initiative, but Wironen from the Nature Conservancy sees the approach as a step in the right direction.

“If TNFD follows the same path as the climate-focused [disclosures], which moved from voluntary guidelines to becoming part of various regulatory frameworks, we could see a major shift in how companies address and disclose their environmental impacts. That would be a real sea change.”

“Nature targets are more complex . . . but they’re not unachievable,” says Tan. The Science Based Target Network is proving exactly this, he adds, referring to the 17 companies, including GSK, Nestlé as well as LVMH and H&M, which signed up for the first scientific targets for nature last year.

The problem may not be a lack of metrics but a surfeit of them, says Lambertini. “The climate community did a super important thing: straight after Paris, they developed a net zero pathway, and then they attached a global standardised way to measure emissions,” he says.

“Now, we need to do the same for nature. One won’t work because nature is more complex, but the 600 different methods that we have today are too many and confuse everybody. So we’re going to try to condense those into a small set of good enough — scientifically and practically speaking — proxies called the state of nature.”

With this, Lambertini hopes to eliminate or reduce the risk of greenwashing. “We need to put some order in this area of claims and contributions,” he says. “Companies say they are contributing to conservation, but it’s not enough. What we need is for contributions to match the scale of the problem.”

Data visualisation by Steven Bernard

Climate Capital

Where climate change meets business, markets and politics. Explore the FT’s coverage here.

Are you curious about the FT’s environmental sustainability commitments? Find out more about our science-based targets here

#corporate #green #goal #nature #positive