Sanofi deal offers only partial headache relief

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Miracle cures are few and far between. The best one can hope for is partial relief. So it is with Sanofi’s consumer health split. The French pharma group’s sale of a majority 50 per cent stake in its Opella unit to Clayton Dubilier & Rice leaves all participants with some ills to address.

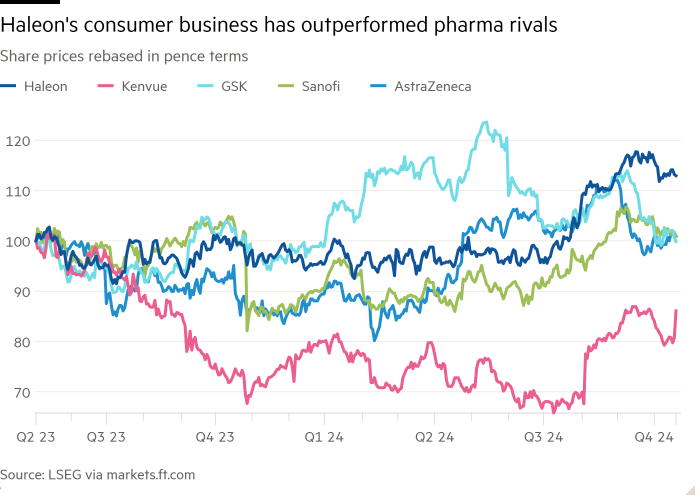

For Sanofi the issue is not strategic. Indeed, separating consumer health — think paracetamol, laxatives and other over-the-counter medicines — from its core biopharma activities is sensible. The two have different R&D profiles, different distribution channels and require different sorts of managerial skills. This is a tried and tested path for pharma companies, with GSK and Pfizer spinning off Haleon and Johnson and Johnson waving off Kenvue in recent years.

Sanofi’s pain is that, despite running a competitive process, it does not seem to have extracted a knockout price. At €16bn, the French pharma group is selling control of Opella for 14 times this year’s expected ebitda. Haleon trades on the market at a roughly 10 per cent premium. Part of the discount is due to Opella’s smaller size and slimmer margins. But Sanofi’s sale price also reflects the current dearth of strategic buyers. Haleon, for instance, is still paying down debt. Reckitt, which also has a consumer health business, is embroiled in legal woes related to its infant nutrition unit.

Sector consolidation is a likely outcome — just not now. That helps explain why Sanofi was keen to retain a sizeable minority stake. It may also go some way towards explaining why CD&R has been willing to play ball in what had become a politically fraught transaction.

The private equity giant has not only piled toppy leverage on to this, admittedly stable, business. It has also accepted a deal in which the French government gets a 2 per cent shareholding and board seat, plus a number of commitments on employment and investment in France.

Yet its numbers could still stack up. Indeed, assuming it can grow topline sales in the low-mid single digits, expand margins to the 25 per cent Haleon is expected to make this year, and exit at Haleon’s current market multiple, it stands to more than double its money in five years.

There is another reason why this transaction is only a partial cure. Sanofi will be left with a pure-play biopharma company that has yet to convince investors of its long-term prospects. It is cheap compared with peers, trading on just over 10 times this year’s forecast ebitda on a standalone basis, compared with AstraZeneca on over 15. It will struggle to re-rate without sizeable R&D wins.

#Sanofi #deal #offers #partial #headache #relief