UK public borrowing exceeds official forecast in September

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

UK public sector borrowing increased in September and was higher than official forecasts, underlining the scale of the challenges facing chancellor Rachel Reeves as she prepares to raise taxes in next week’s Budget.

Borrowing — the difference between public sector spending and income — was £16.6bn in September, £2.1bn more than in the same month last year and the third-highest September figure since monthly records began in January 1993, the Office for National Statistics said on Tuesday.

The figure was lower than the £17.5bn expected by economists polled by Reuters but above the £15.1bn forecast by the Office for Budget Responsibility, the UK watchdog.

Alex Kerr, economist at Capital Economics, said that the figures “highlight the limited scope the chancellor has to increase day-to-day spending without raising taxes”.

Kerr noted that the latest figure meant that borrowing was on track to overshoot the OBR’s forecast for the fiscal year 2024/25.

ONS deputy director for public sector finances Jessica Barnaby said: “While tax revenue increased [in September], this was outweighed by increased spending, partly due to higher debt interest and public sector pay rises.”

In the first six months of the fiscal year to September, borrowing was £79.6bn, which was £1.2bn more than in the same period in the last financial year and higher than the £73bn forecast in March by the OBR.

Darren Jones, chief secretary to the Treasury, said that the Budget would “require difficult decisions to fix the foundations of our economy and begin delivering on the promise of change”.

Reeves has identified a £40bn funding gap, some of which is likely to be filled by tax rises.

She has ruled out increases to income tax, VAT and national insurance for employees, but is expected to raise capital gains and inheritance taxes and extend the income tax threshold freeze beyond 2028.

Not adjusting the tax thresholds for the impact of inflation pushes people into higher tax brackets as they receive pay increases — a phenomenon known as “fiscal drag” — and increases government revenues. Other possible tax rises include raising national insurance contributions for employers and rises on fuel duty.

Rob Wood, economist at consultancy Pantheon Macroeconomics, expects a range of tax increases, but he also forecasts that the chancellor will borrow more to boost investment.

Higher capital spending could boost economic growth and could be helped by tweaks to one of the government’s fiscal rules, which pledges to reduce public debt as a share of GDP between the fourth and fifth years of the forecast.

Using a broader measure of public debt from the current one would give the government about £50bn of additional headroom to borrow, he noted, adding that Reeves’s focus on balancing the current budget “demonstrates a commitment to sustainable finances — unlike during the Liz Truss episode, which saw borrowing to fund an inflationary sugar rush of tax cuts”.

The other self-imposed fiscal rule involves balancing the current budget, which excludes investment, during the forecast period, which will end in 2029-30.

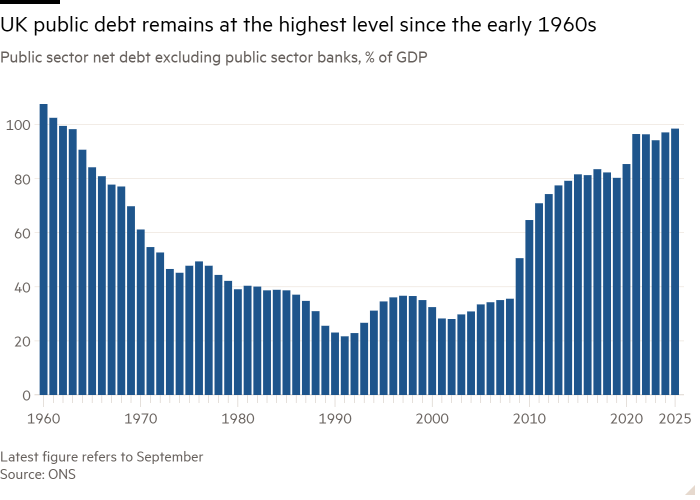

Public sector net debt, or borrowing accumulated over time, was 98.5 per cent of GDP at the end of September, the highest level since the early 1960s, the ONS said.

Cara Pacitti, economist at the Resolution Foundation, a think-tank, said: “Today’s data highlights the scale of the public finances challenges facing the chancellor as she grapples with overspending today, the need to avoid austerity in the future, and having to fund extra public service spending through tax rises.”

#public #borrowing #exceeds #official #forecast #September