France tightens its belt despite risk to growth

After 50 years of failing to balance its budget, France wants to narrow its deficit next year with €60bn-worth of tax rises and spending cuts.

But the belt-tightening poses a risk to growth, analysts and businesses say, in an economic climate that may be as fragile as the country’s government.

That, in turn, creates a headache for the Eurozone, where France’s relative health has acted as a bulwark against a sharp slowdown in Germany.

New conservative premier Michel Barnier this month unveiled a fiscal package that aims to narrow its deficit from 6.1 per cent this year to 5 per cent by the end of 2025.

Barnier believes his proposals will not only put France on track to reach the European Union’s 3 per cent deficit limit by 2029, but also leave the Eurozone’s second-largest economy able to expand by 1.1 per cent in 2025 — a level similar to what the government anticipates for this year.

While they say spending cuts will be considerable, ministers also claim tax increases on large companies and the wealthy will be “targeted and temporary”, insulating jobs and growth.

“In the current, urgent situation, we have no choice but to reduce public spending and the deficit,” said Barnier, who has also warned that France faces a financial crisis if the problems are not addressed.

French forecasts fall as budget bites

Predicting the budget’s impact on the economy is challenging since Barnier lacks a parliamentary majority and risks facing a no-confidence vote, meaning he will have to compromise with lawmakers.

However, many economists believe the impact of fiscal restraint, which amounts to as much as 2 per cent of output, will almost certainly be more dismal than the government expects.

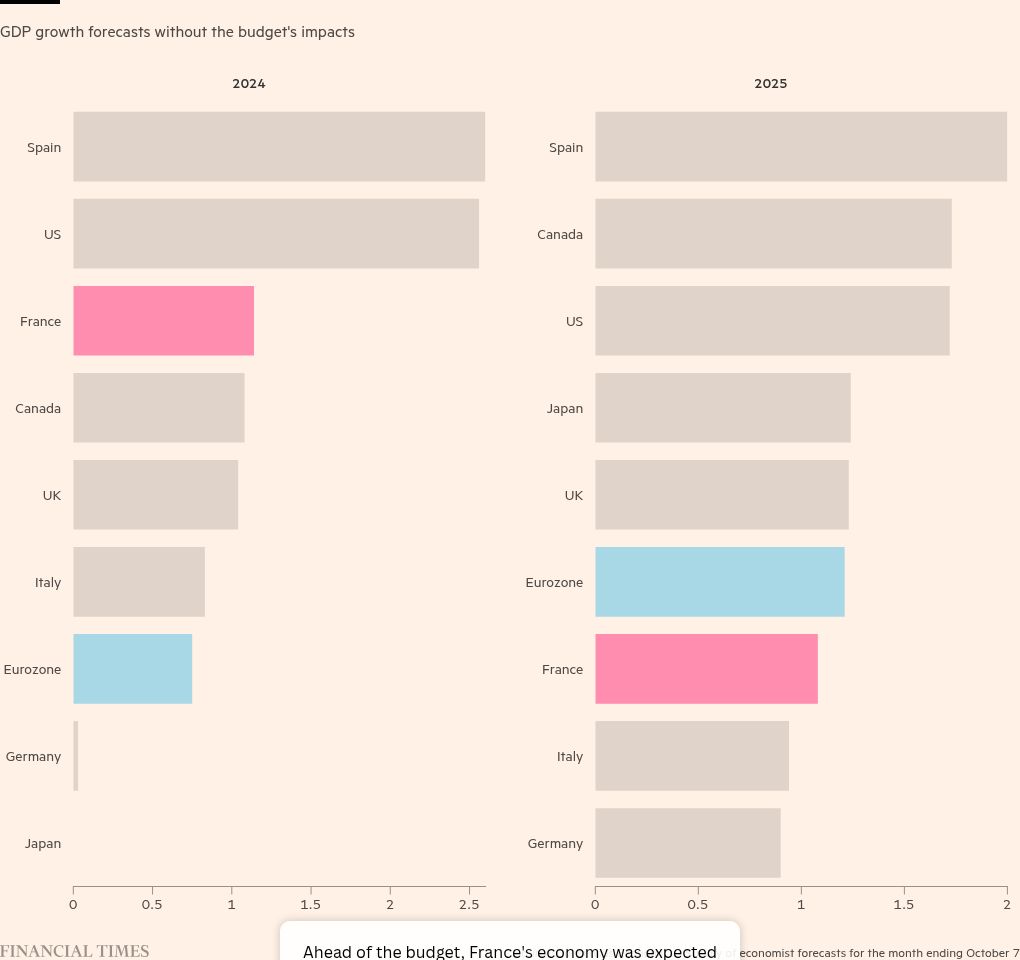

Even before the budget’s impact was factored in, France was expected to be one of the worst performers among large, developed economies.

Some economists now predict that growth in gross domestic product could drop to as low as 0.5 per cent next year.

“This period will be difficult for all: not only businesses and the wealthy whose taxes will rise, but also for households and local governments,” said Bruno Cavalier, chief economist at Oddo, a bank that is among the most bearish. “Everyone will feel some pain.”

OFCE, a Paris-based research group, forecasts GDP will grow by 0.8 per cent, with tight fiscal policy blunting the positive effects of lower energy prices and the European Central Bank’s interest rate cuts.

François Villeroy de Galhau, the governor of the Bank of France, said recently on France Inter radio the impact would be manageable. He called the OFCE forecast “a bit pessimistic” given other “favourable elements”, such as a high level of savings available to cushion consumption.

An already fragile economy

Other economists warn that demand is already fragile, with households still choosing to save rather than spend even as their wages start to catch up with inflation.

“Without government spending, consumption would have been falling already last year,” said Gilles Moëc, chief economist at insurer Axa, who thinks GDP growth could be as low as 0.6 per cent in 2025.

Higher interest rates have already done damage, despite the ECB’s recent cuts. Bankruptcies are at their highest level in years as the cushion from Covid-19 aid programmes fades.

Catherine Geurniou, the owner of a small business that makes windows for homes and offices, has seen her revenues fall by a fifth this year. She fears a further slowdown from the trimming of government subsidies for energy-efficient renovations.

“I’m thinking about cutting back on investment in my company,” Geurniou said.

The proposed budget may also hit jobs.

Generous subsidies worth up to €6,000 a year to companies who hire apprentices — subsidies which helped spur a million more people to join France’s workforce — are set to be trimmed. Other tax breaks given to employers to incite them to hire low-income workers will be cut back.

That will almost certainly put President Emmanuel Macron’s goal of reaching 5 per cent unemployment out of reach, and raise the jobless rate from the current level of 7.3 per cent.

Bruno Castagne, who owns a small cleaning company with eight employees, said his business would be hurt by the lower tax breaks on entry-level salaries and apprenticeships.

“It could take off almost half of my 6 per cent profit margin,” he said. “I feel that it’s getting harder and harder to handle the uncertainty, and our market is also getting more competitive.”

As the Macron era ends, challenges deepen

The budget shows that Macron’s era of business-friendly reforms are on the backburner as cleaning up public finances becomes a priority both for Brussels and investors.

Concerns over France’s fiscal situation have contributed to a sell-off in its long-term debt this year, taking its 10-year yield to just above 3 per cent and crossing above Spain’s for the first time since the 2008 financial crisis.

The Barnier government proposed €15.6bn in new levies on large companies and the wealthy. He has repeatedly promised that the hikes will only last two years, but few observers believe that.

Moëc said the government had little choice in the short term but to target wealthy people and businesses who could “take it on the chin”.

In the longer term, France will struggle to use its habitual method of using taxation to plug the deficit hole because its tax burden already represents a bigger share of GDP than in any other OECD country.

While the government claims the package is two-thirds spending cuts and one-third higher taxes, the independent Haut Conseil des Finances Publiques budget watchdog contests their methodology.

Barnier’s calculations do not use a baseline of 2023 spending, but the counterfactual of what spending would have been in 2025 if nothing was done. The Haut Conseil estimated that the real fiscal straitjacket was much looser — more like €42bn than €60bn — with 70 per cent of the restraint coming from tax hikes.

Economists agree. “The unusual method that the government used makes it seem like they are doing more than they are, and that the package includes more spending cuts than taxes,” said Silvia Ardagna, a Barclays analyst. “The opposite is true.”

Barnier’s perceived sleight of hand, and the fact that France has not balanced its budget since 1974, speak to the scale of the challenges facing the Eurozone’s second-largest economy.

His minority government has little political capital on hand to enact the unpopular policies that France needs to address its persistent deficits.

First among these would be cutting its enormous pensions bill that amounts to 14 per cent of GDP annually — a political third rail given the voting power of the elderly. Public services, from health to education, have also received hundreds of billions in extra money since 2017 without always delivering better results.

“They are doing what’s politically possible . . . but it’s a sticking plaster,” said Andrew Kenningham, at the consultancy Capital Economics. “It’s widely recognised that they need to reduce the cost of the state. They just haven’t got a mandate to do it.”

Additional reporting by Ian Smith in London

#France #tightens #belt #risk #growth