Deutsche Bank is a long way off playing German consolidator

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Deutsche Bank, it would appear, is keen on domestic consolidation — just not yet. The German bank is right to dampen speculation that it might elbow its way into the fraught potential takeover of rival Commerzbank by Italy’s UniCredit. As its latest set of results show, its turnaround has barely begun. There is plenty of knitting for it to stick to.

The lender has undeniably made progress under Christian Sewing, chief executive since 2018. Its revenues are on track to reach about €30bn this year, up more than a third since 2020. While its costs are still high, at 69 per cent of income, the proportion has fallen almost a fifth.

But there are still plenty of niggles, including the outsize contribution from Deutsche’s investment bank and persistently disappointing loan loss provisions.

The bank is reasonably well capitalised, with a core tier 1 equity ratio of 13.8 per cent. It may well hit its target of a return on tangible equity of at least 10 per cent next year.

Trouble is, that is about the bare minimum that shareholders require, and far behind the European pack. Indeed, the sector’s average return on tangible equity next year will be 13 per cent, according to Andrea Filtri at Mediobanca, with top performers nudging 15 per cent. While Deutsche Bank’s stock has rallied almost 70 per cent over the past 12 months, the bank is still valued at a measly 0.5 times its tangible book value. The next leg of its turnaround will require it to explain how it bridges the gap with rivals.

Trying to prise Commerzbank from UniCredit’s jaws would be a distraction for Deutsche — one that it cannot afford.

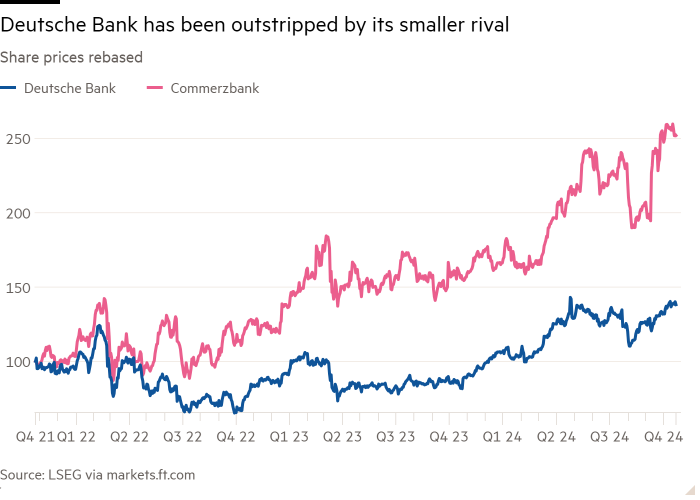

Its smaller rival is not so small any more. Commerzbank has zoomed to a market value of more than €19bn, compared with Deutsche’s own €32bn. It is also more highly valued, trading at a premium on next year’s earnings of more than 20 per cent to its larger rival.

Deutsche has limited excess capital, meaning it would have to pay for any acquisition with newly issued shares. But it would have to issue so many that its earnings per share would fall, according to a Barclays analysis, even if it managed to cut 30 per cent of its target’s cost base.

That contrasts with Deutsche’s standalone prospects, with earnings per share expected to grow by more than 10 per cent a year between 2024 and 2026 on S&P Capital IQ estimates.

True, a UniCredit-owned Commerzbank might make its domestic life harder, at least at the margin. But that is not enough to think that it could or should muscle in.

#Deutsche #Bank #long #playing #German #consolidator