For Vivendi, this split is better than no split at all

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Investors usually like it when conglomerates split themselves up. Demergers eliminate the discount that the market attributes to a collection of disparate assets. The resulting pieces can end up being takeover candidates if their industry consolidates.

Yet Vivendi’s demerger has run into opposition. The French media conglomerate plans to split itself into four listed entities — pay-TV operator Canal+, advertising agency Havas, publisher Hachette and the Vivendi rump (a collection of stakes in media companies) — with largest shareholder Groupe Bolloré ending up with roughly 30 per cent of all four pieces. French activist CIAM has urged shareholders to vote against the transaction on December 9, and launched multiple suits to stop the process.

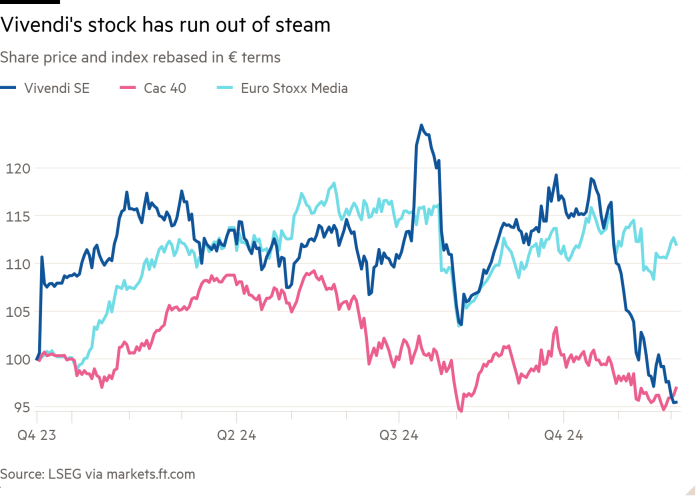

Meanwhile, Vivendi’s share price rally has run out of steam as estimates are reduced for its underlying parts and as hopes fade that a split will create value.

The way Vivendi has structured its demerger does reduce the potential upside for investors. Havas will list in Amsterdam, where local rules provide protection against hostile takeovers. Canal+ is set for London where, as a foreign domiciled company, it is exempt from the UK Takeover Code. That leaves the door open for major shareholder Groupe Bolloré — led by famed French financier Vincent Bolloré — to increase its stake without making a mandatory takeover offer.

Yet investors should not necessarily prefer the status quo. Vivendi itself already arguably suffers from a governance discount given Bolloré’s influence. And it is entirely unclear that, should the existing demerger plan be voted down, the group will come up with a more minority-friendly alternative.

The debate will probably boil down to valuation — and specifically whether the advantage of removing Vivendi’s conglomerate discount outweighs potential drawbacks. As a rule of thumb, for instance, small-caps suffer a 10 to 15 per cent “liquidity” discount.

Much hinges on the value of Canal+, which accounts for about a third of Vivendi’s revenues. Unfortunately, valuing the broadcaster is not an easy task given thin guidance and a lack of peers.

Putting it on a conservative 8 per cent free cash flow yield — as UBS does — yields a valuation of less than €3bn for a total sum of the parts equity value of €9.6bn. That is better than Vivendi’s current €8.8bn market cap, but not wildly exciting.

But buy into the Canal+ prospects, which rest on the increase in entertainment spend and its position in fast-growing markets, and the split looks more compelling. On an ebitda multiple of 5.8 times, in line with European telecoms and indeed UK broadcaster ITV, Canal+ would be worth about €5bn. That extra €2bn of value should entice investors to fall into line.

#Vivendi #split #split