Number of people caught in 60 per cent ‘tax trap’ up 45% in two years

Stay informed with free updates

Simply sign up to the UK tax myFT Digest — delivered directly to your inbox.

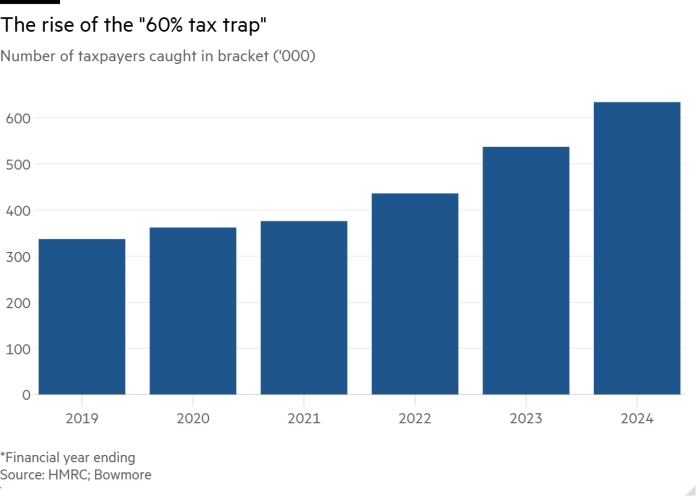

The number of individuals being taxed at 60 per cent on part of their earnings has risen by almost half in two years, new figures seen by the Financial Times show.

The numbers, revealed by a freedom of information request to HM Revenue & Customs, showed that in 2023-24, 634,000 taxpayers were estimated to fall into the 60 per cent bracket — up 45 per cent from 436,000 in 2021-22.

Since 2010, those earning more than £100,000 a year have had their personal allowance tapered away until it is completely eliminated for earnings over £125,124.

The tax-free personal allowance has also been frozen at £12,570 since April 2021, with Chancellor Rachel Reeves maintaining the freeze in place until 2028 in the Budget.

This means that for every £2 earned above the £100,000 threshold, £1 of the allowance is removed — leaving taxpayers within the £100,000-£125,124 bracket facing an effective rate of 60 per cent on that part of their income.

Bowmore Financial Planning, which requested the information from HMRC, said frozen tax thresholds and wage inflation — measured at 5.5 per cent by the Office for National Statistics in January 2024 — were responsible for the rise.

The combination, known as fiscal drag, pushes those with rising incomes into tax brackets they would previously have not reached.

Mark Incledon, chief executive of Bowmore Financial Planning, said the number of taxpayers “falling victim to this notorious tax trap was already incredibly large,” but that hundreds of thousands more people were now in this position.

“The long-term effect of leaving the tax trap issue unresolved is that it disincentivises hard work. People are far less likely go the extra mile and push for promotion if they think they won’t feel the reward for extra effort,” he added.

To avoid being hit by the rate, some individuals may opt for salary sacrifices or further pension contributions. But Dan Neidle, founder of the Tax Policy Associates think-tank, said these were often “unattractive” alternatives.

“For many, this means working more hours and harder for a return they won’t see for decades,” he said.

He added that it was “amazing” so many people had been hit by a “political gimmick designed to raise tax without raising headline rates”.

“The Conservatives don’t want to admit the problem they created, and Labour doesn’t want to be seen to care about people earning £100,000. If I was a chancellor obsessed with growth, I’d be looking very carefully at [the problem],” he concluded.

John Cassidy, a partner at tax advisers Crowe, echoed concerns that the rate was a disincentive to growth. He added that the fear of being hit by the band was leading some small business owners to divert their salary elsewhere.

“Say a spouse is employed so husband and wife can split the income and keep each person below £100,000,” he said. “Their role may be minor, yet generates a large salary diverted from the other spouse.”

The figures, which show the number of taxpayers estimated to be within the 60 per cent bracket has risen continually since 2018-19, are predicted to increase.

Previous reporting by the FT showed that the number of people who were estimated to lose all of their personal allowance would exceed 1mn by 2027-28.

An HM Treasury spokesperson said: “We are committed to keeping taxes low for working people, which is why we protected payslips from tax rises and are not extending the freeze on personal tax thresholds past 2027-28.”

#Number #people #caught #cent #tax #trap #years