Chevron cuts capital budget for first time since Covid-19 oil crash

Unlock the White House Watch newsletter for free

Your guide to what the 2024 US election means for Washington and the world

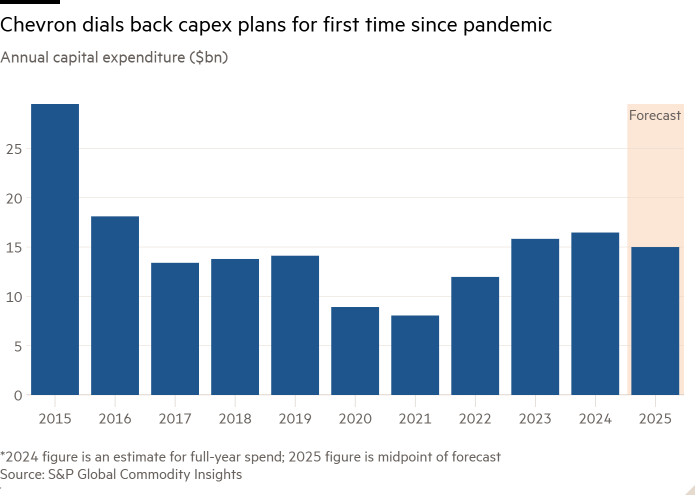

US oil supermajor Chevron will cut capital spending next year for the first time since the pandemic oil crash, dialling back its shale expansion plans just as Donald Trump enters office with a pledge to “drill, baby, drill”.

America’s second-biggest oil producer on Thursday announced a capex budget of $14.5bn-$15.5bn for 2025, down from $15.5bn-$16.5bn this year.

It is the first time Chevron has lowered spending since 2021, when producers were reeling from a pandemic-induced collapse in energy demand, and comes as oil prices retreat on fears of oversupply in the global market.

The Opec cartel announced on Thursday it would continue to hold back supplies, in another sign of producer concern about the oil market’s health.

Chevron also said it would book up to $1.5bn in charges and impairments in the fourth quarter.

“The 2025 capital budget along with our announced structural cost reductions demonstrate our commitment to cost and capital discipline,” said Mike Wirth, Chevron chief executive.

“We continue to invest in high-return, lower-carbon projects that position the company to deliver free cash flow growth.”

Chevron’s tempered spending plans are a blow to Trump’s commitment to pursue US “energy dominance” and unleash the country’s oil sector to bring down prices at the pump for consumers and project American power abroad.

“America is blessed with vast amounts of ‘Liquid Gold’ and other valuable Minerals and Resources, right beneath our feet,” Trump said after winning the US presidential election last month. “We will ‘DRILL BABY DRILL,’ expand ALL forms of Energy production to grow our Economy, and create good-paying jobs.”

But analysts have warned that the White House has limited influence over US oil output, with companies making decisions based on commercial rationale — and fearful that another drilling surge will overwhelm a tepid market.

Weaker prices and Wall Street demands for returns in recent years had already cooled the explosive growth that once characterised the American oil patch, making the US the world’s biggest crude producer and a rival to Opec+ superpowers such as Russia and Saudi Arabia.

Chevron said it would spend between $4.5bn-$5bn in 2025 in the Permian Basin, the engine room of US oil production, “as production growth is reduced in favour of free cash flow”. Its budget for 2024 was $5bn.

The company has been among the main drivers of new output in the basin, which is home to the world’s most prolific oilfield. ExxonMobil, the biggest producer in the oilfield, will announce its 2025 production plans next week.

Chevron has increased production in the Permian in recent years from 159,000 barrels of oil equivalent a day in 2018 to 950,000 boe/d in the third quarter of this year. It plans to top 1mn boe/d in the basin next year.

The company said it would continue to raise offshore output in the Gulf of Mexico, where it recently began production at its deep-water Anchor platform.

Chevron said it would book a restructuring charge of $700,000-$900,000 in the fourth quarter connected to a cost-cutting drive designed to slash overheads by $2bn-$3bn by the end of 2026. It said it would book another $400,000-$600,000 related to impairments and asset sales.

#Chevron #cuts #capital #budget #time #Covid19 #oil #crash