The Trump market, a month in

This article is an on-site version of our Unhedged newsletter. Premium subscribers can sign up here to get the newsletter delivered every weekday. Standard subscribers can upgrade to Premium here, or explore all FT newsletters

Good morning. Chevron announced it will scale back spending on rigs, drills, and other equipment next year. As we said yesterday, Donald Trump can’t have it all: either he will get much lower energy prices or much higher US oil production, not both. Which will he end up with? [email protected] and [email protected].

The Trump market

On the eve of the US presidential election, we made some predictions about the market winners from a Trump victory, highlighting US stocks, banks, and crypto. For winners under Kamala Harris — and therefore relatively weak performers under Trump — we liked Treasuries, homebuilders, Mexico, and emerging markets generally.

None of these predictions required tremendous insight, and a month later things have mostly played out as we expected. Markets have delivered some surprises, though. Let’s begin with what has been unsurprising:

-

US stocks have done well. The S&P 500 is up more than 5 per cent.

-

Small-caps have done better still. With their greater domestic focus, they should benefit more from tax cuts and reshoring of production.

-

Emerging markets (ex-China) stocks are soft, but not terrible. Trump’s policies mostly point to a stronger dollar and higher Treasury yields. That tightens financial conditions for EMs.

-

Oil and copper have been soft. The global growth set-up is bad, from China on down, and the possibility of a trade war doesn’t help.

-

Energy stocks’ poor performance continues. Trump really wants cheap energy.

-

Tesla has done great. The company is controlled by one of the president-elect’s closest allies, and as a result is up almost 50 per cent. We are stupid for not seeing this coming. Bitcoin, up just 43 per cent, is jealous.

And now the surprising developments:

-

Magnificent 7 tech stocks are beating the S&P. It’s not just Tesla: Apple, Amazon, Meta and Microsoft have outperformed as well. We would have expected these stocks to do fine, but more cyclical stocks to be the stars. With the exception of banks’ great performance, that hasn’t happened.

-

Growth is beating value. Again, we would have thought a domestic growth agenda would have helped value more.

-

German stocks are doing great. The main German index is up 5 per cent, despite that country’s economic woes and Trump’s tariff threats. Weak euro to the rescue?

-

Mexico’s stock market and currency have hung in there. That flies against Trump’s threats on tariffs and border crackdowns.

-

Treasury yields are almost even with where they were on election day. Most surprising of all, bond markets have partially shrugged off the view that Trump’s tariffs/border security/tax cuts agenda will be inflationary. Five-year break-even inflation is also just about where it was on election day. Gold has fallen. The dollar is unchanged. Expectations for Federal Reserve policy over the next year have not moved much.

The general message from all this? Markets may have concluded that, on tariffs and immigration, Trump’s bark will prove to be worse than his bite. At the very least, they have decided to suspend their judgment on the matter. If he was expected to come down hard in either area, more volatility would be visible in Germany and Mexico, in US bond markets, and in the dollar.

Are we really going to get a kinder, gentler Trump? Your guess is as good as ours.

Jobs

The repercussions of Donald Trump’s victory feels like the biggest story in US markets right now. But the Federal Reserve’s dilemma might be just as important.

Progress on inflation has stalled; indeed it is ticking up on some measures. Meanwhile, the job market is slowing. If the job market continues to decline, and inflation remains sticky (or worse), the Fed will be stuck between its two mandates. The worst-case scenario — stagflation — could threaten.

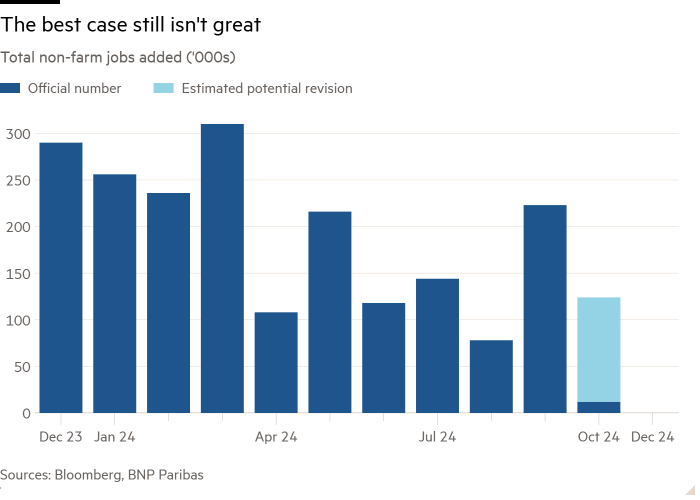

Today’s jobs news is important not only because it is the last one before the December Federal Open Market Committee meeting, but because it carries the weight of two reports. October’s ultra-low 12,000 new jobs was affected by hurricanes and the Boeing strikes. Today’s numbers will include a revised figure for October. BNP Paribas estimates the impact of the storms and strikes could have been as big as 100,000 jobs. But even that would still indicate a cooling labour market.

If the Fed is going to stand pat in December, a solid November report is needed.

Looking at the indicators we have, we might not get it. The ISM manufacturing survey showed contracting employment for the sixth straight month, while the services survey had employment expanding at a slower pace than last month. The ADP employment report showed 146,000 jobs added in November — below October’s 184,000, and below expectations. The one notable positive signal was a mostly unchanged Jolts survey that included an increase in quits — suggesting people are confident about their chances of finding another job.

In an interview on Wednesday, Fed chair Jay Powell emphasised the strength of the US economy and the health of the labour market. The central bank “can afford to be more cautious as we try to find [the neutral rate]”, he said, suggesting it may pause if the jobs report is firm.

The futures market shows investors leaning towards a cut:

Bond yields suggest investors are not quite sure how inflationary Trump’s policies will be. If the jobs report is awful, and the Fed needs to make another cut while prices are still ticking up, inflation will suddenly be back at the centre of the conversation.

(Reiter)

One good read

Space nukes.

FT Unhedged podcast

Can’t get enough of Unhedged? Listen to our new podcast, for a 15-minute dive into the latest markets news and financial headlines, twice a week. Catch up on past editions of the newsletter here.

Recommended newsletters for you

Due Diligence — Top stories from the world of corporate finance. Sign up here

Free Lunch — Your guide to the global economic policy debate. Sign up here

#Trump #market #month