Private credit’s wave of consolidation points to a toppy market

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

A private credit land grab is under way. Providers of non-bank loans are getting hoovered up by traditional asset managers and private equity houses keen to avoid missing out on this fast-growing segment. The willingness of sellers to sell out is a function of high valuations — but it also suggests that private credit’s golden moment may be drawing to a close.

The latest example of this trend is BlackRock’s $12bn deal to buy HPS this week. It follows on from private equity firm Clearlake’s acquisition of MV Credit in September, Blue Owl’s $450mn acquisition of Atalaya in July and Brookfield’s $1.5bn investment to buy a majority stake in Castlelake earlier in the year. TPG bought Angelo Gordon last year, while Nuveen bought $1bn European private credit company Arcmont in 2022.

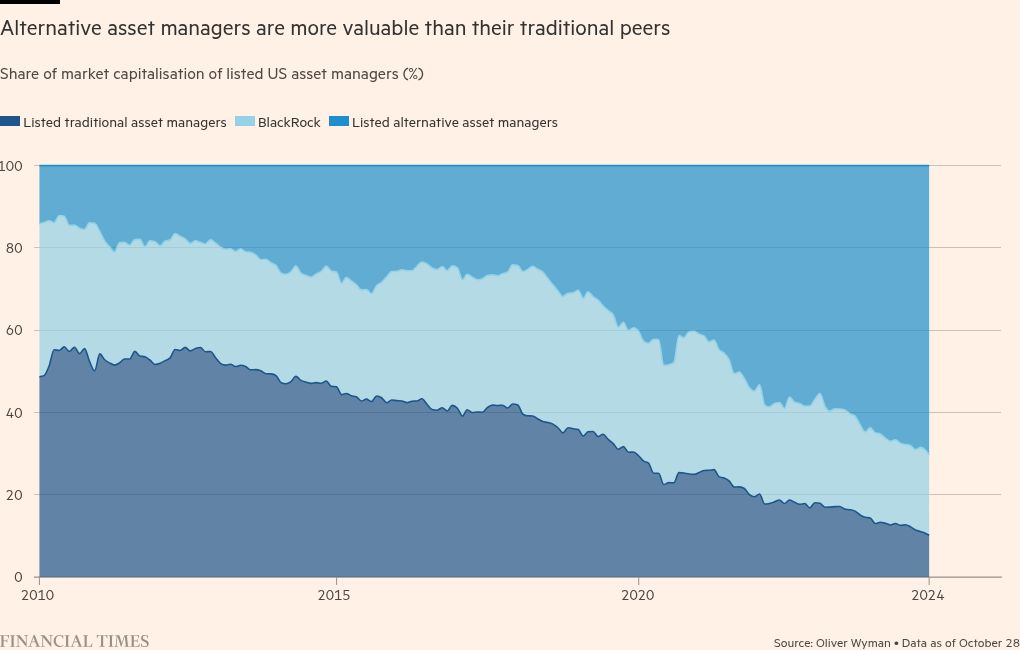

In part, this is a reflection of private credit’s mouthwatering growth rates. Assets under management are forecast to reach $2.6tn by 2029, from $1.5tn in 2023 according to data provider Preqin. Traditional asset managers may also be motivated by fears that, rather than buying into fixed income mutual funds, investors will increasingly prefer a combination of low-cost ETFs and private credit exposure. Already, fixed income ETF flows are up 50 per cent compared with last year, according to Huw van Steenis at Oliver Wyman. By buying HPS, BlackRock can offer clients a range of credit products.

The rush to acquire private credit assets also suggests that, as giants have sprung up, it has become increasingly hard to expand one’s own business to scale. Private credit is, to a great extent, a scale game. Bigger operators see more deals and can build more selective and more diversified portfolios. The behemoths also find it easier to raise money, with Ares this year closing the largest fund ever at $34bn.

Sellers, for their part, will be attracted by the high valuations on offer given the scarcity of independents left on the shelf. BlackRock paid a handsome 30 times HPS’s earnings.

They may also have a wary eye on rising competition. Money has poured into the space to chase opportunities. The syndicated loan market has reopened after its post-pandemic lull, compressing spreads for direct lending. In the US, the share of direct loans paying 600 basis points or more over base rates has dropped from 83 per cent in the second half of 2023 to 22 per cent in the six months to the end of September, according to PitchBook LCD data.

There is plenty of growth in the private credit market yet, especially for those branching out beyond direct lending. But the close of a boom, at least in one of the strategies, is no bad time to be cashing in one’s chips.

#Private #credits #wave #consolidation #points #toppy #market