German stock rally counters European gloom

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The gloom around investing in Europe after the re-election of Donald Trump as US president is profound, unavoidable, depressing, and maybe a little misplaced.

Sad connoisseurs of the year-ahead investment outlook season among investment banks and asset managers (fine, I’m guilty as charged) know the consensus at this point is truly overwhelming and bracingly simple: buy US. Keep buying US. Believe in the US exceptionalism story. Not only is the US firing on all cylinders but Europe is a mess. It is very hard to argue against this, and from what I can tell, few are even trying.

The message from Swiss bank UBS, for instance, is that European stocks are likely to head “sideways” in 2025. Take that for a rallying call.

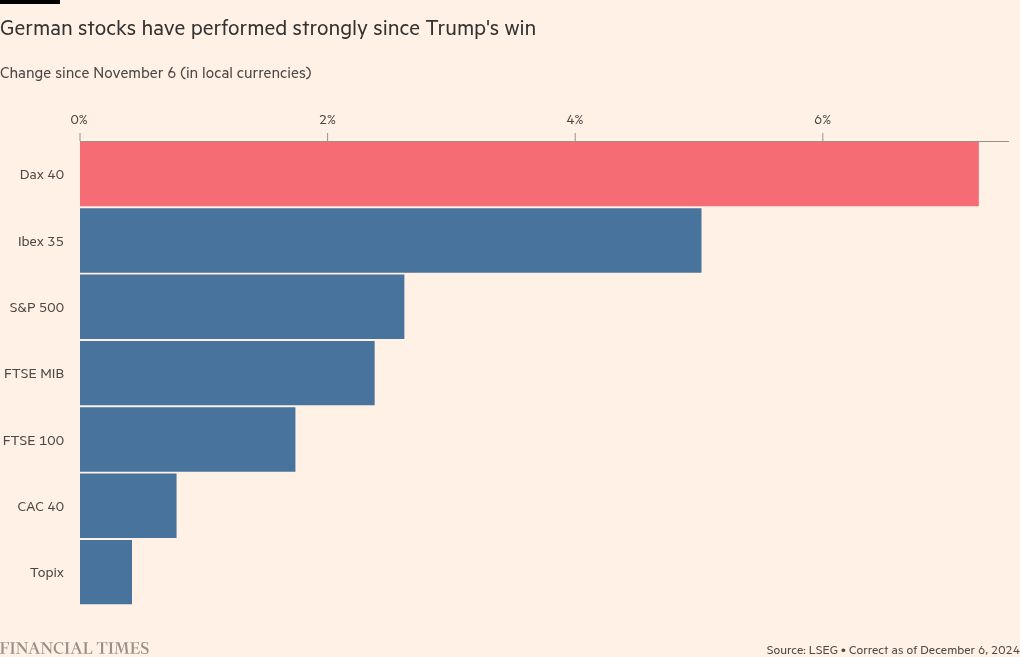

And yet, the inconvenient truth is that one of the best-performing stock markets in the world since the US election is Germany. No, seriously.

The Dax 40 index has rocketed over the past few weeks, cracking above 20,000 for the first time in history. It is up 7 per cent since US election day a month ago (time flies), with a particularly notable acceleration since the final days of November. The US market has grabbed all the attention, and that’s reasonable, given the S&P 500 index of US blue-chip stocks stands at a market capitalisation of $51tn, against the Dax’s €1.4tn. It just matters more. Still, the post-election jump in the German market is only a shade behind that of its much bigger US cousin and outstrips European peers.

What’s going on here? “It’s hard to know exactly why” this is happening, says Gerry Fowler, head of European equity strategy at UBS. But he says it comes down to a few companies in the index.

He’s right, of course. Top of the list is Siemens Energy, up 35 per cent in the past month. Just behind it is Rheinmetall, the arms group, which is up 32 per cent in the past month. In the following pack we have online retailer Zalando up 29 per cent and auto parts group Continental, up 17 per cent.

This is a useful reminder of a few things. One is that when investors decide as a pack to shy away from a particular sector, it doesn’t take much buying to send individual stocks or national indices soaring.

Fowler points out that across Europe, stocks with strong links to China have been outperforming of late. Some brave investors out there may have come to the conclusion that things can only get better for the Chinese economy after a rough year, and Europe is a good place to reflect that view.

Another is that immediately after the razzle-dazzle of the US election, Germany itself fell in to political hot water. Early federal elections have now been called for February and the debate is heating up over whether Germany should loosen its long-standing resistance to more generous borrowing and fiscal spending. “There’s hope that the German election might bring about change,” says Fowler — on deficit expansion and on broad corporate strategy, especially in the crucial autos sector.

On the margins, some other factors may be at play here. France’s loss is Germany’s gain, for instance — its political malaise has punished its stocks more heavily. Plus, the American exceptionalism story, combined with Trump’s trade tariff plans, have generated a burst of dollar strength — for which read euro weakness. That is a boon to Europe’s exporters and should help dull the effect of additional tariffs. It has also pumped up Eurozone government bonds in anticipation of slower growth in the region. Lower bond yields act as a shock absorber by reducing borrowing costs and help to support demand for stocks. This may not be enough to shield the entire region from underperformance, but it does help.

The bigger point here is that the “US good, Europe bad” mantra is a blunt tool. Europe has not given up on its green energy transition — far from it. That props up demand for some of the big German gainers of the past month. And the need for Europe to up its game on defence spending, particularly since Trump’s re-election, is obvious. This opens up plenty of opportunities for investors who at least hope they know where to find them.

“This is the main thing that people need to remember: the European economy and European companies are not the same thing,” Helen Jewell, chief investment officer for BlackRock fundamental equities in Europe, told me this week. “US exceptionalism does not mean that Europe is awful. It does not mean people should be disregarding it . . . People are looking for excuses to invest in the US over Europe,” she added.

This is a common refrain among big asset managers, who often say clients often point at even minor episodes of political instability as a reason to give Europe a wide berth. An outbreak of political tranquility in Germany and France would be really helpful in terms of convincing local investors to keep funds in the region and in attracting overseas funds.

Mix in a faint glimmer of hope that Germany might break with tradition and spend its way out of trouble, and you already have the building blocks for a strong run in selected stocks that few are expecting.

#German #stock #rally #counters #European #gloom