Why UK private sector train operators are in no hurry to step down from driver’s cab

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

For Britain’s privately owned train companies, not all signals are flashing red. Even as the Labour government presses ahead with nationalising the rail network, some operators are seeking to run more unsubsidised routes. These “challenger” services, known as open access, are popular and profitable. But they need continued political support to stay on track.

This year there have been at least seven open access applications by new and existing operators. These include Arriva Group, now owned by I Squared Capital, and London-listed FirstGroup, which runs services under the Hull Trains and Lumo brands. Services typically run to underserved destinations. However, the regulator sometimes approves services that compete with incumbents as long as the challenger is forecast to generate at least 30p of new revenue for every £1 taken away from existing operators.

FirstGroup will triple its open access operations, if all of its proposals are approved. It hopes such services could eventually more than compensate for the loss of its rail franchise earnings. Earnings from the former are higher quality than the latter, says Gerald Khoo of Panmure Liberum. The rights last longer and companies have fewer constraints, such as inherited legacy labour agreements.

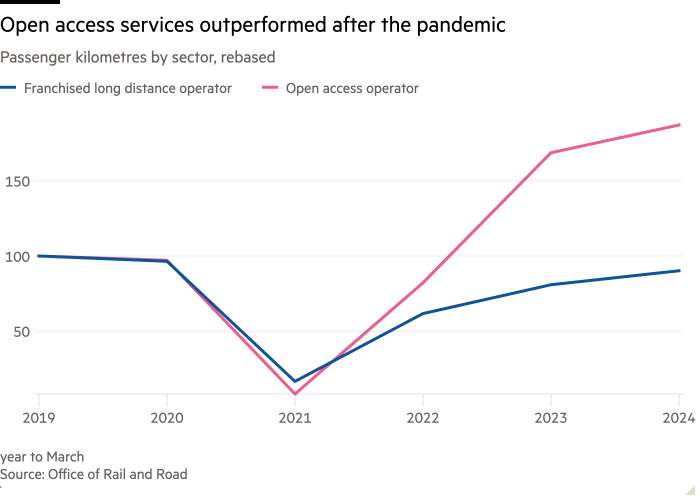

FirstGroup’s boss Graham Sutherland is not worried that political support might falter. For one thing, a recent train order may help to secure the future of a Hitachi factory in County Durham. For another, the open access routes improve connections to some key constituencies. Moreover, the services are well used, having recovered from the pandemic more strongly than the franchised routes.

Nonetheless, open access has some influential opponents. In September the Trades Union Congress agreed to campaign for the absorption of open access operations into Great British Railways, a promised government-owned body to oversee the country’s rail system. Rail unions claim that open access operators receive an indirect subsidy because they do not pay the full cost of operating the infrastructure. That is despite the regulator introducing an additional charge on open access operators in 2018 deemed to be able to afford it.

Coexisting with a nationalised, vertically integrated railway could be tricky. The regulator needs clear guidelines to stop the scales being tipped in the publicly owned railway’s favour, says consultancy Oxera.

Labour’s manifesto promised that open access operators could continue to compete if they added value to the network. But it is less clear that it wants the sector to expand. The flurry of recent applications could be a sign that companies think the rules could become less favourable to new applications. When there is a threat of disruption to Britain’s rail network, it makes sense to get on board while you can.

#private #sector #train #operators #hurry #step #drivers #cab