France and Greece: spot the differences

This article is an onsite version of our Europe Express newsletter. Sign up here to get the newsletter sent straight to your inbox every weekday and Saturday morning. Explore all of our newsletters here

Welcome back. Commenting on the nervous reaction of bond markets to France’s political crisis, finance minister Antoine Armand felt it necessary last month to state: “France is not Greece.”

I suspect many Greeks greeted his remarks with a mixture of amusement and indignation. For unlike France, Greece these days receives much praise for its fiscal rectitude and political stability, having navigated its way out of the debt emergency that gripped it in the early 2010s.

If, however, we compare France and Greece, what are the similarities and where do the differences lie? I’m at [email protected].

Converging bond yields, high public debt

Meaningful comparisons between France and Greece must go beyond headline economic and financial data, and take account of political trends as well as the strength of state and private institutions.

All the same, let’s start with some facts and figures that shed some light on the question.

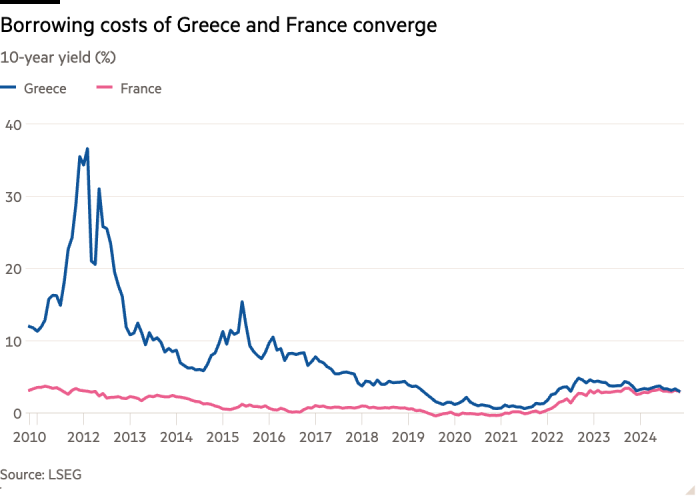

As the chart below shows, French and Greek 10-year government bond yields have converged in recent weeks. That mostly reflects the sharp fall in Greek yields since the debt crisis, but also a steady, smaller increase in French yields since the Covid pandemic.

The spread between French and benchmark German yields is now almost exactly the same as that between Greek and German yields. However, France is nowhere near the precipice towards which Greece was moving a decade ago, when it came close to falling out of the Eurozone.

Regarding public debt, France’s debt-to-GDP ratio now stands at just over 110 per cent, having risen from about 60 per cent at the euro’s birth in 1999. Although France manages its debt with great skill — the average maturity of its long- and medium-term bonds is just over nine years — the rise in the public debt stock is a deeply entrenched trend that needs halting or reversing.

By contrast, when Greece joined the Eurozone in 2001, its debt-to-GDP ratio was already over 100 per cent — a point that raised doubts at the time over Greece’s fitness for membership of Europe’s monetary union.

According to a European Commission report on the Greek economy, published in June, the debt-to-GDP ratio hit a peak of 207 per cent in 2020, before declining to almost 162 per cent last year.

However, as the commission observed, a large chunk of Greek debt is still owned by its official creditors. Coupled with Greece’s rigorous fiscal policies over recent years, this makes the risk of another national debt crisis as remote as in France.

Public spending and tax revenues

One striking parallel between France and Greece concerns public expenditure. In this document, issued by Eurostat, the EU’s statistical agency, we see that France had the EU’s highest level of government expenditure in 2022 at 58.3 per cent of GDP.

Greece had the sixth highest in the 27-nation bloc at 52.9 per cent.

Keeping public spending under control is therefore a challenge for both countries. However, France under the talented technocrats of the Fifth Republic has always been better than modern Greece at collecting (and paying) taxes.

So whereas the French problem concerns persistently high state spending, the Greek problem is more about tax evasion and inefficiencies in the tax system, as highlighted in this article by Thanos Tsiros for the Greek newspaper Kathimerini.

Current account deficits, competitiveness

In a speech this week in New York, Yannis Stournaras, Greece’s central bank governor, described the nation’s economy as “beyond any doubt an international success story over the past few years”, but correctly identified some vulnerabilities.

Stournaras said the most important challenge was Greece’s current account deficit, which at 6.2 per cent of GDP in 2023 was far above the French level of 1 per cent.

He went on to say that the main reason for the deficit was lagging economic competitiveness, and noted that Greece was placed 47th in the Swiss-based International Management Institute Global Competitiveness Index for 2024.

Reading this prompted me to find out where France ranked — and, rather to my surprise, I discovered that it was in 31st place.

This seems low for a country that boasts many first-class private-sector companies and has a historically strong record on labour productivity — which, however, has slipped since the pandemic, as the Banque de France noted in June.

‘A mediocre political class’

Perhaps a clue is to be found in the turbulent state of French politics? In this FT report, an unnamed Paris-based lawyer is quoted as saying:

On one side you have the strong performance of French companies, banks and private equity, and across from you is this kind of incompetence from a mediocre French political class with no vision of the common good.

The conventional view is that President Emmanuel Macron must take much of the blame for the present crisis, having called unnecessarily early legislative elections that produced a parliament so divided that the fall of Michel Barnier’s government was only a matter of time. (Macron yesterday named centrist François Bayrou to replace Barnier.)

However, some commentators contend that it is premature to pronounce that France is on the road to political perdition. Sylvie Kauffmann, writing for the FT, says:

Few experts think the time has come to bury the Fifth Republic. The constitution, they argue, offers flexibility.

In this article for Carnegie Europe, Rym Momtaz says that Macron, despite his domestic woes, is still strong on the international stage in matters such as the Ukraine war, European defence and the Middle East:

This is the paradox the French Fifth Republic presents for its citizens and Europe: the country is reeling from a historic fiscal crisis and political instability not seen since before the second world war, while Macron, the politician most responsible for the situation, is scoring international successes.

Political polarisation

If one compares France with Greece, there are some similarities — and some important differences — between the French political scene now and the Greek scene at the height of the debt crisis.

In France, the hard right and radical left have been gaining strength at the expense of the moderate, technocratic centre.

(In the left’s case, who will buy as a Christmas present “Now, the People!”, the English translation of Jean-Luc Mélenchon’s latest book? According to the blurb, it calls for “permanent insubordination against an unjust and destructive world order” and denounces Macron as the “representative of the bourgeois political bloc”.)

Likewise, in 2015 the Greek debt crisis propelled to power Syriza, a radical leftist party. However, the far right didn’t achieve a major electoral breakthrough in Greece — indeed, it has never enjoyed the influence over national politics that Marine Le Pen’s Rassemblement National has acquired this year in France.

Moreover, Syriza today is a shadow of its former self — divided, unpopular and no longer even the main opposition in Greece’s parliament.

Social discontent and France’s moustache strike

This isn’t to say that all is calm and going well in Greece.

A wiretapping scandal reflected poorly on the government and state institutions. One Greek commentator calls it “one of the biggest scandals since the restoration of democracy” in 1974.

Another observes that Greece’s political system is still “earthquake-prone” and that “anti-systemic sentiment and a penchant for conspiracy theories remain strong”.

However, Greece in recent years has experienced nothing like France’s gilets jaunes (yellow vests) movement or the mass protests against Macron’s pension reforms.

Some would say these events form part of a rich French tradition of social protest. My personal favourite — brought to my attention decades ago by historian Ross McKibbin — is the Great Moustache Strike of 1907, when waiters in Paris stopped work to demand better pay, more time off and the right to grow moustaches, denied at the time to lower-class workers.

A worthy cause, no doubt.

People’s trust in politics

To round things off, let me mention an OECD survey, published in July, on people’s trust in government and politicians. This showed very similar levels in France and Greece: in 2023, 34 per cent of French respondents reported high or moderately high trust in the government, compared with 32 per cent in Greece.

Both were slightly below the OECD overage of 39 per cent.

This is a trend that needs watching — though undoubtedly most attention in coming weeks and months will be less on Greece than on how France tackles its political impasse.

The impact of trade on anti-globalisation voting: evidence from France — a paper by Antoine Bouet, Anthony Edo and Charlotte Emlinger for the Centre for Economic Policy Research

Tony’s picks of the week

-

A year into his tenure, President Javier Milei of Argentina has shown himself to be at more effective at getting things done than his many critics forecast before his election, the FT’s Ciara Nugent and Michael Stott report

-

Rather than making Europe less reliant on US security guarantees, the incoming Trump administration risks leaving the continent more vulnerable to Russian aggression and Chinese economic dominance, Daniel Hegedüs writes for Washington-based The Hill

Recommended newsletters for you

Trade Secrets — A must-read on the changing face of international trade and globalisation. Sign up here

Chris Giles on Central Banks — Vital news and views on what central banks are thinking, inflation, interest rates and money. Sign up here

#France #Greece #spot #differences