Scholz hopes to lose confidence vote while Putin spins in annual phone-in

This article is an on-site version of our The Week Ahead newsletter. Subscribers can sign up here to get the newsletter delivered every Sunday. Explore all of our newsletters here

Hello and welcome to the working week.

Do you remember when the days leading up to Christmas presented a certain calm in the news agenda? Not this year. We begin in Berlin where German parliamentarians will be taking part in a vote of no confidence in Chancellor Olaf Scholz. He is expected to lose — and that’s the outcome he wants, in order to formally open the way for new elections on February 23. Tune into the FT’s election poll of polls here.

Meanwhile, the British government, which can thank its lucky stars that its enormous majority precludes a confidence vote, will this week attempt again to get on the front foot by publishing its devolution white paper, a policy document setting out proposals for future legislation, for the English regions. England remains one of the most centralised nations in the OECD, with regional and local taxes amounting to 1.7 per cent of GDP, compared with 9.4 per cent in the US and 16.2 per cent in Canada, hence calls for a “devolution revolution”. The government’s stated aim is to increase regional influence and power by forming “combined authorities”.

And if that proves to be problematic? Well, the Joint Expeditionary Force meeting of northern European leaders in Tallinn on the same day will provide Prime Minister Sir Keir Starmer with a golden opportunity to be pictured in an icy Estonian landscape with British troops before Christmas.

Tuesday is also a significant day for UK news with the conclusion of the oral evidence stage of the long-running inquiry into the Post Office Horizon IT scandal. Among those due to give closing statements are lawyers representing the sub-postmasters, many of whose livelihoods were destroyed by wrongful claims of theft, followed by Paula Vennells, former chief executive of the government-owned postal service, and Gareth Jenkins, who helped build the faulty Horizon software that threw up erroneous discrepancies in branch accounts. This inquiry still has a way to run, however, before the production of the final report. Here’s the FT explainer.

Back to democracy, or at least the Russian version of it. Thursday sees the annual phone-in hosted by President Vladimir Putin. This carefully stage-managed hours-long spectacle is in part a pressure valve release mechanism to trick ordinary Russians into thinking that they’re being heard. It also provides an insight into the possible social stressors and anxieties the Kremlin wants to quell. Putin might try to ease concerns about inflation. There’s also a slim chance he will address the prospect of a negotiated end (or pause, perhaps) in the Ukraine war next year, which would be headline-grabbing.

As the working week draws to a close, the shocking trial of those charged in the Gisèle Pelicot mass rape case comes to a head with the sentencing of the 50 men involved in this horrific series of events. Pelicot’s 72-year-old husband Dominique drugged her for a decade with prescription sleeping pills enabling him and the others to commit the rapes. The case has gripped France, not least because those convicted represent such a broad sweep of society. The FT’s profile of Gisèle Pelicot provides more detail.

There will be a steady flow of corporate news in what is the last full week of trading. On Monday, Vivendi’s newly spun-off entities Canal+, Havas and Louis Hachette Group will start trading in London, Amsterdam and Paris respectively, after shareholders of the French media conglomerate voted overwhelmingly in favour of a high-stakes split project earlier this month. Premium FT subscribers can click here for the Lex view.

Thames Water, which is markedly better at providing a steady supply of news headlines than its liquid product it seems, applies to the High Court in London to restructure its debt, while the industry regulator Ofwat publishes a price review for the entire sector.

Friday is the deadline for Google to file court papers that could offer its own proposal to restore competition after a judge ruled that it illegally monopolised online search in a case brought by the US Department of Justice.

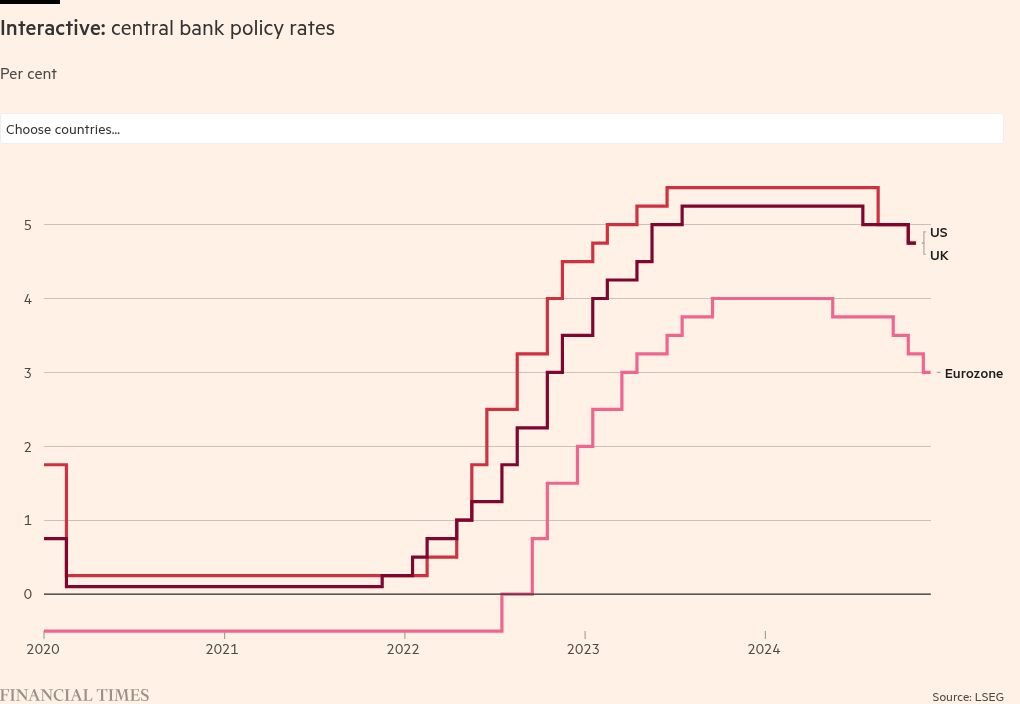

Then we have the treble for interest rate news with Monetary Policy Committee announcements from the US Federal Reserve, the Bank of England and the Bank of Japan. The Federal Open Market Committee goes first on Wednesday, a day before its British and Japanese counterparts. Swaps markets are pricing in about 0.75 percentage points of cuts from the Fed by next September, which would bring the target range down to between 3.75 and 4 per cent. A quarter-of-a-percentage point interest rate cut this month would bring the policy rate to the 4.25 to 4.50 per cent range. For those interested in tracking rates more widely, we have a tool for that.

Other central bankers will also be out on the speaking circuit, notably Bank of Canada governor Tiff Macklem, who will be giving his annual address on the North American nation’s economy and monetary policy on Monday. We will also have a final estimate for US third-quarter GDP, British, German and Japanese inflation data and a run of house price, retail sales and consumer confidence reports from different countries. More details about all of these items below.

One more thing . . .

This will be my last week writing The Week Ahead before the Christmas break. Fear not, however. My colleague Harvey Nriapia has, very much in the spirit of the season, agreed to step in to write next Sunday’s edition. Meanwhile, I will be attempting to get all the present shopping and food preparations completed in good time for Christmas, while trying to enjoy the moment of waiting that is Advent. If you have any tips about how to achieve this, please drop me a line at [email protected]. And whatever you are doing, however you mark the moment and whatever you celebrate at this time, I wish you a joyous Noël.

Key economic and company reports

Here is a more complete list of what to expect in terms of company reports and economic data this week.

Monday

-

Bank of Canada governor Tiff Macklem gives his annual address on the economy and monetary policy at a Greater Vancouver Board of Trade event

-

Luis de Guindos, vice-president of the European Central Bank, speaks at the ninth anniversary of Madrid Foro Empresarial

-

Vivendi’s newly spun-off entities Canal+, Havas and Louis Hachette Group will start trading in London, Amsterdam and Paris respectively

-

Competition Law Forum director Liza Lovdahl Gormsen brings a £2.3bn class action claim in London for damages against Meta Platforms Inc, Meta Platforms Ireland and Facebook UK caused by infringing Article 102 of the Treaty on the Functioning of the EU

-

China: November house price index and retail sales figures

-

EU, France, Germany, India, Japan, UK, US: S&P Global/HCOB flash December manufacturing and services purchasing managers’ index (PMI) data

-

Japan: October machinery orders data

-

South Africa: Day of Reconciliation. Financial markets closed

-

UK: Rightmove December House Price Index

-

Results: OVS Q3

Tuesday

-

Thames Water applies to the High Court in London to restructure its debt, estimated to reach £18bn by March next year

-

Canada: November consumer price index (CPI) inflation rate data

-

Germany: December ifo business climate index

-

UK: December labour market figures, including public sector employment

-

US: December National Association of Home Builders Housing Market Index

-

Results: Amentum Q4, Bunzl pre-close trading statement, Capita pre-close trading update, Chemring FY, Hollywood Bowl FY

Wednesday

-

EU: November harmonised index of consumer prices (HICP) inflation rate data

-

UK: November CPI and producer price index (PPI) inflation rate data, plus October House Price Index

-

US: Federal Open Market Committee interest rate announcement

-

Results: General Mills Q2, IntegraFin FY

Thursday

-

Ofwat publishes price review final determinations for all water and sewerage companies in England and Wales in relation to their five-year business plans

-

Germany: December GfK consumer climate survey

-

Japan: Bank of Japan interest rate announcement

-

UK: Bank of England interest rate announcement

-

US: final Q3 GDP estimate

-

Results: Accenture Q1, CarMax Q3, ConAgra Brands Q2, Darden Restaurants Q2, FedEx Q2, Nike Q2, PayChex Q2, Serco FY pre-close trading statement

Friday

-

Deadline for Google to file court papers that could offer its own proposal to restore competition in the online search market

-

China: Prime Loan Rate interest rate announcement

-

Germany: November PPI inflation rate data

-

Japan: November CPI inflation rate data

-

UK: November public sector finances and Great Britain retail sales figures

-

US: November employment figures

World events

Finally, here is a rundown of other events and milestones this week.

Monday

-

Estonia: Prime Minister Kristen Michal will host the Joint Expeditionary Force Leaders’ Summit of 10 north European nations, welcoming his UK counterpart Sir Keir Starmer among others

-

Germany: parliamentary vote of confidence in Chancellor Olaf Scholz’s government ahead of the February 23 election

-

UK: government publishes a devolution white paper for England

Tuesday

-

Japan: ADBI-KDI Global Forum on Global Supply Chain and Sustainable Development in Asia and the Pacific is held in Tokyo

-

UK: Post Office Horizon IT Inquiry concludes the oral closing statements stage

-

US: electoral college electors meet in their states to vote for the new president and vice-president on separate ballots and confirm the results of the November 5 election, in which former president Donald Trump won a second term

Wednesday

-

International Migrants Day

-

Belgium: EU-western Balkans summit in Brussels, aimed at implementing a growth plan and integration between the region and the trade bloc

Thursday

-

Belgium: European Council’s two-day meeting of EU heads of state and government chaired by Council President António Costa, begins in Brussels

-

Bulgaria: Nato secretary-general Mark Rutte visits the multinational battle group at the Novo Selo training ground and meets Bulgarian minister of defence Atanas Zapryanov

-

Russia: President Vladimir Putin delivers his annual press conference

Friday

-

China: 25th anniversary commemorations in Macau marking the handover of the former Portuguese colony to Chinese rule on this day in 1999

-

France: deadline for a decision in the rape trial that has shocked the nation. The prosecution has asked that Dominique Pelicot be given the maximum sentence of 20 years in prison for drugging and raping his then-wife, Gisèle Pelicot, and recruiting others to rape her

Saturday

-

Finland: Prime Minister Petteri Orpo will host EU high representative for foreign affairs and security policy Kaja Kallas, Italian premier Giorgia Meloni, Greece’s PM Kyriákos Mitsotákis and his Swedish counterpart Ulf Kristersson for the North-South Summit, a two-day security gathering in Saariselkä

-

UK: Winter Solstice, marking shortest day of the year in the northern hemisphere, is commemorated with sunrise celebrations at Stonehenge

-

US: Sneaker Con Bay Area event for sneaker connoisseurs, sports fans, fashionistas and influencers, held in Santa Clara

Sunday

-

Spain: Loteria de Navidad, aka El Gordo, or the “Fat One”, annual Christmas lotto — the world’s biggest lottery, which has no single jackpot but rather a complex share-the-wealth system

Recommended newsletters for you

White House Watch — Your essential guide to what the 2024 election means for Washington and the world. Sign up here

FT Opinion — Insights and judgments from top commentators. Sign up here

#Scholz #hopes #lose #confidence #vote #Putin #spins #annual #phonein