Honda and Nissan need off-road thinking to solve EV challenge

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Carmakers have not one existential problem to contend with, but two. They need to make money on their combustion engine vehicles in a hypercompetitive and — over time — shrinking addressable market. Meanwhile, they have to navigate the bumpy but unstoppable transition to electric vehicles.

A mooted tie-up between Honda and Nissan, which would create a Japanese behemoth with revenues of $220bn, would help with the former. But traditional remedies aren’t much good when it comes to imagining, investing in and building a whole new business model. That requires some creative thinking.

First the good news. Honda and Nissan, with the possible addition of Mitsubishi Motors (in which Nissan has a near 27 per cent stake), would boast a combined annual production of about 8mn vehicles. That would vault them into fourth place in global rankings, not a million miles behind leader Toyota which is expected to sell about 10mn vehicles this year.

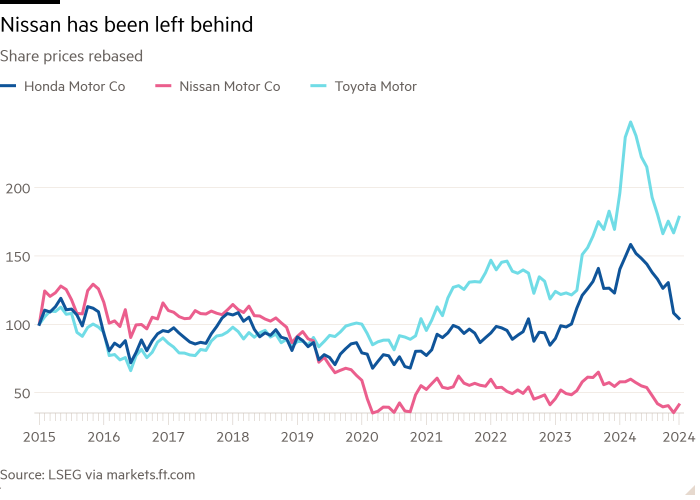

What, exactly, a combined group could do in terms of extracting better terms for components, shrinking production capacity and cutting costs is not clear — not least because big lay-offs are politically fraught. But, for an idea of the potential value creation, put Nissan on Honda’s forecast operating margin and price earnings multiple. That would create $14bn of value, or 30 per cent of the companies’ combined market capitalisation on Tuesday.

Yet even a stronger traditional business won’t be much help in the long run. Nissan and Honda are also-rans in the race for EV leadership. While Honda does have ¥2.5tn to invest in the new business, according to James Hong at Macquarie Capital, it is hard to even imagine how the companies could catch up with Tesla and BYD, which accounted for 35 per cent of global EV sales last year.

Rather than trying to build EV manufacturing scale, traditional carmakers should seek out a different route. They might take inspiration from the personal electronics industry, which has outsourced manufacturing to where it is cheaper and better. That would leave them free to focus on features that differentiate EV models such as software and design.

That’s not a downhill path, of course. Tariffs and general protectionism mean that a truly integrated global auto supply chain is a long way off. Carmakers, too, may be reluctant to abandon manufacturing. Factories are hard to dismantle. Should industrial competences lose their importance, design and software companies such as Apple would be well-placed to eat their lunch. Reports that Taiwan’s Foxconn — the contractor which makes Apple phones and much else besides — has been circling Nissan provide some idea about the direction of travel.

Having one problem may be better than having two. But cost cuts alone won’t get a combined Nissan Honda to its long-term goal.

#Honda #Nissan #offroad #thinking #solve #challenge