Neta founder’s crystal ball and US targets smart auto tech

Hello, this is Kenji in Tokyo. I flew in from Hong Kong for a short trip to cover the 10th anniversary of Hong Kong’s Umbrella Movement. Organisers and participants believe it is no longer possible to host the event in the city, similar to other remembrances like June 4 commemorations of the Tiananmen crackdown.

To refresh your memory, in the decade-old Umbrella Movement thousands of students and citizens took over the streets of central Hong Kong to protest Beijing’s decision to deny people’s constitutional right to choose their own top leaders through genuine universal suffrage. This right is written in the city’s Basic Law, or constitution, which took effect when sovereignty was handed over from the UK to China in 1997.

As the promise for fundamental democratic rights kept being pushed back, on September 26, 2014, people started to surround the government building, demanding to be heard. The official start of the movement is widely deemed to be two days later, when an official declaration by the organiser called for a peaceful takeover of the business district to gain momentum in the pushing forward of their demands.

Fast-forward 10 years. Hong Kong’s governance has transformed drastically, especially since national security laws were put in effect in 2020 and 2024. Hong Kong is no longer able to attract people in all walks of life from around the world. Academics and journalists are denied visa extensions and entry into the city, as we just witnessed in the case of an AP photographer with a French passport.

On the other hand, mainland Chinese people and companies are moving in to fill the gap. On top of the leisure travellers that have been visiting for decades, more mainland Chinese people are taking jobs under special visa arrangements by the local government. Many Chinese companies are seeking to utilise Hong Kong to go global, including those in electric vehicles. Reasons may vary among companies, but trying to escape harsh market conditions of over-competition, overproduction and slowing growth is a common theme.

Neta’s big fear

Neta Auto is one of over 100 mainland Chinese electric-vehicle makers that recently made first-batch deliveries to Hong Kong, an important step in accelerating globalisation. But founder and chair Fang Yunzhou told Nikkei Asia’s Cissy Zhou that he is not sure his company will be among the ones that survive the cut-throat competition.

“I’m not saying or boasting now that Neta Auto will definitely survive in three to five years,” Fang said, speaking openly about the grim conditions his company faces at home. As only a few Chinese EV makers such as BYD and Li Auto are profitable, Fang is not alone in predicting some rivals will drop out in the coming years. Chery Automobile chair Yin Tongyue and Huawei CEO Yu Chengdong have said only around five brands will survive.

Meanwhile, North America and Europe are on Neta’s radar despite both raising tariffs on China-made EVs, claiming unfair subsidies, which Beijing denies. Fang said Neta’s entry into those markets is “just a matter of time,” despite not being a top priority for the time being.

FBI probes Silicon Valley investor

The FBI is investigating whether a US venture capital fund that used Chinese money to become one of Silicon Valley’s most prolific early investors allowed Beijing to obtain the trade secrets of tech start-ups.

California-based Hone Capital, which launched in 2015 with $115mn of initial capital from a Chinese private equity group, invested in 360 US tech start-ups in less than three years, Tabby Kinder in San Francisco writes for the Financial Times.

This included acquiring stakes in driverless-car maker Cruise, payments group Stripe and aerospace engineer Boom.

The FBI is examining whether Hone Capital accessed information about the technology, finances or clients of start-ups for the benefit of its Beijing-based owner or Chinese authorities, said several people close to the matter. The FBI declined to comment.

These people said concerns have been raised during FBI interviews that some of its portfolio companies are contracted to provide services to the US government and that some of Hone’s money might have originated from Chinese government funds.

According to fund documents and people close to the matter, Hone’s money was provided by China Science & Merchants Investment Management Group (CSC), a Beijing-based private equity group established in 2000 and led by billionaire Shan Xiangshuang.

Legal representatives for CSC and Shan said the “CSC Group firmly believes that all of its US investments were conducted in full compliance with applicable laws.”

The probe comes as heightened geopolitical tensions between the US and China have rattled Silicon Valley’s venture industry, which for years had welcomed Chinese investment before more recently being put on notice by US authorities to beware of foreign espionage.

Subsidies for China EVs

China’s subsidies to its EV supply chain remain the key rationale for higher tariffs by Europe and the US, and Nikkei Asia’s Kenji Kawase has found that more than half of the top 10 recipients of public financial support during the first half of the year were from the sector.

Once again, leading Chinese EV battery supplier CATL reigned at the top of all mainland listed companies. It raked in 35 per cent more government subsidies for the first six months of the year, amounting to about $550mn.

Other EV names such as Chongqing Changan Automobile, Guangzhou Automobile Group, Great Wall Motor, BYD and SAIC Motor were in the top 10 as well, providing hints on where the Chinese government’s industrial priorities lie.

Biden targets smart auto tech

The latest round of the Sino-American tech war has erupted on software and hardware that enables cars to be connected to one another and to various other technologies.

Nikkei Asia’s Yifan Yu reports the administration of US President Joe Biden has initiated a process intended to ban systems that allow cars to communicate externally or enable autonomous driving capabilities and that come from the two foreign actors specifically identified in the proposed rule — China and Russia.

Cameras, microphones, GPS tracking and many other systems and technologies are connected to cars through the internet. “It doesn’t take much imagination to understand how a foreign adversary with access to this information could pose a serious risk to both our national security and the privacy of US citizens,” US commerce secretary Gina Raimondo said.

Biden aims to make the proposal official before he leaves the White House in January.

Suggested reads

-

China’s foldable phones herald conquest of OLED screen market (Nikkei Asia)

-

The mystery of Masayoshi Son, SoftBank’s great disrupter (FT)

-

Fact-checking services face existential challenges worldwide (Nikkei Asia)

-

Huawei laptop reveals China’s progress towards tech self-sufficiency (FT)

-

Thailand, Indonesia, Sri Lanka seek digital nomads’ skills and money (Nikkei Asia)

-

Why Foxconn’s next bid for growth is a room on wheels (FT)

-

Thai auto sector has 4 years to adjust to China EVs, says major parts maker (Nikkei Asia)

-

US proposes banning Chinese software and components in vehicles (FT)

-

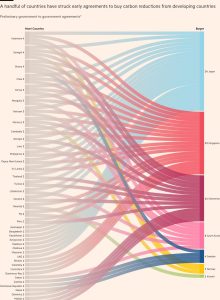

Germany finds 45 irregular Chinese carbon-cut projects, begins review (Nikkei Asia)

-

US and Taiwan seek to strengthen drone supply chain to keep out China (FT)

#Neta #founders #crystal #ball #targets #smart #auto #tech