Is Harris vs Trump impacting the economy?

Unlock the US Election Countdown newsletter for free

The stories that matter on money and politics in the race for the White House

Pity the poor American CFOs trying to weigh-up what the US presidential election will mean for their companies.

Kamala Harris still hasn’t provided much detail on her economic agenda. (Many assume it’ll just be continuity Biden.) On the Republican side, Donald Trump has made clear that he’d unleash a barrage of tariffs to solve all ills (oh, and maybe dilute the Inflation Reduction Act too).

There is enough of a difference there to get planning. Problem is, the polls are on a knife-edge. Among likely voters nationwide, a CNN poll last week found 48 per cent support Harris and 47 per cent Trump. That creates a lot of uncertainty in boardrooms.

FTAV wondered if election anxiety is indeed getting to Main Street, and if so, how? Here are five charts:

1) News anxiety: First up, businesses must have their head in the sand if they are not picking up on the mounting election chatter in the media.

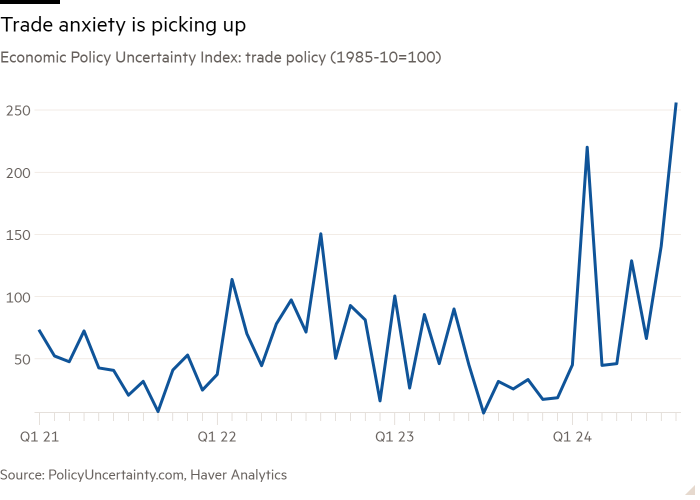

The chart below shows the policy uncertainty index for trade, which reflects the frequency of articles in US newspapers that discuss trade policy uncertainty. It has hit its highest since early 2021, as Trump has made tariffs central to his platform to tackle everything from China and high grocery prices to, erm, childcare costs . . .

2) Boardroom blues: The news chatter has certainly reached some boardrooms. In a research note in August Goldman Sachs said (with FTAVs emphasis below:

Election discussions have entered management commentary earlier than in past election cycles, with some companies — particularly financials, government contractors, and those with exposure to the Inflation Reduction Act — noting that either they or their customers are postponing some investment decisions until after the election.

Their analysts reckon that capital expenditure growth has been 5 percentage points lower for companies citing election uncertainty on their Q2 earnings calls. But on the upside the same companies could see a bounceback in investment post-election.

3) Construction is slowing: Those panicked earnings calls are reflected in actual spending numbers, too. Manufacturing construction spending boomed after the IRA, but it is now easing off. Sure, higher interest rates play a part too. But uncertainty over the future of US industrial policy also contributes to a risk-off mindset.

As MainFT reported last month:

While the bulk of IRA-related manufacturing investments have flowed to Republican-controlled districts, the law received no votes from party members in Congress. At campaign rallies the former president has vowed to “terminate” the IRA if elected.

4) Contingencies in action: Not convinced? Well, 30 per cent of firms have postponed, scaled down, delayed or cancelled investment plans because of election uncertainty, according to responses on the latest CFO Survey, via the Atlanta and Richmond Fed. That’s slightly up on 28 per cent in the second quarter. Not a majority, but not insignificant either.

5) Economic activity to come down: The anxiety and remedial actions to ease it will show up more in the economic numbers as we near voting day (assuming polls remain tight).

ISM activity indicators for both manufacturing and services — often leading indicators for GDP — have been flirting with contraction in recent months. Respondents have cited election uncertainty as a factor.

The upshot? Well, a tight race between two candidates, with varying implications for particular industries, is not amenable to business-as-usual. Hedging for things like changes in trade, tax, and regulatory policy now, could just be an unnecessary expense. Best just to wait, and it looks like many organisations are.

In other words, it won’t just be the weight of the Fed’s previous rate hikes slowing the US economy in the months ahead. Election anxiety will play its part too.

#Harris #Trump #impacting #economy