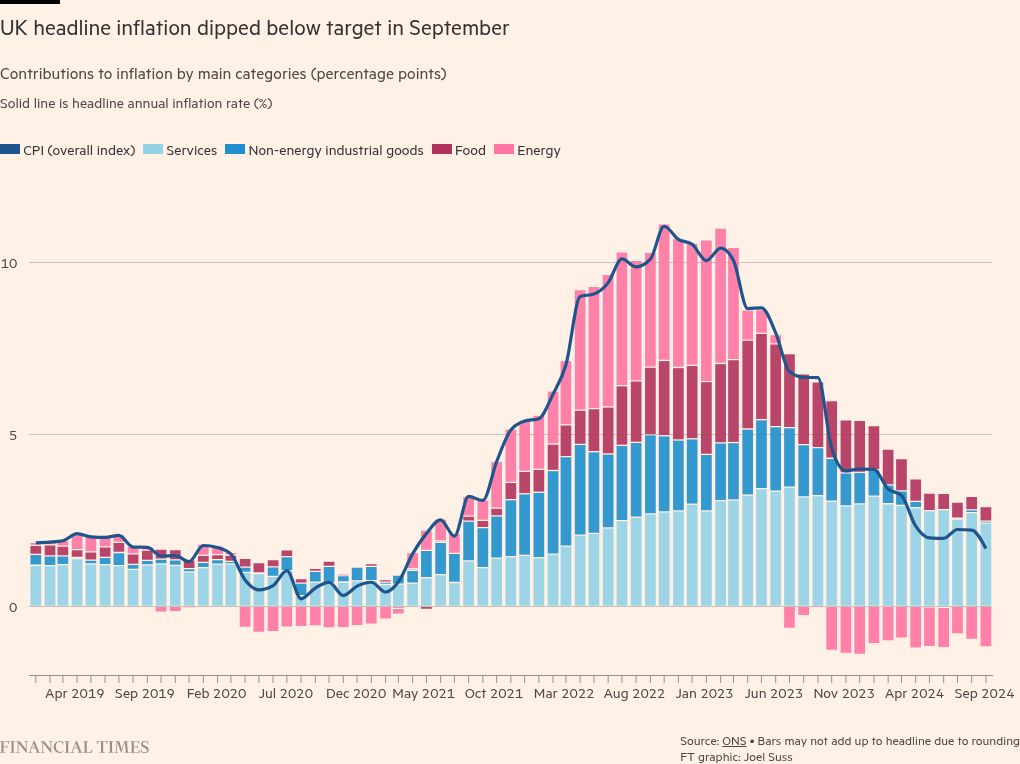

UK inflation falls more than expected to 1.7% in September

Stay informed with free updates

Simply sign up to the UK inflation myFT Digest — delivered directly to your inbox.

UK inflation fell more than expected to a three-year low of 1.7 per cent in September, opening the door to more Bank of England interest rate cuts before the end of the year.

Wednesday’s data release by the Office for National Statistics shows that inflation has come back under the BoE’s 2 per cent target for the first time since April 2021.

The annual increase in consumer prices is less than the 1.9 per cent predicted in a Reuters survey of economists and compares with August’s figure of 2.2 per cent. The retreat was driven by lower airfares and petrol prices.

The numbers will come as a boost to Sir Keir Starmer’s government just two weeks before what promises to be a tough Budget containing steep tax rises. Chancellor Rachel Reeves is looking to close a funding shortfall of £40bn, according to officials close to the Budget process.

Core inflation was 3.2 per cent, lower than economists’ expectations of 3.4 per cent, while the services rate of inflation fell from 5.6 per cent to 4.9 per cent.

The pound was down 0.3 per cent to $1.30 immediately after the inflation data was released.

In comments that investors see as a signal that the BoE could cut rates at both its November and December meetings, governor Andrew Bailey said recently that rate-setters could be “a bit more aggressive” in lowering borrowing costs if inflation continued to fall.

The BoE cut rates by a quarter point in August. But it held them at 5 per cent at its September meeting while suggesting a further reduction in November.

Darren Jones, the chief secretary to the Treasury, said Wednesday’s inflation figures would be “welcome news for millions of families”, adding that “there is still more to do to protect working people”.

#inflation #falls #expected #September