Chinese AI groups get creative to drive down cost of models

Stay informed with free updates

Simply sign up to the Artificial intelligence myFT Digest — delivered directly to your inbox.

Chinese artificial intelligence companies are driving down costs to create competitive models, as they contend with US chip restrictions and smaller budgets than their Western counterparts.

Start-ups such as 01.ai and DeepSeek have reduced prices by adopting strategies such as focusing on smaller data sets to train AI models and hiring cheap but skilled computer engineers.

Bigger technology groups such as Alibaba, Baidu and ByteDance have also engaged in a pricing war to cut “inference” costs, the price of calling upon large language models to generate a response, by more than 90 per cent and to a fraction of that offered by US counterparts.

This is despite Chinese companies having to navigate Washington’s ban on exports of the highest-end Nvidia AI chips, seen as crucial to developing the most cutting edge models in the US.

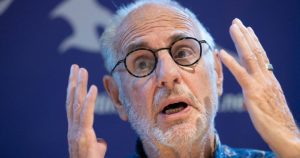

Beijing-based 01.ai, led by Lee Kai-Fu, the former head of Google China, said it has cut inference costs by building a model trained on smaller amounts of data that requires less computing power and optimising their hardware.

“China’s strength is to make really affordable inference engines and then to let applications proliferate,” Lee told the Financial Times.

This week, 01.ai’s Yi-Lightning model came joint third among LLM companies alongside x.AI’s Grok-2, but behind OpenAI and Google in a ranking released by researchers at UC Berkeley SkyLab and LMSYS.

The evaluations are based on users that score different models’ answers to queries. Other Chinese players, including ByteDance, Alibaba and DeepSeek have also crept up the ranking boards of LLMs.

The cost for inference at 01.ai’s Yi-Lightning is 14 cents per million tokens, compared with 26 cents for OpenAI’s smaller model GPT o1-mini. Meanwhile inference costs for OpenAI’s much larger GPT 4o is $4.40 per million tokens. The number of tokens used to generate a response depends on the complexity of the query.

Lee also said Yi-Lightning cost $3mn to “pre-train”, initial model training that can then be fine-tuned or customised for different use cases. This is a small fraction of the cost cited by the likes of OpenAI for its large models. He added the aim is not to have the “best model”, but a competitive one that is “five to 10 times less expensive” for developers to use to build applications.

Many Chinese AI groups, including 01.ai, DeepSeek, MiniMax and Stepfun have adopted a so-called “model-of-expert” approach, a strategy first popularised by US researchers.

Rather than training one “dense model” at once on a vast database that has scraped data from the internet and other sources, the approach combines many neural networks trained on industry-specific data.

Researchers view the model-of-expert approach as a key way to achieve the same level of intelligence as a dense model but with less computing power. But the approach can be more prone to failure as engineers have to orchestrate the training process across multiple “experts” rather than in one model.

Given the difficulty in securing a steady and ample supply of high-end AI chips, Chinese AI players have been competing over the past year to develop the highest-quality data sets to train these “experts” to set themselves apart from the competition.

Lee said 01.ai has approaches to data collection beyond the traditional method of scraping the internet, including scanning books and crawling articles on the messaging app WeChat that are inaccessible on the open web.

“There is a lot of thankless gruntwork” for engineers to label and rank data, he said, but added China — with its vast pool of cheap engineering talent — is better placed to do that than the US.

“China’s strength is not doing the best breakthrough research that no one has done before where the budget has no limit,” said Lee. “China’s strength is to build well, build fast, build reliably and build cheap.”

Additional reporting by Cristina Criddle in San Francisco

#Chinese #groups #creative #drive #cost #models