Volkswagen will struggle to reverse out of this dead end

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Can Volkswagen cost-cut its way out of a crisis? The automaker plans to shut several German plants and axe tens of thousands of jobs. At this point, though, the question is no longer whether VW needs to restructure but whether the axe will be sharp enough to excise its troubles.

The German group is facing a car crash of problems, as a series of profit warnings and, more recently, a 64 per cent decline in third-quarter earnings exemplifies.

China is a key issue as domestic carmakers churn out cheaper and better vehicles. VW’s deliveries in the region fell by 10 per cent in the first nine months of the year. The contribution from its joint ventures in China this year will be some €1.6bn of “proportionate operating income”, thinks VW, around half the amount in 2022.

Competition from Chinese carmakers — whether in China or abroad — is structural and will not be easily reversed. EU tariffs on Chinese EVs will slow, rather than halt, penetration.

That, plus an arguably cyclical slowdown in European vehicle sales — which this year are expected to be 14mn across the market compared to 16mn pre-pandemic — is forcing VW to grapple with its unsustainably high cost base.

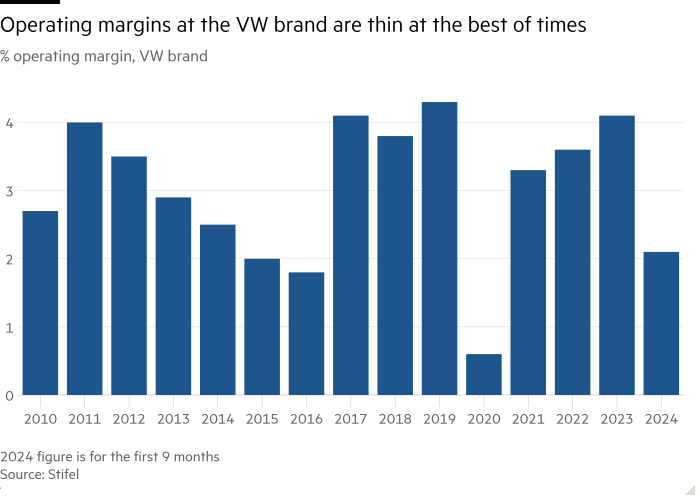

Much of the problem lies with the group’s core VW brand. This struggles to make much of a margin even in the good times. In the third quarter, it fell to 1.8 per cent of sales. That’s well below the group’s full-year target of 5.6 per cent. Rival Renault is looking at full-year ebit margins of near 8 per cent, according to S&P Capital IQ.

Volkswagen wants to raise the VW brand margin to 6.5 per cent by 2026. It last year outlined €10bn of performance improvements. The recently reported plant closures and employment reductions might add another €4bn, thinks Daniel Schwarz at Stifel. Combined, such measures account for roughly 15 per cent of VW brand sales — a lot more than it needs to meet its margin target.

Investors may hope that this overshoot speaks to VW’s huge potential to cut costs and cushion the worst of the slowdown in vehicle sales. The fear, however, is that it instead reflects a deteriorating environment in which Chinese carmakers continue to gain share domestically and abroad, electric vehicle sales prove dilutive to margins and pricing on internal combustion engines declines.

That, coupled with the fact that mooted cuts and closures will face fierce opposition, explains why VW’s stock trades at 3.3 times next year’s earnings. Investors clearly do not believe that the carmaker is getting its show back on the road.

#Volkswagen #struggle #reverse #dead