Why it’s hard to box in the wealthy on tax

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Burly types usually find it hard to wriggle out of tight spots. But broad shoulders do not stop the wealthy escaping certain taxes. The UK Budget unveiled a string of measures targeting the rich. But it did not go as far as many had initially feared. That is a tacit acknowledgment that many can choose when and where they pay tax.

The changes to the “unfair” treatment of private equity show the difficulty of raising large sums from highly mobile executives. The reforms to carried interest — executives’ share of profits on successful deals — are only set to raise £100mn a year by 2029. On the face of it, the rate change — amounting to an effective marginal tax rate of 34.1 per cent for additional-rate payers from April 2026 — should have raised six times as much. But about one in nine earners — accounting for a quarter of all carried interest gains — are thought at high risk of leaving the country, according to the Office for Budget Responsibility, the fiscal watchdog.

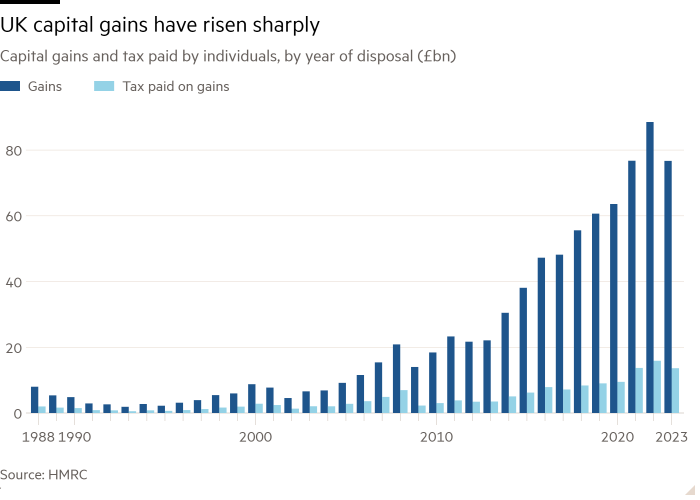

In principle, a similar argument applies to capital gains tax. Taxable capital gains are very concentrated among a small number of people. Just 12,000 people accounted for two-thirds of CGT revenue in 2022-23. Many are footloose. The Centre for the Analysis of Taxation, a think-tank, reckons Britons with £5bn of business shareholdings left the country in the year to April 2024.

UK chancellor Rachel Reeves appears to have settled on a CGT rate rise that will limit the risk of a further exodus. The 4 percentage point rise to 24 per cent for higher-rate taxpayers leaves Britain in the middle of the pack of its peers. Even so, the OBR pencilled in a 60 per cent cut in the yield due to behavioural changes such as deferring disposals. Business owners will still benefit from Business Asset Disposal Relief, despite repeated criticism that the tax break has failed to boost investment. But the rate will gradually increase to 18 per cent in April 2026. Business sales are likely to accelerate in the run-up.

CGT is a voluntary tax to the extent that asset owners are not obliged to sell. Should it be designed so it is harder to escape? One option would be taxing unrealised capital gains at death. Another would be the imposition of an exit tax, a move that would presumably require the UK to give up taxing new arrivals’ gains that had accrued abroad. Brexit has made such a move easier, and many other countries impose exit taxes. But it could prompt entrepreneurs to accelerate business sales. Even a well-designed tax might put people off coming to the UK.

To be sure, tax is not usually the main determinant of where the wealthy choose to live. Nonetheless, high rollers have plenty of options. The decision of a relatively small number of big taxpayers can make a big difference to revenues. Losing well-heeled investors is a bad look for a chancellor who said she wanted to lead the most pro-growth Treasury in history.

A government intent on boosting growth would also focus on improving the design of CGT. It currently provides the investor with no compensation for inflation or delayed consumption. It should be possible to design it in a way that encouraged savings and investment. The Budget changes are pragmatic, but Labour has missed an opportunity for reform.

#hard #box #wealthy #tax