The internal rivalries that will determine Trump’s policies on trade

Unlock the US Election Countdown newsletter for free

The stories that matter on money and politics in the race for the White House

Some people think it’s a category mistake even to address Donald Trump’s trade policy as an actual thing rather than a mess of prejudices and contradictions, and that for other governments to employ logic and game theory in engaging with it is like trying to play chess with an angry rhino. They may have a point. It’s not a thing of clarity and beauty. Still, if the Republican candidate does get elected, his policy positions will at least delineate the landscape for his administration’s internal battles.

At the moment Trump is promising at least five sometimes contradictory or outright impossible policies: raising tariffs against all trading partners to 10 or 20 per cent, increasing tariffs on Chinese imports to 60 per cent or higher, replacing the federal income tax with tariff revenue (which literally cannot be done), passing a “reciprocal trade act” that will put tariffs on trading partners equivalent to theirs on the US and, sometimes, depreciating the dollar. The varied aims of this array of weapons include, but are not limited to, closing trade deficits, weakening China relative to the US, forcing general tariff reductions and boosting median incomes in the US.

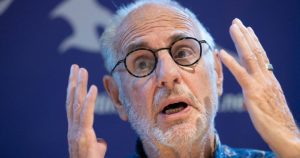

Trump has a reputation for being an unrepentant protectionist, but trade policy in his first term was characterised by a continual tension between ideas and people. Different characters were openly in conflict, ranging from out-and-out tariff warriors such as Peter Navarro, director of the shortlived White House National Trade Council, to avowed free-traders like Larry Kudlow, head of the National Economic Council. As I wrote on Monday, the EU, through lobbying Kudlow, in 2018 managed to escape threatened car tariffs aggressively pushed by Navarro by offering (baseless) promises of commodities purchases plus a (doomed) zero-tariff deal on industrial goods.

A second Trump administration would very probably similarly feature what we might delicately call lively internal debates. One problem in trying to work out where they would end up is that even policies that look as if they make some sense can’t be taken at face value.

Currently, self-styled free-trader Trump allies such as Kevin Hassett, former chair of his Council of Economic Advisers (here in conversation with the FT’s Unhedged), are emphasising the reciprocal trade plan. The proposal looks like a neat way of using the US’s existing low tariffs to compel liberalisation. If applied uniformly and fairly, though, it would be politically explosive. The US isn’t quite as free-trade as it thinks it is.

Specifically, certain US agricultural products from swing political states receive far more protection than those of US trading partners, an obvious one being dairy. New Zealand is commonly known as the Saudi Arabia of milk: it has around a quarter of the world export market for milk powder. According to calculations for the FT by the Global Trade Analysis Project (GTAP) at Purdue University, New Zealand dairy products encounter an average 14 per cent applied tariff (the New Zealand dairy industry itself reckons a bit higher) on sales to the US, the world’s third-largest dairy market after India and the EU and China.

New Zealand itself maintains zero tariffs on almost all its own dairy imports. The second-biggest dairy-producing state after California is politically sensitive Wisconsin. It’s unlikely Trump (and certainly Congress) would want to match New Zealand by cutting its tariffs to practically nothing and expose swing-state dairy farmers to low-cost competition.

It’s a similar situation with sugar. Brazil, a super-competitive exporter, maintains applied tariffs on American raw sugar of about 16 per cent, according to GTAP calculations, which it would be able to cut if that unlocked market access elsewhere. The US, which has a quota-and-tariff system, imposes duties on Brazilian exports of 44 per cent.

The Florida cane-growers are notoriously fearsome lobbyists — as president Bill Clinton interrupted time with Monica Lewinsky in the Oval Office to take a call from one of the Fanjul family of sugar barons — and a reciprocal deal on sugar is similarly improbable. There is certainly no fair and comprehensive across-the-board reciprocity plan waiting to be implemented.

Trump may be clear on his aims, but no one, probably including the man himself, knows how serious he is about any specific policy. If you believe advisers such as hedge fund manager Scott Bessent, Trump is threatening high tariffs merely as a bargaining ploy, and moreover has no intention of weakening the dollar. A contrasting view from others with experience of working with Trump is that he likes tariffs in themselves, not least to raise revenue and allow income tax to be cut if not abolished, but might be prepared to negotiate them down if he gets the right offer.

There would undoubtedly be people in his administration wanting the US to decouple from China. There would be others who, conversely, might think a liberalising deal with President Xi Jinping could be done.

Those who argue it is futile to analyse Trump’s policies are correct that he would not enter office with a coherent plan about which instruments to use for what end. Nor would his officials all be pulling in the same direction. But seeing the various weapons currently on display gives us at least some basis for judging how the internal battles might be fought.

#internal #rivalries #determine #Trumps #policies #trade