How Carvana turned Apollo’s $1.3bn concession into $50bn

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Ernie Garcia is the rare executive to stare down Apollo Global Management and live to tell the tale. His prize: the online used-car platform he runs, Carvana, has survived a near-death experience. Its total market value has soared from $1bn to more than $50bn over the past 22 months.

On Wednesday, not that long after a bankruptcy scare, Carvana reported record profitability. It shares jumped more than 20 per cent in overnight trading on expectations it will continue to increase market share while keeping a lid on operating expenses.

This U-turn is all the more extraordinary considering it began with Garcia fending off a group of ornery bondholders, led by Apollo, which collectively held almost $6bn in paper. By the end of 2022, Carvana’s revenues had collapsed amid higher interest rates and weary American consumers. With high coupon payments and looming maturities, Garcia and his banker Ken Moelis sweet-talked and in mid-2023 strong-armed the Carvana creditors into taking an overall $1.3bn haircut. They separately won a deferral in cash interest owed as well.

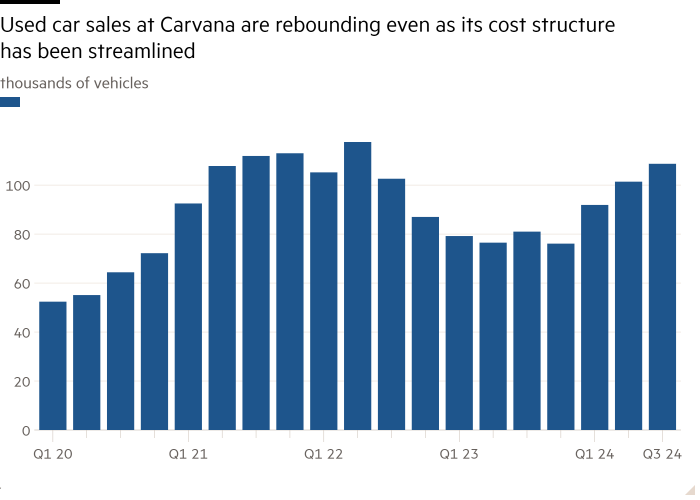

Garcia also purchased more Carvana equity. The resulting breathing room allowed the company to spend 2023 slashing costs. This year has been about the trickier task of a lean organisation growing sales again. In less than three years, the overhead per car sold has now fallen to under $3,800, from $6,300.

Carvana had been a pandemic darling, taking advantage of the demand for used cars. Its sales rocketed, though it spent heavily to achieve that. The company now has real ebitda — at least $1.5bn annualised — as well as positive free cash flow.

Still, with heavy financial and operating leverage as well as an internal mini-bank that originates and sells off car loans, Carvana remains a high-wire act. But Garcia has proved that there is a significant market for buying and selling used cars on a smartphone. Carvana’s overall share in the used-car market is still only about 1 per cent of the 40mn used cars sold annually in the US.

As for the bondholders, in the 2023 debt swap they negotiated a better collateral package, higher contractual interest payments and strict covenants. With those elements, as well as hedges, other side trades and falling interest rates, they will do just fine. But Apollo and the others should rue that they did not demand equity warrants. That would have let them share at least some of the spoils of the improbable turnaround engineered by Garcia.

#Carvana #turned #Apollos #1.3bn #concession #50bn