Trump could take US trade policy all over the place

This article is an on-site version of our Trade Secrets newsletter. Premium subscribers can sign up here to get the newsletter delivered every Monday. Standard subscribers can upgrade to Premium here, or explore all FT newsletters

US election tomorrow. Hard to think of what can be said that hasn’t already been said, but hard to think of anything else to talk about. Last week Robert Lighthizer, US trade representative (USTR) in the first Trump administration and possibly something bigger if the former president wins again, wrote in the FT about how he’s right and I’m wrong (not his exact words, as such).

I’ll kick off today with some reader feedback on what you think Trump might do and then, striving to find something not entirely election-related to write about, I’ll look at the global electric vehicle industry, which could take quite a different turn depending on who’s in the White House. Charted Waters is on electrical transformers.

Get in touch. Email me at [email protected]

You on Trump

On the basis that your guess in these matters is almost certainly as good as mine, I asked readers last week for their views on what Trump would do during a second term in office.

Obviously no one thought it would be a free-trade administration as such. “A massive experiment in import-substituting re-industrialisation (rockily encompassing Canada and Mexico), an ad hoc approach to foreign direct investment, and radical domestic deregulation that will harm the US quality of life and endanger the global environment” was one cheery prediction.

But at least as many stressed the predictability (low) and the likely tone (aggressive) as the policies themselves. I think this is right. In last week’s Trade Secrets column I myself wrote about how trade policy in Trump’s first term, although with a general animating principle of aggressive nationalistic mercantilism, was characterised by public infighting within the administration.

There really was a long distance between Peter Navarro, the autarky-adjacent director of the National Trade Council, and Larry Kudlow, the business-friendly TV talking-head-turned-Trump official who headed the National Economic Council — as indeed both made clear in the media. (Having the fights take place in public certainly makes a change from the White House press corps doing endless tedious anonymously sourced “administration split over X” stories.)

Will this happen again? Yes, almost certainly. Unlike, say, immigration, where he’s pretty much resolutely against it, Trump’s instinctive protectionism is in conflict with the art of the deal. On this subject, the one-word reader email I got saying “Unpredictable” was perhaps my favourite.

I also got a nice reminder that the US has never exactly been a pussycat on trade talks, from someone who recalled the utterance of a USTR lawyer in a negotiation back in the 1990s. “If you don’t like our first offer,” the official apparently said, “you sure as hell won’t like our second.”

Careful with those threats, China

An interesting nugget last week: according to Reuters, the Chinese Ministry of Commerce has told carmakers to pause the investments they’re making in countries that supported the EU antisubsidy tariffs against electric vehicle imports.

Those tariffs went into force last week after talks to avoid them broke down. Trying to punish individual member states for annoying Beijing isn’t exactly a new Chinese strategy. Just ask Lithuania. But given that foreign direct investment into the EU is one key way that carmakers are going to avoid the tariffs, trying to use the threat of creating jobs in one member state rather than another as leverage is a risky tactic.

As I’ve written before, Chinese companies investing in the EU are vulnerable to official action via the Foreign Subsidies Regulation (FSR) if they are deemed to be subsidised. The regulation allows the bloc to act swiftly and with considerable force, certainly compared with more ponderous trade defence instruments such as antisubsidy and antidumping duties. Whether an FSR case gets brought depends on the European Commission, but is subject to member state lobbying.

If I were a Chinese company, or the Chinese government, I wouldn’t want to be creating enemies in the EU by deliberately cutting off investment in their economies and thus giving them nothing to lose by pushing for an FSR case. Defusing local resentment by building car plants that genuinely add value and create jobs locally, rather than putting “Made in EU” stickers on imported Chinese cars to circumvent the antisubsidy tariffs, will also be a massive issue.

In Washington recently I encountered a surprising number of people who thought the EV bubble was bursting and the EU would fall into line with the US on excluding Chinese cars from the supply chain. If Trump gets elected and starts slashing electric vehicle subsidies under the Inflation Reduction Act, this is highly unlikely to be true. You can’t fight something with nothing.

Even under a Harris administration practising continuity Biden policies, it feels like wishful thinking to me. Facts are rapidly being created on the ground in the EU. Chinese EV imports have risen sharply, antisubsidy duties or not. Joint ventures are being formed and FDI in Hungary and Spain is proceeding. But it’s still a warning to China and Chinese companies not to screw up the implementation.

Meanwhile, although Volkswagen closing three plants in Germany feels like the end of an era, there’s not much sign European carmakers, concerned about their precarious footholds in the Chinese market, are turning protectionist. German car industry mercantilism has served the general cause of free trade for decades and continues to do so.

Absent any serious signs of investment as a whole stopping, I’m putting this reported incident down to a somewhat clumsy attempt to exert leverage rather than any fundamental change in the Chinese EV penetration of Europe.

Charted waters

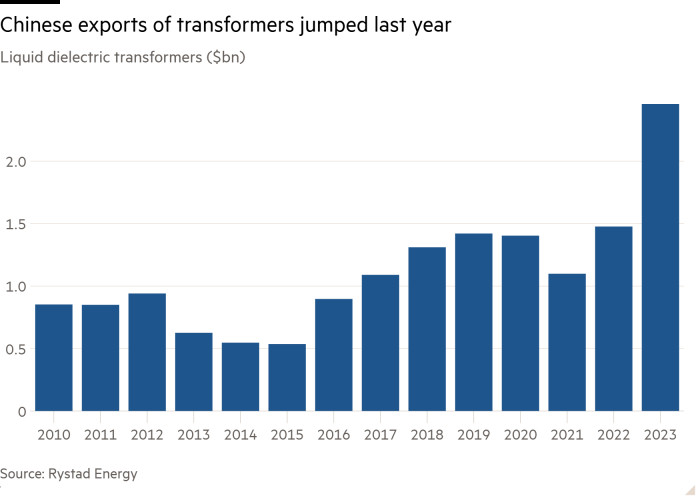

Exports of electrical transformers from China are shooting higher in response to a global shortage, which has threatened the expansion of power grids.

Trade links

-

The FT offers views on how to trade on events like the US election in the financial markets.

-

World Politics Review looks at how China has captured a large part of the global smelting industry for critical minerals.

-

My colleague Martin Sandbu argues that rich democracies must do better to create an integrated financial system to fight off challenges from the likes of China and Russia.

-

Speaking of which, the FT reports that Russian exporters are resorting to barter, thanks to rich-world financial sanctions hobbling their operations.

-

Academic research contends that the US economy flourished during the Gilded Age of 1870-1909 despite, rather than because of, the widespread use of import tariffs, no matter what Trump might think (my framing, not theirs). This echoes famous work from the great Douglas Irwin, which found that on balance tariffs hindered rather than helped industrialisation.

Trade Secrets is edited by Harvey Nriapia

Recommended newsletters for you

Chris Giles on Central Banks — Vital news and views on what central banks are thinking, inflation, interest rates and money. Sign up here

Europe Express — Your essential guide to what matters in Europe today. Sign up here

#Trump #trade #policy #place