A Burberry takeover is not for the faint hearted

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

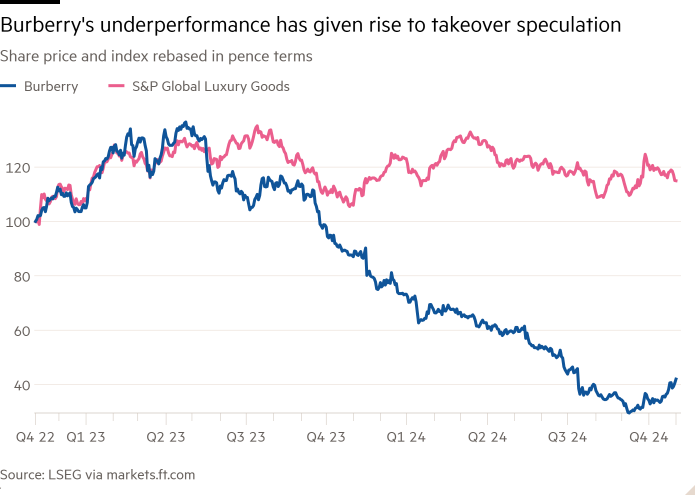

Could Burberry be a takeover target? It is not hard to see why deal rumours — this week’s featuring Italy’s Moncler — have started to do the rounds. The UK luxury group’s botched turnaround has halved its share price over the past 12 months. With a bijou market capitalisation of £3bn, Burberry has become a bite-sized morsel in a world that is increasingly dominated by giants. Yet even now, potential predators will struggle to make the numbers stack up.

The problem is not that the Burberry brand lacks potential. But in its attempt to “elevate” it — for which read hike prices — the group has managed to sink sales. Analysts expect revenues to be down almost 20 per cent this year, virtually wiping out operating profits.

The way out of this slump probably requires lowering prices and ditching zanier aesthetics in favour of classic British outerwear, like the trenchcoat for which the company is famed. New boss Josh Schulman will unveil his strategy next week. But the company’s newer products have already reduced the average selling price by 27 per cent from mid-2024, according to Luca Solca at Bernstein.

Focusing on affordable, quality products is a sensible path for Burberry. Higher-end luxury groups have increased their prices so much that they must be leaving unsatisfied demand in the echelon below. The problem is that mid-market luxury companies such as Tapestry and Capri trade at a discount of 15-20 per cent compared to high-end groups. Burberry’s valuation had already diverged from that of LVMH. But giving up on brand elevation removes hope of a valuation uplift, leaving any buyer reliant on a huge improvement in profits to create value.

For an idea of the optimism required here: say a buyer would have to shell out some £5bn for Burberry, including a 30 per cent takeover premium and £1.1bn of debt. Even assuming that cheaper products drove average annual sales growth of 10 per cent from 2025 to 2030 and ebitda margins settled in the high teens, Burberry would be worth perhaps £7bn by the end of the decade on an affordable luxury multiple. That is a 40 per cent uplift over five years, but under assumptions that would be challenging in the current, depressed luxury environment.

A strategic buyer might be able to cut some costs, by merging supply chains and optimising stores, but it is hard to see how this could tip the scales. Potential private equity predators, meanwhile, would need to load debt on to the group to juice up returns — another tall order given its current circumstances. Any Burberry shareholders hoping for a giant cheque may be disappointed.

#Burberry #takeover #faint #hearted