America Inc and its new CEO

Unlock the White House Watch newsletter for free

Your guide to what the 2024 US election means for Washington and the world

Years ago, a well-known Silicon Valley billionaire told me something I’ll never forget: “China is an autocracy, Europe is a technocracy and America is a company.” That statement has never felt truer to me than since Donald Trump was re-elected president of the US last week.

You can start with the obvious points, which are that Trump is a particularly rapacious businessman, and that leadership in America is an asset to be bought and sold.

That has been particularly so since the Supreme Court opened the doors to unlimited corporate spending on campaigns with its 2010 ruling on the case of the non-profit corporation Citizens United vs the Federal Election Commission. But during this election, more of the remaining rules that separate candidates and their super-PACs were overturned. The result is that of the nearly $16bn reportedly spent in the electoral cycle, a record amount, tens if not hundreds of millions were from unknown donors. It’s not just money that rules US politics, but dark money.

Still, as is the case with top shareholders in filings to the Securities and Exchange Commission, Trump’s biggest political investors are quite well known.

Chief among them is Elon Musk, the entrepreneur and co-founder of Tesla who coughed up $118mn for Trump’s campaign. A good chunk of this was spent on canvassers around the country in the final days. But Musk also provided something even more valuable — the black box of algorithmic control of X, one of the country’s best-known social media platforms, which undoubtedly funnelled any number of potential voters down a rabbit hole of misinformation. Pity the poor swing-state voters worried about the cost of living. They’ve just elected a man who many experts are betting will make inflation far worse.

Of course, Musk and a host of other billionaire supporters such as Timothy Mellon, Steve Schwarzman and Jeff Yass, along with Trump well-wishers such as Jeff Bezos, Mark Zuckerberg and Tim Cook, who were among the first to tweet their congratulations to the president-elect, know exactly what they are getting — a leader who is just as transactional as they are.

They know, for example, that past promises are no indication of future performance. The truth of that was all too clear in the market reaction that greeted Trump’s victory, when stocks and risky assets rose while bond prices fell. This is a man who has promised across-the-board import tariffs and support for the US manufacturing sector. That would argue for lower US share prices and a weaker dollar, to make exports more competitive; investors are betting on just the opposite.

While some of us had a dream that Joe Biden had ushered in a post-neoliberal era in economic policymaking, it’s now quite clear that the US is, as it has been since the 1980s, all about shareholder “value”.

A vote for Trump was a vote for the idea that low taxes, less regulation and more debt will add up to “growth” that will make the US economy — which has fared dramatically better than any other rich nation post-Covid — into something greater. A vote that a gravity-defying act will keep share prices at current record values, and avert the recession that (if you discount the V-shaped blip of the pandemic) is several years overdue by historical standards.

Plenty of Fortune 500 companies have in recent years used debt and endless share buybacks to defy market gravity in the hope of keeping margins and share prices high forever. But America Inc under our brand new CEO Trump feels less like a blue-chip and more like a private equity firm: it’s a highly leveraged, short-term play with an average hold time of around four years.

FT Edit

This article was featured in FT Edit, a daily selection of eight stories to inform, inspire and delight, free to read for 30 days. Explore FT Edit here ➼

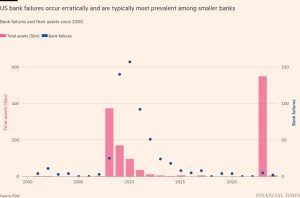

Like Trump, private equity is able to strip assets for immediate profit — no matter how important. The president-elect is likely to kill much of the Biden administration’s clean energy strategy, leaving China to dominate the strategic sectors of the future. He will probably also roll back bank capital requirements at a time when debt, leverage and financial risk is growing.

Even Trump’s proposals to round up and deport millions of migrants amount to a kind of massive lay-off strategy, the sort that activist investors tend to love. Immigrants may be perceived as a cost on Trump’s political balance sheet, but they are one of the key reasons that labour inflation hasn’t been higher in the post-pandemic US. Still, corporate raiders are not generally worried about human capital — just cold, hard cash.

If Trump is our CEO, is America now a distressed asset? One has to wonder. The US economy has done better in recent years than anyone could have hoped, and perhaps better than we deserved. I can’t help but think that our sheer wealth — the per capita GDP of Mississippi is roughly on a par with that of France — and all the consumer distractions that it offers (particularly of the mindless digital variety) are one of the reasons we’ve re-elected a convicted felon to the White House.

The US has become a victim of its own success. I fear we’ve also bought into Trump at the top of the market. But one thing is for sure: we voted in line with our own values. A recent Gallup poll found that money, more than patriotism, religion, family or community, is the defining American value. In Trump, we have a president that represents the full horror of that — and little else.

#America #CEO