Why Trump’s election will not tank European defence stocks

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The election of Donald Trump should, on the face of it, mean a direct hit for the European defence sector. The president-elect has never been a fan of Nato, grumbling that the US pays too much, and he wants to broker a speedy end to the war in Ukraine. But investors appear unfazed. Share prices of big European defence groups continue to climb following last week’s US election.

That is less counterintuitive than it sounds. True, Trump’s approach suggests there will be fewer US dollars streaming into security and non-US military industry. The US, together with Germany, provides the biggest slice — 16 per cent apiece — of Nato’s annual running costs. It is also the biggest spender on defence, with a planned budget of $850bn. But for European defence investors, props remain.

First, creeping protectionism is not limited to the US. Europe, too, wants more spending kept at home. More soft infrastructure is in place to do so. In March, the bloc penned its first European defence industrial strategy with the aim of reversing overseas spending: 78 per cent of EU states’ defence orders from February 2022 to June 2023 went to companies outside the region.

The EU is on the verge of appointing its first defence commissioner. Andrius Kubilius, the former Lithuanian prime minister, said in last week’s hearing that he wanted to create “a true single market for defence”.

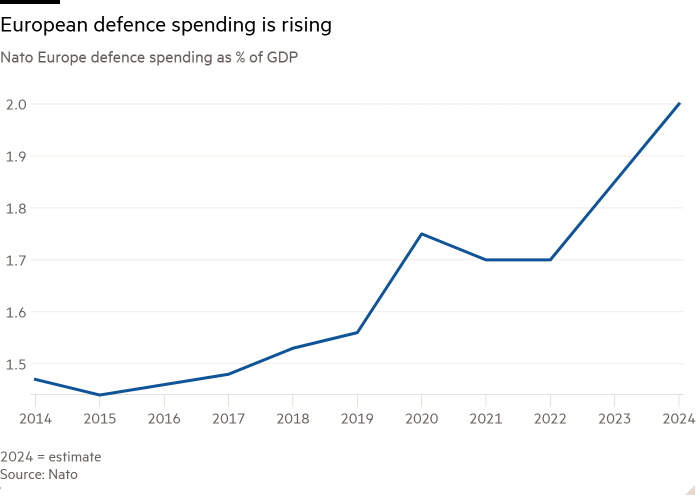

Nato’s European members are also increasing their spend. This year, 23 of 32 members are expected to meet or exceed the 2 per cent of GDP target; together, European allies and Canada will spend a combined 2.02 per cent of GDP, up from 1.43 per cent a decade ago.

US defence spending will not entirely be out of reach, either. Germany’s Rheinmetall and its ilk have US businesses and plants that may give them continuing access.

Second, despite recently increased spending on tanks and shells, Europe has decades of under-investment in security to address. Over the past 30 years, it has spent a cumulative $1.4tn less than required to meet Nato criteria, according to Berenberg estimates. This year’s $23bn overspend relative to the target is a drop in the ocean. That suggests a huge programme of equipment upgrades will buoy spending even absent war.

Manufacturers are still minting money. Prodigious defence spending sent Rheinmetall’s sales up 39 per cent year on year to €2.45bn in the third quarter. Full-year guidance is for €10bn of sales on a 15 per cent operating margin.

The real bottleneck to the European defence industry is physical: ropey supply chains and a highly fragmented procurement base. Changes in the White House make fixing that all the more important.

#Trumps #election #tank #European #defence #stocks