Disney strikes back

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

This article is an on-site version of our Unhedged newsletter. Premium subscribers can sign up here to get the newsletter delivered every weekday. Standard subscribers can upgrade to Premium here, or explore all FT newsletters

Good morning. On the prediction market Kalshi, Howard Lutnick has the edge over Scott Bessent to be the Treasury secretary, 53 per cent to 38 per cent. The difference seems to be a Tweet from Elon Musk. How did we speculate about politics before betting sites and social media? We can’t remember. Email us: [email protected] and [email protected].

Has Disney turned the corner?

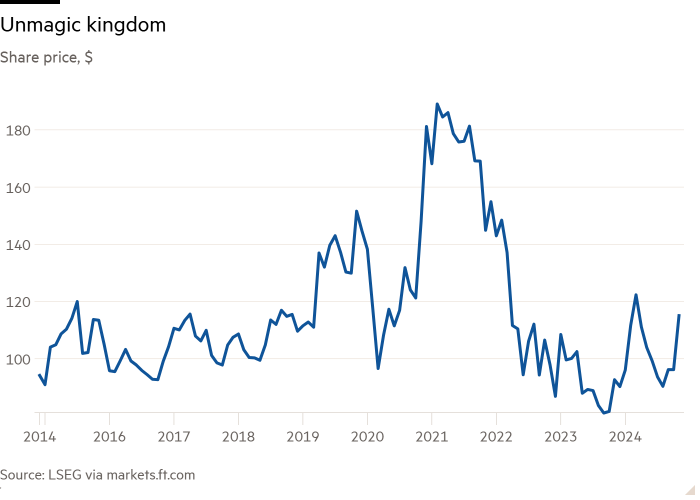

Disney’s shares are up 25 per cent in the past two months. They are unchanged over the past nine years. Those two facts capture the company’s current situation neatly.

Except for a brief period of lockdown exuberance, the past decade or so at Disney has been a brutal test of the old notion that Content is King. No one seriously doubts the quality of Disney’s content factory. While it ebbs and flows, with more ebbing than flowing lately, it is the best there is. But Disney investors have discovered what newspaper investors discovered a generation earlier: while Content may be King, distribution is the Chancellor of the Exchequer.

Ten years ago films moved smoothly from theatres to video stores to cable to network television, and the ESPN cable sports network was the centre of the US sports universe. Streaming video distribution undercut both businesses, in different ways. Recently, however, a comeback is afoot. In its most recent quarter, reported last week, Disney’s streaming channels produced a profit.

In addition to profits from Disney+, Hulu and ESPN+, the movie studio produced a couple of big hits. The company set out detailed targets for its various business units for the next two fiscal years, and company-level earnings growth targets for the next three. Disney is signalling that it has come to grips with the distribution revolution.

Disney has not come all the way back. Here is annual free cash flow per share:

Disney’s new targets paint the following picture: profitability in streaming improves steadily. The parks and cruise ships business, which is receiving heavy investment, grows steadily, too. Together, their growth more than offsets the continued decline in cable and network TV. And the movie studio is the movie studio. Seen this way, the company is a steady grower with very high barriers to entry — its brands — and should trade at a premium.

Disney now trades at 24 times trailing free cash flow, or if you prefer, a free cash yield of about 4 per cent. That is, relative to stocks generally, not very cheap — it prices in a lot of the near-term growth the company is promising. But it’s very cheap next to streaming rival Netflix, which has a 2 per cent cash flow yield. In the past, I’ve argued that Disney’s valuation was not attractive. I’m starting to change my mind.

Five risks stand out. Three are minor. The speed of decline of linear TV (22 per cent of profit in the year just finished) is unclear. So is the pay-off time for the big investments in the cruise ships and parks. And the studio may not continue its current hot streak. While these three could create a lot of variability in profit over the next few years, there are no existential questions involved. The ships and parks are a great, stable business. Linear TV is going to be much smaller eventually. And the studio is simply volatile.

Now the major risks. One: the competitive dynamics in streaming are still in flux. Asked what gives them confidence that streaming profits can grow, Disney executives listed subscriber growth, higher pricing, and lower churn. None of those is a foregone conclusion. Two: Disney is relaunching ESPN’s streaming platform next year, and the degree to which live sports (with gambling features added) can be successful at scale away from network and cable TV is unproven. Disney has spent a lot of money on rights to events. Streaming them needs to work.

Turkish markets

Turkey, as unlikely is it sounds, could be the next Trump trade. The main piece of evidence, pointed out in a note from Nicholas Farr and Liam Peach at Capital Economics, is the Turkish lira’s recent stability in the face of the strengthening dollar. It has only weakened slightly over the past month, while most other EM currencies have fallen:

Turkey’s main stock index has also risen since the US election, after trading down for a few months, and yields on 10-year Turkish government bonds have fallen:

There are several reasons for Turkish assets to prosper in the US election’s aftermath. Trump’s promise to end the war in Ukraine could be a boon to the Turkish economy. In both trade and finance, the country has been stuck between Russia and the West since President Recep Tayyip Erdoğan declared neutrality in the conflict. Trump might also further revive US-Turkey relations by pulling US troops out of Syria — a major sticking point between Trump and Erdoğan during Trump’s first term, souring an otherwise friendly relationship. If Trump and Erdoğan grow close again, favourable tariff treatment for Turkey may be on the table.

That is all speculative. A concrete reason for the recent outperformance of Turkish assets is an improved monetary outlook. After years of unorthodox monetary policy, the Turkish central bank has gotten its act together. Inflation is starting to come down from its dizzying heights. And net foreign reserves are positive and climbing:

Foreign investor sentiment has perked up as a result. Turkey’s current account balance has also turned positive, in part because of higher foreign investment:

Negative net FX reserves had meant that the Turkish central bank could not intercede to support the lira against currency pressures, making carry trades unappealing to traders, despite Turkey’s extremely high policy rate of 50 per cent. Tunc Yildirim, head of institutional equity sales at Istanbul-based investment bank UNLU & Co, points out that the recent stretch of lira strength and stability means the currency now has the highest vol-adjusted carry among its peers. This is probably helping to keep the lira above other EM currencies.

Turkey faces major hurdles in the next few years, including persistent services inflation and uncertainty over the direction of fiscal policy. But for the first time in a long time, a few things are going right.

(Reiter)

Two good reads

Does greedflation exist? Or not?

FT Unhedged podcast

Can’t get enough of Unhedged? Listen to our new podcast, for a 15-minute dive into the latest markets news and financial headlines, twice a week. Catch up on past editions of the newsletter here.

Recommended newsletters for you

Due Diligence — Top stories from the world of corporate finance. Sign up here

Chris Giles on Central Banks — Vital news and views on what central banks are thinking, inflation, interest rates and money. Sign up here

#Disney #strikes