Japan’s beef bowl economy shows consumer resilience as prices rise

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Beef bowls are serious business in Japan. Shares in Zensho Holdings rose 10 per cent on Tuesday to give the local fast-food restaurant operator a market value of nearly $10bn following plans to raise beef bowl prices at its chain Sukiya. The Japanese restaurant industry, where some groups have increased menu prices several times this year, has been a profitable sector to buy into this year with price rises having little impact on locals’ appetite for dining out.

Prices for about 60 per cent of Sukiya’s menu will rise starting this Friday. Zensho, which also operates outlets including family restaurants Coco’s and Jolly Pasta, plus conveyor-belt eatery Hama Sushi, has said this is due to a recent increase in Japanese rice prices. It last raised prices only seven months ago. Local peer Yoshinoya Holdings and Skylark Holdings are among other local groups that have also increased prices at their restaurants

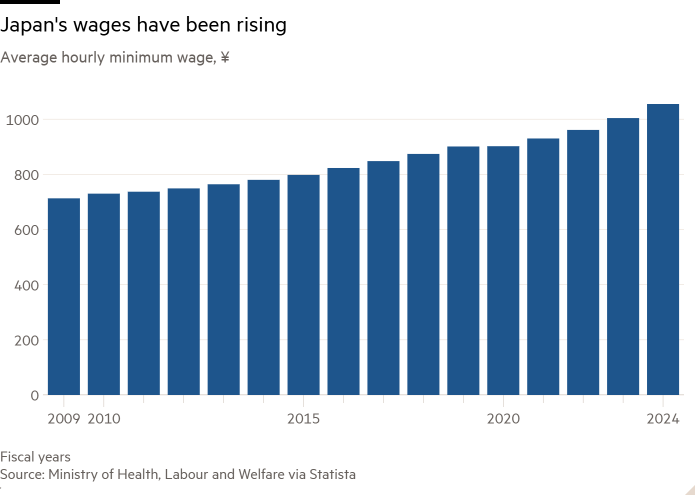

A severe labour shortage in Japan and higher wages have contributed to rising costs: the average minimum wage is set to rise by a record 5.1 per cent in the fiscal year to next March. Rising wholesale inflation, which rose 3.4 per cent in October, the fastest annual pace in over a year, is another factor.

Yet price rises at fast food outlets and restaurants have not deterred locals from dining out. For example, Skylark Holdings’ net profit grew 11-fold in the first half following price increases at some of its restaurants as sales per customer rose. More notable, though, was that the number of total customers also grew by a 10th.

This is a pattern that has occurred across price segments: McDonald’s Holdings Japan reported a record net profit for the first half despite price rises, with operating profit up a third. The number of customers continued to grow, even following price increases in January.

The latest bout of beef bowl inflation should mean earnings growth for Zensho too, which is already enjoying growing sales from its takeout sushi chains in the UK and North America. A stronger yen this year, up 9 per cent against the US dollar since September, should help ease pressure on costs such as from imported beef — which hit a record high earlier this year — adding a further profit boost.

Shares in Zensho are up a quarter this year but trade at 28 times forward earnings, around half the levels of last year. The resilience of Japan’s beef bowl economy suggests investors can keep dining out on this one.

#Japans #beef #bowl #economy #shows #consumer #resilience #prices #rise