Nestlé serves up a bland vision for consumer conglomerates

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

For the average consumer goods giant, life is sadly lacking in spice. The pandemic-era bubble has dissipated, taking volume growth with it. Product prices have been raised about as far as consumers can stand. To deliver even halfway-decent sales growth, companies need to pour money into marketing — and keep wielding the axe even to maintain margins.

That is an apt description of Nestlé’s daily grind. In his maiden capital markets day, new boss Laurent Freixe has ditched almost every target the Swiss group — maker of Nescafé coffee, KitKat bars and Maggi stock cubes — had previously set. Nestlé will also turn its water business into a standalone unit, a possible prelude to the sort of slimming down that Reckitt and Unilever have been engaged in. This is all perfectly sensible but, given Nestlé’s much-reduced prospects, will come as cold comfort to its investors.

Medium-term sales growth has been cut to 4 per cent plus, down from a mid-single-digit target set in 2022. That already baked in a decline compared with the 8.4 per cent achieved that year. Even that reduced level does not look easily achievable given Nestlé’s 2024 sales growth guidance — after two cuts — has fallen to 2 per cent.

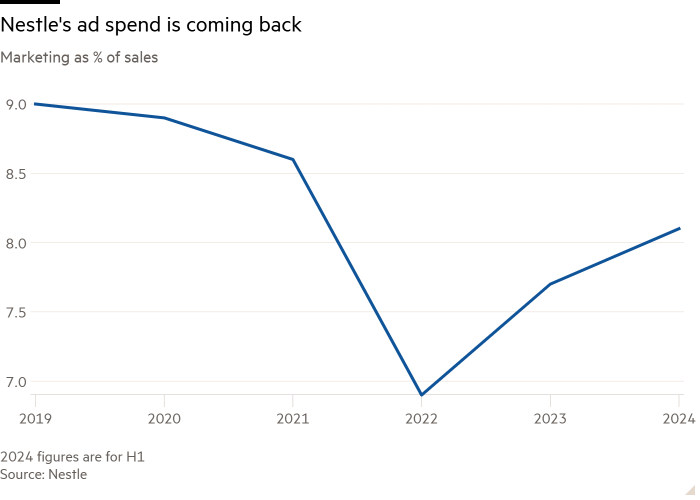

Delivering this reduced level of ambition will require Nestlé to raise marketing investment to 9 per cent of sales. That will cost an extra SFr700mn ($794mn) a year, according to UBS analysis, about the same as the new cost cuts the company is targeting. Operating margins are hence expected to settle at 17 per cent plus — flattish on this year — down from its previous target range of 17.5 to 18.5 per cent.

All this reflects the fact that for Nestlé, like other big consumer groups, growth is hard to come by. Emerging markets are not what they were. Products have achieved reasonable penetration, and local brands are increasingly formidable competitors. Indeed, Nestlé’s emerging market sales growth of near 12 per cent in 2012 will fall to somewhere around 4 per cent this year, thinks Jefferies.

Subdued underlying demand leaves consumer giants reliant on their own innovation to beat GDP. The race is on to create products that can wrest market share from rivals, or even open up a whole new market. Nestlé did so with Nespresso capsules — now under siege from “compatible” rivals.

Ultimately, this is a much harder proposition than simply selling necessities into growing markets — and makes for a pretty bland outlook.

#Nestlé #serves #bland #vision #consumer #conglomerates