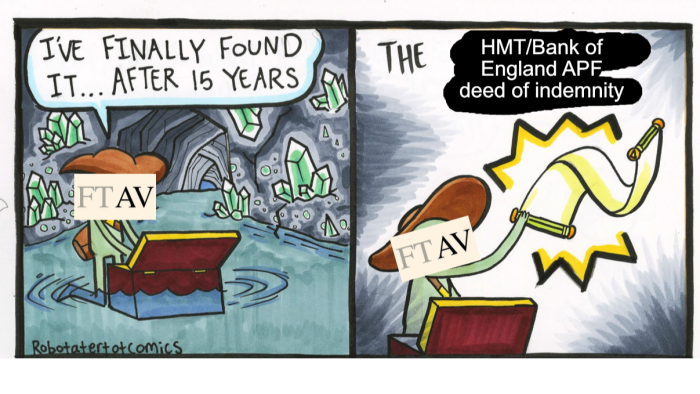

We got the UK Government to finally release the document underpinning quantitative easing

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

FT Alphaville has written, like, a lot now about quantitative easing (and its somewhat-opposite quantitative tightening) in the UK.

Behind almost all the coverage of the Bank of England’s massive-scale bond buying, there has existed something of a mystery: the “deed of indemnity” document underpinning the UK’s unusual QE arrangement — in which the Treasury pays to cover the BoE’s losses from the scheme — had never been released, to the chagrin of journalists and the House of Lords.

Today, that has changed: after a ruling by the Information Commissioner’s Office following an Alphaville freedom of information request, the Treasury has been forced to disclose much of the document.

You can read it, with redactions, here.

Naturally, our evening plans are now sorted. Although much of it appears to have said elsewhere, as expected, this is the first time the legal details have been disclosed. As the Treasury says:

As noted in the ICO’s decision notice, a high level of transparency already exists in relation to the UK’s quantitative easing programme and the APF, and the Commissioner considers that the public interest in disclosure is met to a large extent by the myriad of information which has been published online by HM Treasury, Parliament and other public authorities.

The redactions in place appear to relate largely to details of the Government’s cash-handling arrangements. HMT has previously attempted to block the document’s release by claiming its release could facilitate economic crime.

FTAV disagreed with this, and the ICO (whose judgment can be read here) landed on our side regarding publication of most of the document.

HMT says today:

Certain sections of the deed of indemnity have been redacted as the release of these sections would reveal operationally sensitive information related to government cash management practices. The ICO has considered this case and ruled that HM Treasury had correctly applied exemptions to part of the requested information as release would be likely to prejudice the economic interests of the UK. The ICO ruled that public interest weighed in favour of maintaining the exemptions and withholding the release of certain sections of the deed.

One potentially material element of the document regards its flexibility: for instance, would a chancellor be able to unilaterally abolish the indemnity.

The answer, it would appear, is no. Both sides would need agree a waiver, and virtually nothing will stop HMT’s liability from existing:

We get a very rough timeline of the deed’s development: first agreed in 2009, it was updated in 2012, 2016 and 2019.

On that point, it’s great to see that silly typos can appear in even the most economically-important documents:

To some extent this is just a little transparency win, but do let us know if you spot anything interesting in there!

Further reading

— The OBR should trust markets on the cost of quantitative tightening

— Getting into the weeds of active QT and UK fiscal rules

#Government #finally #release #document #underpinning #quantitative #easing