UK property sector hit by fears of resurgent inflation

Stay informed with free updates

Simply sign up to the Property sector myFT Digest — delivered directly to your inbox.

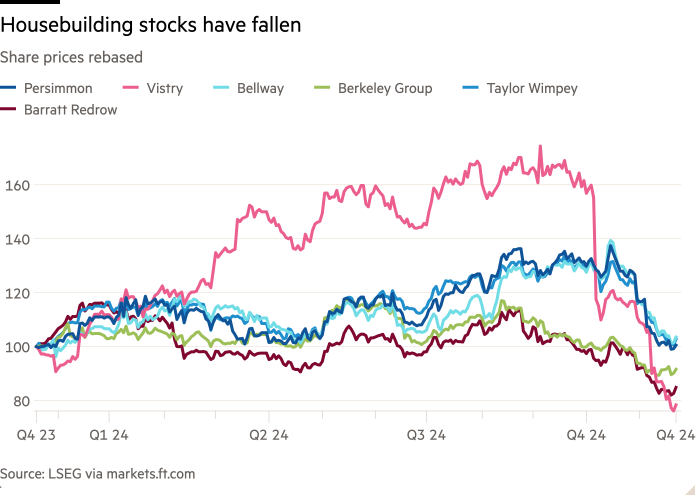

Renewed inflation fears are hammering the UK property sector, as anxieties over borrowing costs, the UK Budget and the election of Donald Trump have sent shares spiralling downwards.

The six biggest listed housebuilders by market capitalisation are down by an average of about 18 per cent since the Labour government’s first Budget on October 30, while real estate investment trusts have fallen almost 5 per cent.

Worried by higher-for-longer interest rates, investors have punished a sector that is key to the government’s growth plans, wiping billions off market valuations.

Clyde Lewis, an analyst at Peel Hunt, said the sector was experiencing higher inflation with “cost pressures starting to creep back in”, citing measures such as the rises in employer national insurance contributions and the minimum wage.

He added that increased swap rates, which mortgage providers use when setting interest rates, owing to “fears over government borrowing” and the UK’s poor growth outlook had also hurt the sector.

Concerns over higher sustained inflation began ahead of the Budget with gilt yields and swap rates rising sharply before chancellor Rachel Reeves announced £40bn of tax raising and about £28bn of borrowing.

A week later, and a day after the US election, the benchmark 10-year gilt yield hit its highest level this year at 4.56 per cent. While it has come down slightly since then, it remains high at 4.41 per cent.

Industry fears were cemented by Wednesday’s announcement that inflation had accelerated to 2.3 per cent in October, up from 1.7 per cent in September and higher than analysts’ predictions of 2.2 per cent.

The property sector share slump deepened on the news as expectations rose that the Bank of England would delay its next interest rate cut until 2025.

Several FTSE 100 property companies have pointed to the risk to their businesses from rising borrowing costs.

“There has been some volatility around the recent Budget and US election . . . that has been a headwind for the listed equities,” British Land chief executive Simon Carter said on Wednesday.

Persimmon, whose stock price has fallen by more than a fifth since October, warned this month of “signs of build-cost inflation”.

Part of the hit to housebuilders has come from Vistry, by far the worst-performing stock in the sector, having lost more than half its value since last month. The company has issued two profit warnings in recent weeks following an external review into undercounted building costs.

RBC analyst Anthony Codling said Vistry’s case was less the result of cost inflation than of the company getting its “maths wrong”. He added that housebuilders were trading at a discount because there had been “an overreaction to small increases in mortgage rates since the Budget”.

Investor confidence has also been knocked by a lack of clarity from the government over how it will reach its target of building 1.5mn new homes in England over five years — the OBR recently projected that Labour would miss the target by 400,000.

Housing minister Matthew Pennycook warned this week that it would be “more difficult than expected” to meet the target because of the depth of the supply downturn.

#property #sector #hit #fears #resurgent #inflation