Britain’s biggest export sector is, or possibly isn’t, in trouble

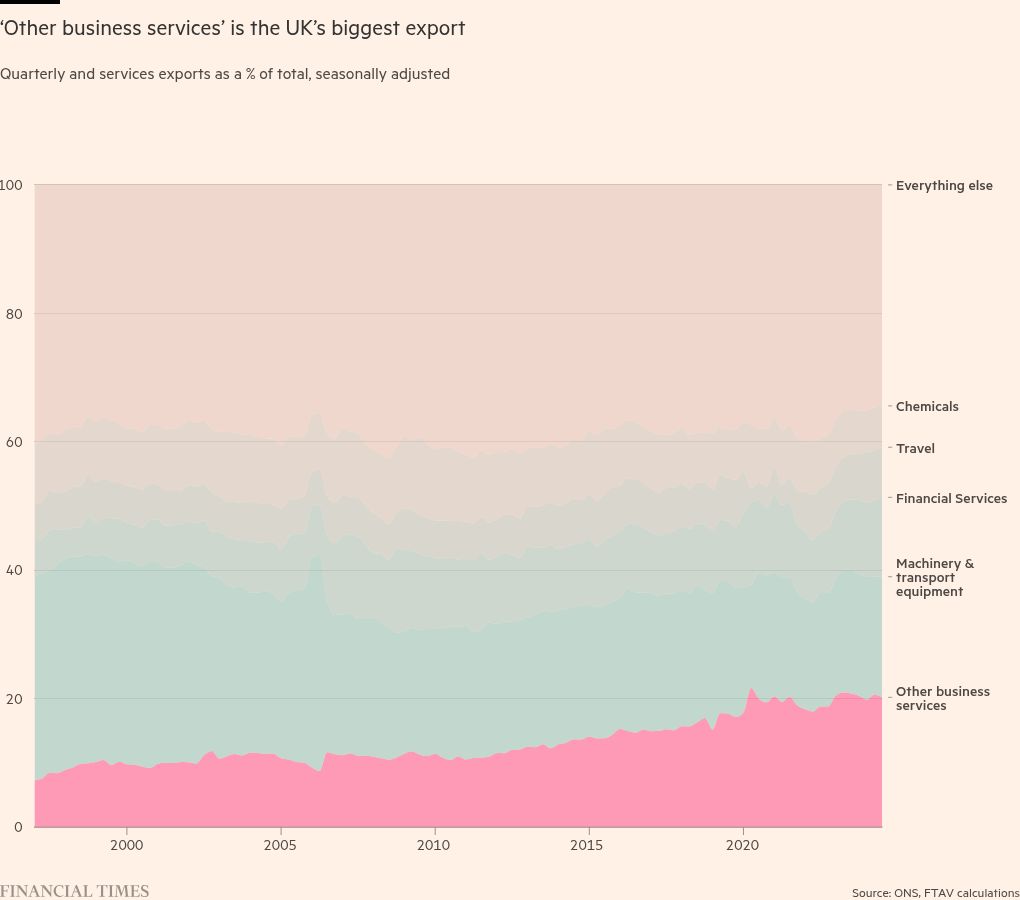

There’s nothing Britain is better at selling abroad than “other”:

As we wrote earlier this year, the UK ought to be viewed in large part as a “consultation nation”, expert in exporting vague services. Professional and management consultancy is usually the biggest sub-category of this key export lump.

Economically speaking, this is a good and bad thing.

It’s good because, in a very general sense, it’s better for an economy to be doing more things, and so finding things to do is typically preferable to the alternative.

It’s bad because the marvellous mystery crop labelled “other” is one of the hardest to make sense of, and therefore to cultivate. Its inherent vagueness makes it harder to tell when a shock or a change in cycle is occurring. Its inherent vagueness also makes it hard to tell what it really is.

We looked at this latter dynamic in a follow-up piece, prompted by a paper by the Resolution Foundation’s Sophie Hale. She had written about the need for the UK to prepare for the possibility that future trade shocks hit vague, mushy services instead of the usual suspects like manufacturing. Image your friend’s dad who spent twenty years in the civil service then decided he wanted a bimmer, rather than, eg, car factory workers (oops, it happened again).

As is our wont, we spent about half the piece actually addressing the question and the other half ragging on an in-our-view premature graphic that Bloomberg had attached to their write-up, which showed ‘Other business services’ dropping sharply in Q4 of last year. Our contention is that it wasn’t possible to pinpoint the actual cause of this drop, because even a vague breakdown of data would not arrive until we got the latest edition of the Pink Book, the UK’s balance-of-payments bible.

We wrote then:

Let’s imagine the kind of trade shock Hale is describing did arrive — that UK consultancy exports collapse this quarter because of, say, AI. As things stand it would be well over a year before we know from a macro standpoint what had happened. That surely can’t be good for the discourse.

Well, it’s been most of a year since then, so let’s check in, using the ‘UK trade: goods and services publication tables’, which are seasonally adjusted:

OK, it’s not the most terrifying chart we‘ve ever seen — but is this showing a consultancy crisis? From a growth perspective, things have never looked this bad, although many other sectors would probably be jealous of what constitutes a downturn here:

We know a lot of the big consultancy firms have been shedding jobs this year in response to a downturn in demand, so perhaps it’s not surprising that there’s a dip in the headline figures. But is consultancy even to blame?

To find out, we need better data: the tables linked above don’t break “Other business services” down into its subcomponents.

We cracked out the Pink Book — a new edition of which landed on Hallowe’en — but because it only has an annual total for each subcomponent up to the previous year end, it’s not particularly timely and doesn’t show the variation within a year (important in this instance because we’re potentially looking for a sharp drop in the fourth quarter of last year).

Can we do better? As it turns out: yes, somewhat.

We were under the impression that sub-components of “Other Business Services” only came out annually with the Pink Book, but the ONS kindly pointed us towards “UK trade in services: service type by partner country, non-seasonally adjusted”, which has roughly the same data quarterly up to Q2 of this year.

We say roughly — this data set uses a different methodology and classification system to the Pink Book, so management consultancy is found within “10.2.1.3: Business and management consulting and public relations services”. Significantly, the table is non-seasonally adjusted.

In this view, things look different, but not, like, majorly different. Just a bit mushy really.

Putting those overall “Other business services” totals side-by-side, we get this:

If we smooth both the seasoned and non-seasoned varieties to four-quarter averages: yeah they‘re pretty much the same:

An ONS spokesperson told us that, beyond the adjustments, any differences between these two data sets would be down to methodology, which is fair enough. It doesn’t exactly help us work out what’s really going on but gives us some vague confidence moving forward. Eventually, this detailed data set will align with the main, seasonally-adjusted measure.

Now that we know the detailed data set is telling us roughly the same thing as the broader one, let’s take advantage of those details. To do so, and make the numbers still add up, we had to calculate a new category that is the residual of the “Other business services not included elsewhere” part of the “Technical, trade-related and other business services” part of the “Other business services” part. For the purposes of the chart below, we’ve dubbed this “Other other other other”.

Here’s the breakdown, ordered bottom to top by size:

Prod the legend to show and hide things, and you’ll see that the consultants are basically, probably fine.

The bigger problem, perhaps, is an apparent downturn in that most traditional of British exports: “Services between affiliated enterprises n.i.e. [not included elsewhere]”. As Eurostat explains:

Services between affiliated enterprises, n.i.e. is a residual category. It covers payments by affiliates to their parent companies for general management costs (for planning, organising and controlling) and reimbursements of expenses settled directly by parent companies, funds transferred by parent companies to affiliates for covering overhead expenses, and any other services between affiliated enterprises that cannot be broken into individual service categories.

Now then: we don’t to besmirch this category by saying it’s all legal profit diversion, but when the top recipient country is Ireland you know something’s up.

If this is all roughly correct (and it’s national statistics, so who knows), it at least seems like one of the more desirable ways to have your biggest export plateau.

Further reading:

— If a services export collapses in the woods, and nobody hears it for ages, does it make a discourse?

— Britain, consultation nation

#Britains #biggest #export #sector #possibly #isnt #trouble