Trump’s return jeopardises global fight against plastic pollution

This article is an on-site version of our Energy Source newsletter. Premium subscribers can sign up here to get the newsletter delivered every Tuesday and Thursday. Standard subscribers can upgrade to Premium here, or explore all FT newsletters

Good morning and welcome back to Energy Source, coming to you from New York, where people are off celebrating Thanksgiving.

Americans are travelling at record levels for the holiday as lower fuel and food prices deliver relief to inflation-weary consumers. Nearly 80mn people will travel at least 50 miles this Thanksgiving, an all-time high, according to the American Automobile Association. The Federal Aviation Administration is forecasting the busiest travel season “in decades”.

The heavy traffic comes as a weak Chinese economy and a ceasefire deal in the Middle East drag down the cost of crude. Petrol prices averaged $3.04 on Monday, the lowest level for the holiday since 2020, according to the US Energy Information Administration.

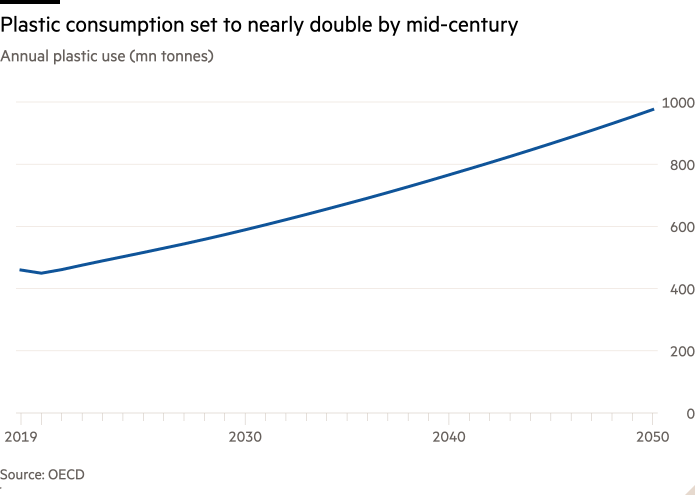

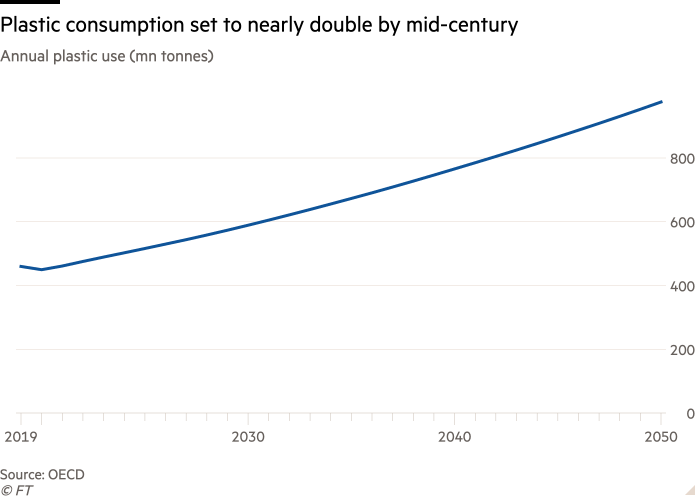

Today’s Energy Source looks at what Donald Trump’s election victory means for global efforts to address plastic pollution. Talks between delegates from more than 170 countries have reached an impasse in Busan, South Korea, with days left to broker the first UN treaty on plastic. Plastics, a building block of modern life, is a big driver of oil demand, with global consumption expected to nearly double by 2050.

Happy Thanksgiving, and thanks for reading.

Amanda

Trump victory hangs over UN plastic treaty talks

Donald Trump’s election victory could jeopardise global efforts to curb plastic production as nations convene in South Korea to negotiate the first UN treaty on plastic waste, according to attendees and stakeholders.

Delegates from more than 170 nations gathered in Busan, South Korea, this week for the fifth and final round of talks to secure a global treaty similar to the Paris climate agreement to address plastic pollution.

But the return of Trump has cast doubt over where the US stands and the likelihood that the country, one of the top producers of plastic, will join the agreement under a president who had previously withdrawn from the Paris agreement and is averse to international treaties.

“Everyone now knows that the US will not join this agreement anytime soon, and their credibility in engaging in this process is severely compromised due to the election,” said one European negotiator, who belongs to one of the nearly 70 countries in the so-called high ambition coalition calling for binding targets to reduce plastic production.

“[Trump’s election] is creating a lot of space for countries that don’t want to see an effective treaty . . . It’s quite clearly a setback,” they said.

Ben Cardin, the outgoing Democratic chair of the Senate foreign relations committee, which deliberates international treaties, warned that US collaboration on the global plastic treaty could wane under Trump.

“The president-elect has had a troubling record that reflects a pattern of retreat . . . This approach threatens to weaken America’s industries, workers and leadership on the global stage,” Cardin told Energy Source in a statement, saying that work on plastic pollution “must continue with bold domestic action and strengthened global co-operation”.

The treaty talks come as petrochemicals, the feedstock for plastic, become the biggest driver of oil demand. The International Energy Agency has identified the petrochemicals sector as the cornerstone of oil demand growth this decade as the electrification of power and transport reduces the thirst for crude.

Global plastic consumption is expected to balloon to 736mn tonnes by 2040, up 70 per cent from 2020 levels, according to OECD projections. The sector’s carbon footprint is also expected to grow as a result, making up 10 per cent of global emissions by 2050, up from 5 per cent in 2019, according to a Lawrence Berkeley National Laboratory report.

The debate around whether countries should include reductions to plastic production in the UN treaty or instead focus on recycling has stalled progress, with China and Saudi Arabia strongly in opposition to supply targets. While the US had originally been opposed to production measures, the Biden administration reversed its stance in August.

Whether the US will formally join a treaty that aims to reduce plastic production is highly unlikely. Even if countries agree to a text by the end of the week, the treaty will probably not be finalised before the arrival in January of the Trump administration and a Republican-controlled Senate, where a two-thirds majority vote is required for ratification.

“They’d probably walk it all the way back,” said Pete Keller, vice-president of recycling and sustainability at Republic Services, one of the largest US waste management companies. Michael Wilson, chief executive of Vibrantz Technologies, which produces pigments for the plastic industry, told Energy Source that “everything is more problematic if the US doesn’t support [the treaty]”.

Jim Risch, the top Republican on the Senate foreign relations committee, accused the Biden administration of trying to achieve a “rushed deal” in a statement to Energy Source. “They should leave this issue to the incoming Trump administration who will rightly focus on American workers and families, not the narrow partisan interests of radical climate NGOs,” he wrote.

Earlier this month, Risch and 19 other Republican senators sent a letter to the Biden administration warning they would not support a treaty that restricts plastic production.

A US state department spokesperson said that Washington’s goal “remains to complete negotiations in 2024” in line with the UN deadline set in March 2022.

“We support an effective global agreement with meaningful and feasible universal obligations throughout the plastics lifecycle, including production, consumption and waste,” they added.

Large petrochemical producers dismissed concerns that a Trump administration would undermine UN negotiations. “We should not be focused singly on a couple of big countries here,” said Edison Terra, executive vice-president at Braskem, the largest petrochemical company in Latin America.

“If you can come up with a treaty that is collaborative and addresses these fundamental principles, we think that it’s a solution that will work for everyone,” said Steve Prusak, chief executive of Chevron Phillips Chemical, the petrochemical joint venture between Chevron and Phillips 66.

The US has a poor record of ratifying multilateral climate agreements. It is the only UN member country that has yet to ratify the UN convention on biological diversity established in 1992. The Kigali amendment to the Montreal Protocol, agreed by nearly 200 countries on the eve of Trump’s first election victory in 2016, did not get ratified by the US until 2022.

“The US is important to contribute to the discussions and so on, but they’re not the pivotal state,” said John Duncan, co-chair of the Business Coalition for a Global Plastics Treaty, which involves more than 200 companies including Walmart and Unilever, and supports reductions to plastic production. “The US doesn’t have to be a party for the agreement to work.” (Amanda Chu)

Job moves

-

Former BP chief executive Bernard Looney has been appointed the chair of Prometheus Hyperscale, a US data centre company, as he seeks a comeback from a scandal last year that cost him the top job at the oil major.

-

Amber Hetzendorf has left Freyr, a Norwegian battery company, where she served as executive vice-president of its battery project. She has joined Gridtential Energy, a battery start-up, as chief executive.

-

Northvolt chief executive and co-founder Peter Carlsson has stepped down from the troubled European battery maker.

-

Patrick Flint, has been appointed as chair of Desert Metals, an Australian nickel and copper exploration company, succeeding Mark Stewart.

-

Bolaji Osunsanya is retiring from Axxela, a Nigerian gas and power company. Ogbemi Ofuya will serve as the new chief executive.

Power Points

-

Texas and 10 other Republican-led states are suing BlackRock, State Street and Vanguard, alleging that they conspired to curtail coal supplies to further a “destructive” green agenda.

-

“Production first, safety later”: Unions and workers say Indonesia’s dominance of the EV supply chain has come at a price.

-

US farmers urge the Biden administration to crack down on surging Chinese imports of used cooking oil for biofuels, warning the shipments are undermining rural America’s big bet on crops for green transport.

Energy Source is written and edited by Jamie Smyth, Myles McCormick, Amanda Chu, Tom Wilson and Malcolm Moore, with support from the FT’s global team of reporters. Reach us at [email protected] and follow us on X at @FTEnergy. Catch up on past editions of the newsletter here.

Recommended newsletters for you

Moral Money — Our unmissable newsletter on socially responsible business, sustainable finance and more. Sign up here

The Climate Graphic: Explained — Understanding the most important climate data of the week. Sign up here

#Trumps #return #jeopardises #global #fight #plastic #pollution