Europe lacks a monetary response to Trump

This article is an on-site version of our Chris Giles on Central Banks newsletter. Premium subscribers can sign up here to get the newsletter delivered every Tuesday. Standard subscribers can upgrade to Premium here, or explore all FT newsletters

What do we want? Economic growth without inflation. When do we want it? Now.

If there is one thing that Eurozone central bankers agree upon, it is that their political masters should implement the recommendations of the Enrico Letta report into the EU single market and European competitiveness report by Mario Draghi. This, they say, would improve structural elements of Europe’s economy, making monetary policy better able to control the economic cycle without risk of recession.

Back in the real world, they have the day job of controlling inflation regardless of whether politicians agree on ways to improve the economic foundations.

And there is quite an argument about inflation risks at the moment.

In the past week François Villeroy de Galhau, governor of the Bank of France, floated the idea of a large half-point rate cut at the December meeting of the ECB, saying there was every reason to cut and calling on his colleagues to “remain open on the size of the cut, depending on incoming data, economic projections and our risk assessment”.

In contrast, ECB executive board member Isabel Schnabel stressed she had “a strong preference for a gradual approach” to rate cuts in an interview with Bloomberg. She warned against moving rates into anything like accommodative territory, which she defined as between 2 and 3 per cent, the upper bound of which was half a percentage point higher than Villeroy de Galhau estimated.

Overseeing this emerging argument, ECB president Christine Lagarde did not mention monetary policy or interest rates in a wide-ranging FT interview. She did speak extensively, and much more openly than most officials dare, about the effects of Donald Trump’s election on Europe’s economy and inflation.

“Sit down and talk” to Trump, she advised. “Not to retaliate, but to negotiate”. It is worth reading the whole interview.

ECB watchers will note, however, that the central bank’s executive board does not have a consensus view about the effects of tariffs or Trump on Eurozone inflation.

Lagarde said “the actual net effect on inflation is uncertain at this point”, with perhaps a leaning towards a view that “it’s a little net inflationary in the short term, but you could argue it both ways”.

Schnabel was a little more definitive, saying tariffs were likely to be bad for growth and “on inflation [the effect] is, if anything, slightly positive”. Even with weaker activity, she said the positive inflationary impact implied that tariffs “cannot justify an accommodative policy stance”.

Speaking on Soumaya Keynes’ economics show this week, the ECB’s chief economist, Philip Lane, brought out why the inflationary consequences of tariffs were causing the ECB so much analytical pain. He said it mattered what tariffs were imposed, how long they would last, whether there would be retaliation, whether the world trading system would fragment, whether the macroeconomic hit to European investment would also damp inflation, whether the dollar would appreciate and how far that would go, whether China would flood Europe with the cheap goods it could not get into the US and whether through any turmoil European companies thought they would have pricing power.

That is quite a long list of caveats.

Lane said the ECB understood the various scenarios and needed to “be very closely working out, meeting by meeting essentially, which of these scenarios look like they were fake news . . . [and] which of those scenarios look like they may take hold in the data”.

I spoke to Thomas Harr, chief economist of the Danish central bank and co-author of The great inflation resurgence, who said that working out the likely inflationary consequence of a Trump presidency was “really tricky for central banks”.

“In our book, we stress that inflation is a global phenomenon, but now I am uncertain about whether Trump will be inflationary or disinflationary for the rest of the world,” he said.

The problem of setting policy in an environment with so many caveats is that it makes it essentially impossible to forecast inflation, just as it was when Russian troops were on manoeuvres near the Ukrainian border in 2021.

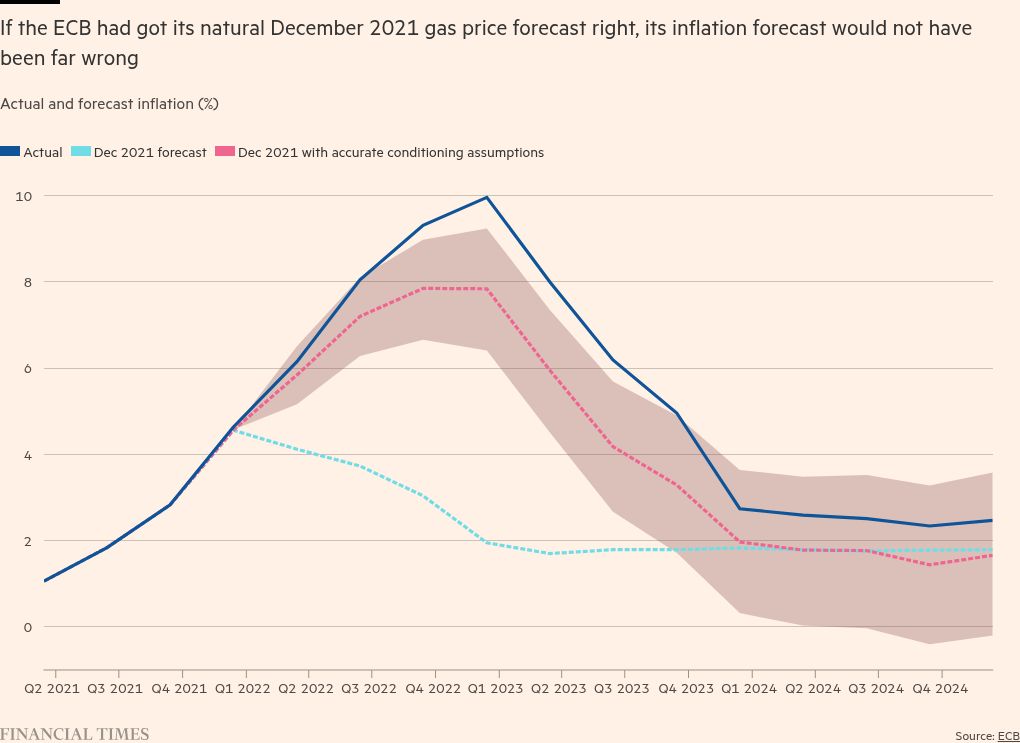

Work at the ECB highlighted by Lane in a speech last month examined how the central bank’s main economic model performed at predicting inflation after Covid. On one level, it was terrible — in the chart below, the dark blue line of actual inflation far exceeds the December 2021 forecast in light blue.

On another level, the ECB has identified the source of most of the errors as the conditioning assumptions (natural gas price, exchange rates etc) that the model used.

Plugging in the correct conditioning assumptions, the pink line shows the model would have done a reasonable job in forecasting inflation had it had the right data to work with. It would not quite have forecast the extent of the rise in prices, but it is hard to claim that the model failed.

This is exactly the problem about modelling tariffs. What Lane was agonising about in the podcast was exactly the same conditioning assumptions that need to be given to an economic model. And no one knows.

Since the Trump administration is best viewed as a medieval court with various flunkies seeking to impress the king, predicting what will happen is near to impossible. As Alan Beattie wrote last week, many people will have theories but no one knows.

Another Lane speech last month, however, allows us to get an idea of the scale of inflation risks through trade. It is not that encouraging. A “severe decoupling” of US, Chinese and European trade blocs, which would include a full trade ban in all sectors, was likely to be very bad for growth and inflationary.

The chart below for Europe in this extreme scenario suggests an initial 4 percentage point rise in Eurozone core inflation with ongoing further inflationary outcomes dependent on how much workers seek to avoid taking the inevitable pain through reductions in their real wages. That is essentially a repeat of the inflationary episode we have just experienced.

Of course, that scenario is largely made up and extremely severe. Another way of looking at the same question is to look at financial market pricing, since traders cannot say “it’s all too uncertain”, and have to take a view.

For what it is worth, the market view since Trump’s election is that trade wars will raise US prices and force the Federal Reserve to slow US interest rate cuts. Their view of the Eurozone is reversed, suggesting that growth and inflation will be weaker so the ECB will cut rates slightly more aggressively.

Harr thinks this is as good a bet as any. “The 2021-22 inflation was a global phenomenon and we underestimated the spillovers — that said I have a lot of sympathy with financial markets pricing that this time is different,” he said.

The market outcome on inflation and interest rates is just one aggregated view, however. And it’s predictive power in 2024 has been shocking.

So it is best, probably, to say we just don’t know how inflationary Trump’s tariffs will be. It is not a satisfactory answer, but it is, again, the best one we have got. Anything else is just a hunch.

What I’ve been reading and watching

-

One central bank has explicitly decided that Trump’s victory requires lower rates to help deal with additional trade frictions and pressures on exports. In an unexpected move, South Korea’s central bank eased policy last Thursday saying the Republican victory in the US was bigger than it had forecast

-

Worries over France’s budget deficit are mounting in bond markets. It’s not yet a crisis, says Katie Martin as French bond yields briefly exceeded those of Greece last week

-

At the same time China looks more and more Japanese with its very low bond yields, reflecting deflation fears

-

Many people want to improve GDP by adding in values of things they think are important. My column looked at official attempts to do this, which result in a nasty mess of little use to anyone

A chart that matters

A revolution in communications is happening in Frankfurt. The ECB has analysed all of its monetary policy statements since 1999 and found that the latest, read by Lagarde, requires much less formal training to understand than earlier versions both by herself and her predecessors. Average readers now need US high school levels of reading proficiency rather than undergraduate level to understand the text.

The chart highlighted by ECB chief economist Philip Lane at the Bank of England watchers conference underpins the reality that most people get their monetary policy understanding intermediated through the media in brief headlines, so you want to get those right. Simple language does not help more expert audiences understand the reaction functions of central banks when officials themselves are not sure how they will react to events.

Recommended newsletters for you

Free lunch — Your guide to the global economic policy debate. Sign up here

The Lex Newsletter — Lex, our investment column, breaks down the week’s key themes, with analysis by award-winning writers. Sign up here

#Europe #lacks #monetary #response #Trump