Golden shares may be tarnished but a comeback beckons

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Would-be buyers of UK assets are polishing off an old school favourite: golden shares. These confer the holder — usually governments — rights such as vetoing takeovers or hiring and firing directors.

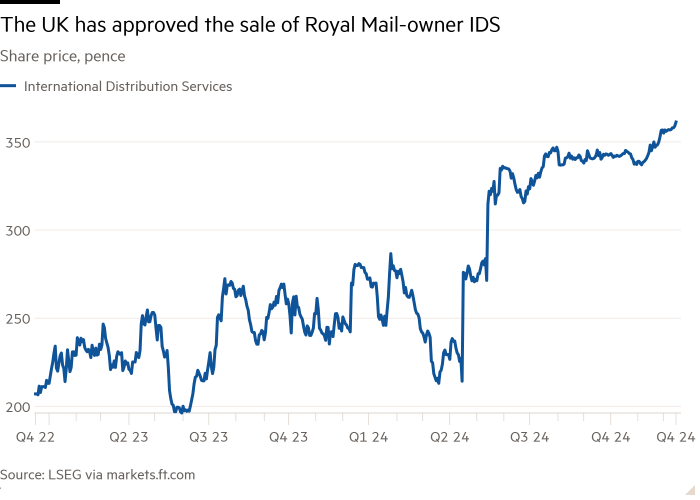

Golden shares were a hallmark of the 1980s wave of privatisations in the UK. They flourished across Europe too. Now Czech billionaire Daniel Křetínský has stamped one on his proposed £5.3bn takeover of Royal Mail owner International Distribution Services, greenlit by the UK government on Monday. UK infrastructure investor Covalis Capital is including special rights for the government in its bid for troubled utility Thames Water.

Such special rights are conferred on governments — and may also offer a degree of comfort to other stakeholders such as employees and customers. But make no mistake, they protect the buyers too. Their uses to new owners include fending off subsequent hostile takeovers. By ensuring government participation, they can also provide a useful backstop for the buyer if things go pear shaped.

Lex is among the critics of golden shares. The ability to block foreign takeovers, as with any poison pill, distorts the allocation of cross-border capital. Management, insulated from takeovers, can afford to take their foot off the pedal, perhaps resulting in lower productivity or cost control.

More fundamentally, nixing the possibility of a buyer wielding a juicy premium-inflated cheque puts a cap on share price performance. It is true that not all the UK’s privatisations are glowing testimonials to private ownership. Nonetheless, it took just two years after the government relinquished its golden shares in the UK’s electricity companies before 11 out of 12 had either been bought or merged.

A number of legal cases at the European Court of Justice, which objected to the constraints placed on free movement of capital, stripped governments of their long-standing golden shares, including in German automaker Volkswagen held under the 1960 so-called “VW law”. The UK was similarly forced to give up its rights in airport operator BAA.

The culling which has occurred over the course of this century has left a huge dent in government holdings. In the UK, of the 25 companies that boasted special government stakes, very few remain. These are in the defence sector: BAE Systems, Rolls-Royce and Babcock subsidiaries Devonport Royal Dockyard and Rosyth Royal Dockyard. Some of these, such as BAE, specify the risks of national security assets being held by overseas interests.

For sure, a golden share renaissance is not on the cards. But in an increasingly protectionist world, expect more buyers to slide the promise of domestic government stakes into their bids.

#Golden #shares #tarnished #comeback #beckons