Why Costco shares are unlikely to end up in the bargain bin

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Bargain hunters flock to Costco for $5 rotisserie chickens and bulk staples like 48-count packs of batteries. But when it comes to shares in the big-box retailer, fans of the company are more than happy to pay over the odds.

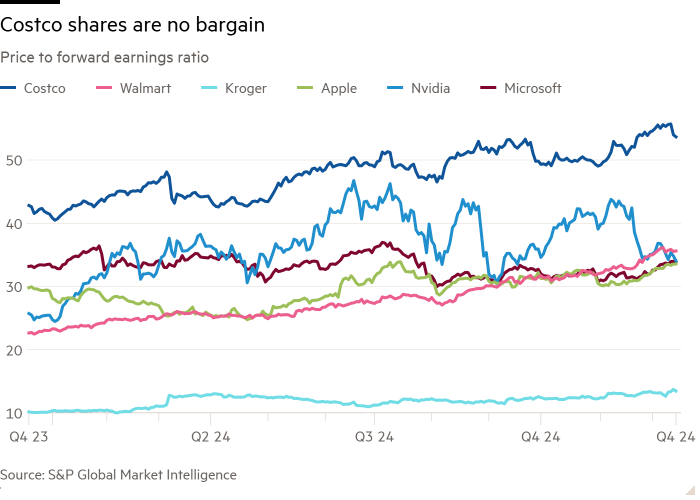

The stock, up 52 per cent this year, is trading on a price to forward earnings ratio of 54 times. That compares with the sector average of about 15 times. Walmart — another high-flying retail winner — commands a multiple of “just” 36 times. More impressive still, Costco shares are now pricier than tech darlings like Nvidia, Apple and Microsoft — all of which are trading at about 34 times forward earnings.

Costco is hardly a high-growth company. Revenue rose 5 per cent to $254bn in its most recent fiscal year ending on September 1. Both gross and ebitda margins — at 12.6 per cent and 4.5 per cent, respectively — are far lower than those at Walmart or grocer Albertsons.

Instead, Costco’s secret weapon is the millions of customers who happily pay an annual membership fee for the privilege of buying goods on the cheap. It essentially forgoes much of the margins on goods sold in its cavernous warehouses in order to engender loyalty.

The strategy works. At a time when bricks-and-mortar retailers are struggling to get shoppers through their doors, Costco boasts 137mn members worldwide, with a 90 per cent renewal rate. The $4.8bn in membership fees it took in last year drove most of its profits.

Costco’s premium valuation reflects the company’s reliable cash flows and strong customer loyalty. Once members, customers tend to do more of their shopping at Costco stores. Its size also gives it plenty of heft to negotiate with suppliers to keep prices on products low.

Expectation of the company’s ability to squeeze more out of annual membership fees will ensure Costco keeps its premium valuation. Last year, Costco announced a Netflix-style crackdown on unauthorised membership sharing. More recently, it raised membership fees in the US and Canada for the first time in seven years. It raised Gold Star memberships by $5 to $65 and Executive memberships by $10 to $130. The increase, which came into effect on September 1, is likely to generate $380mn a year in additional fee income, according to Citi.

Early investors in Costco have done well. The stock has generated a near-1,268 per cent return since 2010. Of course, it has a much higher multiple today. But its shares, while pricey, are unlikely to end up in the discount bin.

#Costco #shares #bargain #bin